Reebok 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

130

2012

/

03.2

/

Group Business Performance

/

Economic and Sector Development

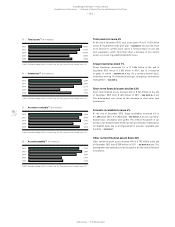

entering the market. In technical apparel, this trend resulted in

healthy growth, particularly in shells, fleece and base layer clothing.

The e-commerce channel continued to see rapid expansion across the

industry, with a wide diversity of strategies being presented by many

players on how best to embrace omni-channel retail and leverage

digital, social media and, particularly, mobile technologies. In addition,

2012 saw further consolidation of the industry, with several important

acquisitions during the year.

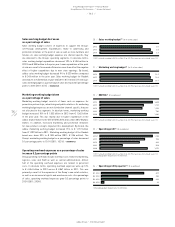

Modest growth of Europe’s sporting goods industry

In Europe, despite austerity measures and high unemployment in many

markets, the sporting goods industry grew modestly in 2012. The region

benefited directly from two of the world’s major sporting events which

took place in the region. The UK’s industry, in particular, was buoyed

by the London 2012 Olympic and Paralympic Games. Many European

markets benefited from the UEFA EURO 2012, especially the title

winners Spain and the host nations Poland and Ukraine. In European

emerging markets, rising wages supported consumption, which also

positively impacted the sporting goods sector, particularly in Russia.

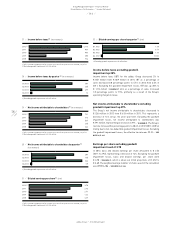

Strong retail activity drives growth of North American

sporting goods industry

The gradual recovery of the US market and a stabilisation of inflation

helped drive solid consumer spending which, in turn, benefited retailers

and the sporting goods industry. Strong retail sales trends in basketball,

training and sporting lifestyle offset slight contractions in certain

running, walking and outdoor categories. We estimate that sporting

goods sales in the USA increased at a mid-single-digit rate in 2012,

driven mainly by improvements in average selling prices. Many sporting

goods retailers focused on high-performance and innovative products

to drive sales, in addition to increasing e-commerce activities. Footwear

sales are estimated to have increased at a mid-single-digit rate in 2012,

driven in particular by growth in the basketball and training categories.

US sporting apparel sales are also estimated to have increased at a

mid-single-digit rate in 2012.

International brands drive Asian sporting goods

industry expansion

Strong wage growth and consumer spending supported increases in

Asia’s sporting goods industry, which grew at a low- to mid-single-digit

rate in 2012. Growth in the region’s sportswear industry was mainly

driven by international brands, with consumers attracted to them as

pseudo-luxury brands at attainable price points. In China, industry

growth remained robust; however, inventory issues negatively impacted

many of the domestic players. In Japan, by contrast, low consumer

spending on discretionary items kept sporting goods sales muted during

2012, in line with overall economic trends in that market.

Latin America’s sporting goods industry records

strong momentum

In Latin America, despite some inflationary pressures, low un-

employment and a significant increase in access to credit for many

consumers helped drive retail sales and spending on sporting goods.

Sales in the region also benefited from the Copa América as well as the

first activities ahead of the 2014 FIFA World Cup.

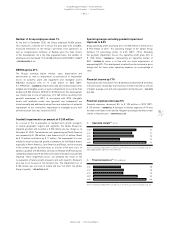

adidas Group and competitors outperform

economic environment

adidas Group revenues and profitability, as well as that of many

competitors and retailers, increased in 2012. In most regions, sales of

our Group and other major sporting goods companies grew at a higher

rate than GDP and overall consumer spending.

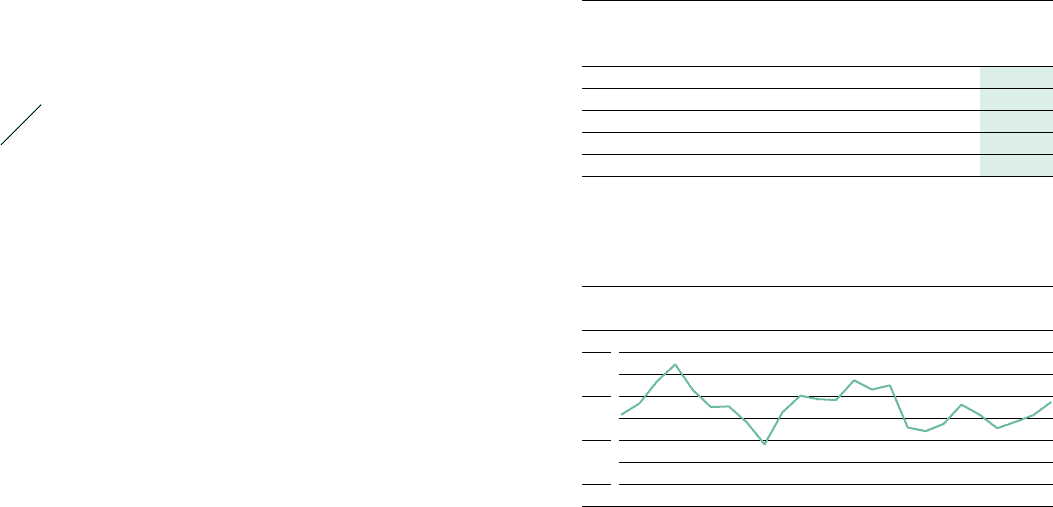

06

/

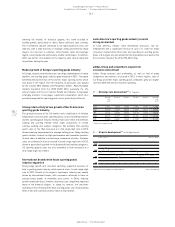

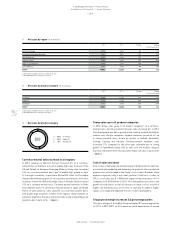

Oil price development 1) (in US $ per barrel)

| Jan. 1, 2011 Dec. 31, 2012 |

120

100

80

60

1) West Texas Intermediate Cushing crude oil. Source: Bloomberg.

05

/

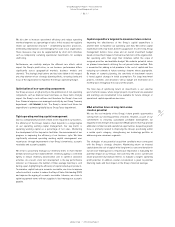

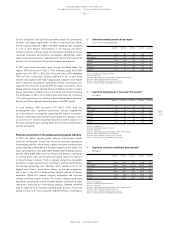

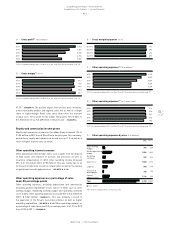

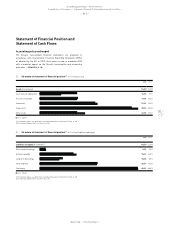

Exchange rate development 1) (€ 1 equals)

Average

rate

2011

Q1 2012 Q2 2012 Q3 2012 Q4 2012 Average

rate

2012

USD 1.3922 1.3356 1.2590 1.2930 1.3194 1.2862

GBP 0.8678 0.8339 0.8068 0.7981 0.8161 0.8115

JPY 111.04 109.56 100.13 100.37 113.61 102.65

RUB 40.871 39.171 41.316 39.976 40.074 39.951

CNY 9.0000 8.4067 7.9639 8.1989 8.2931 8.1137

1) Spot rates at quarter-end.