Reebok 2012 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

154

2012

/

03.3

/

Business Performance by Segment

/

Other Businesses Performance

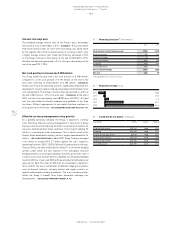

Factory outlet revenues include sales from adidas and Reebok factory

outlets. In 2012, factory outlet revenues grew 9% on a currency-neutral

basis. Sales increased at a double-digit rate at adidas. Reebok sales grew

at a high-single-digit rate. Comparable factory outlet sales increased 7%

on a currency-neutral basis. In 2012, the Group opened 52 and closed

57 factory outlets. In addition, one concept store was reclassified as a

factory outlet. As a result, the number of factory outlets decreased by 4 to

730 at the end of 2012 (December 31, 2011: 734)

/

DIAGRAM 15. Currency

translation effects had a positive impact on sales in euro terms. Factory

outlet sales increased 16% to € 1.528 billion from € 1.321 billion in 2011.

Concession corner revenues include adidas and Reebok concession

corners. In 2012, sales from concession corners increased 7% on a

currency-neutral basis. Sales grew at a high-single-digit rate at adidas

while Reebok sales were up at a low-single-digit rate. Currency-neutral

comparable sales from concession corners grew 6%. In 2012, the Group

opened 21 concession corners and closed 94. In addition, 57 concept

stores were reclassified as concession corners. As a result, the number

of concession corners decreased by 16 to 279 at the end of 2012

(December 31, 2011: 295), of which 182 were related to the adidas brand

and 97 to the Reebok brand

/

DIAGRAM 15. Currency translation effects

had a positive impact on sales in euro terms. Concession corner sales

increased 13% to € 115 million (2011: € 101 million).

eCommerce revenues include e-commerce operations of the adidas and

Reebok brands. In 2012, sales from adidas and Reebok e-commerce

platforms were up 68% on a currency-neutral basis compared to 2011.

Sales increased at strong double-digit rates at both adidas and Reebok.

Currency translation effects had a positive impact on sales in euro terms.

eCommerce revenues grew 78% to € 158 million from € 89 million in

2011.

Other Businesses Performance

Other Businesses full year results

In 2012, revenues of Other Businesses grew 17% on a currency-neutral

basis, mainly driven by strong double-digit sales growth at TaylorMade-

adidas Golf as well as at Other Centrally Managed Brands. Sales at

Rockport and Reebok-CCM Hockey also increased. Currency translation

effects positively impacted revenues in euro terms. Sales of Other

Businesses grew 25% to € 1.977 billion (2011: € 1.580 billion)

/

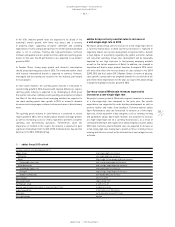

TABLE 16.

Gross margin decreased 0.8 percentage points to 42.8% (2011: 43.5%),

driven by lower product margins at Reebok-CCM Hockey, where

increased sourcing costs as well as the NHL lockout negatively impacted

gross margin development. Other Businesses gross profit was up 23% to

€ 845 million versus € 688 million in 2011

/

TABLE 16.

Segmental operating expenses as a percentage of sales decreased

1.1 percentage points to 15.4% (2011: 16.5%). Segmental operating

expenses in Other Businesses primarily relate to expenditure for sales

force and administration as well as sales working budget expenses

for TaylorMade-adidas Golf, Rockport, Reebok-CCM Hockey and

Other Centrally Managed Brands. In euro terms, segmental operating

expenses rose 17% to € 304 million from € 261 million in 2011. This

was driven in particular by higher expenditure for sales force and

administration at TaylorMade-adidas Golf and Rockport.

Other Businesses segmental operating profit increased 27% to

€ 541 million in 2012 versus € 427 million in the prior year. Segmental

operating margin was up 0.4 percentage points to 27.4% from 27.0%

in 2011

/

TABLE 16. This was the result of lower segmental operating

expenses as a percentage of sales, which more than offset the negative

effects from a lower gross margin.

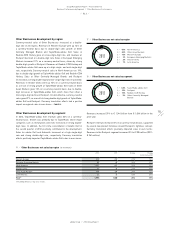

15

/

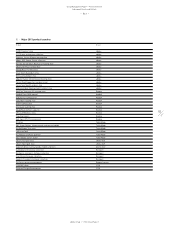

Retail number of stores

2012 2011

Concept stores 1,437 1,355

Factory outlets 730 734

Concession

corners 279 295

Total 2,446 2,384

■ 2012 ■ 2011

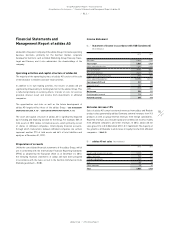

16

/

Other Businesses at a glance (€ in millions)

2012 2011 Change

Net sales 1,977 1,580 25%

Gross profit 845 688 23%

Gross margin 42.8% 43.5% (0.8pp)

Segmental operating profit 541 427 27%

Segmental operating margin 27.4% 27.0% 0.4pp