Reebok 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

134

2012

/

03.2

/

Group Business Performance

/

Income Statement

20

/

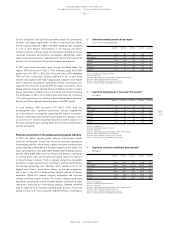

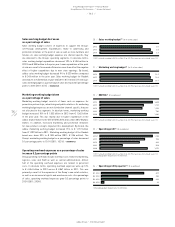

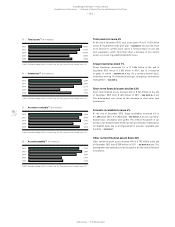

Sales working budget 1) (in % of net sales)

2012 2.0

2011 2.5

2010 2.6

1) 2011 restated according to IAS 8, see Note 03, p. 203. Prior years are not restated, see p. 131.

21

/

Marketing working budget 1) (in % of net sales)

2012 10.1

2011 10.2

2010 10.7

1) 2011 restated according to IAS 8, see Note 03, p. 203. Prior years are not restated, see p. 131.

24

/

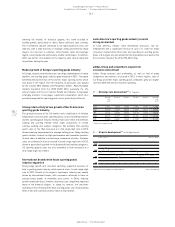

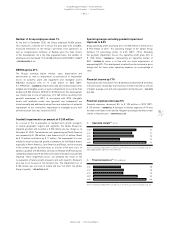

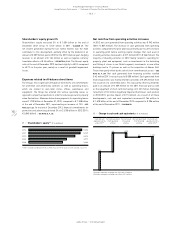

Operating profit by quarter 1) (€ in millions)

Q1 2012 409

Q2 2012 256

Q3 2012 494

Q4 2012 26

1) Excluding goodwill impairment of € 265 million.

22

/

EBITDA 1) (€ in millions)

2012 1,445

2011 1,199

2010 1,159

2009 780

2008 1,280

1) 2011 restated according to IAS 8, see Note 03, p. 203. Prior years are not restated, see p. 131.

23

/

Operating profit 1) (€ in millions)

2012 2) 1,185

2011 953

2010 894

2009 508

2008 1,070

1) 2011 restated according to IAS 8, see Note 03, p. 203. Prior years are not restated, see p. 131.

2) Excluding goodwill impairment of € 265 million.

Sales working budget decreases

as a percentage of sales

Sales working budget consists of expenses to support the Group’s

sell-through development. Expenditures relate to advertising and

promotion initiatives at the point of sale as well as store furniture and

fixtures. As sales working budget expenses are channel specific, they

are allocated to the Group’s operating segments. In absolute terms,

sales working budget expenditure decreased 10% to € 304 million in

2012 from € 338 million in the prior year. Lower expenditure at the point

of sale as a result of increased efficiencies more than offset the negative

effect of higher expenditure due to new store openings. By brand,

adidas sales working budget decreased 9% to € 220 million compared

to € 243 million in the prior year. Sales working budget for Reebok

declined 2% to € 50 million at year-end (2011: € 51 million). The Group’s

sales working budget as a percentage of sales decreased 0.5 percentage

points to 2.0% (2011: 2.5%)

/

DIAGRAM 20.

Marketing working budget down

as a percentage of sales

Marketing working budget consists of items such as expenses for

promotion partnerships, advertising and public relations. As marketing

working budget expenses are not distribution channel specific, they are

not allocated to the segments. In absolute terms, marketing working

budget increased 10% to € 1.502 billion in 2012 from € 1.362 billion

in the prior year. This was mainly due to higher expenditure at the

adidas brand related to the UEFA EURO 2012 and London 2012 Olympic

Games. In addition, increased marketing and promotion initiatives

for new product concepts impacted this development. By brand, the

adidas marketing working budget increased 15% to € 1.157 billion

from € 1.007 billion in 2011. Marketing working budget of the Reebok

brand was down 20% to € 188 million (2011: € 236 million). The

Group’s marketing working budget as a percentage of sales decreased

0.1 percentage points to 10.1% (2011: 10.2%)

/

DIAGRAM 21.

Operating overhead expenses as a percentage of sales

increase 0.2 percentage points

Group operating overheads include overhead costs related to marketing,

logistics, sales and R&D as well as central administration. Almost

half of the operating overhead expenses are related to personnel

costs. In absolute terms, operating overhead expenses were up 12%

to € 4.344 billion in 2012 versus € 3.867 billion in 2011. This was

primarily a result of the expansion of the Group’s own-retail activities,

as well as an increase in logistic and warehouse costs. As a percentage

of sales, operating overhead expenses grew 0.2 percentage points to

29.2% (2011: 29.0%).