Reebok 2012 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

208

2012

Notes

/

04.8

/

Moreover, as a result of these adjustments relating to the financial year

2011, the consolidated statement of changes in equity, the consolidated

statement of comprehensive income and the comparative amounts for

2011 in the Notes to the consolidated financial statements also had to

be restated accordingly. In addition, a correction of the consolidated

statement of changes in equity at the time of the opening balance as at

January 1, 2011 was necessary.

In particular, the following errors had to be adjusted:

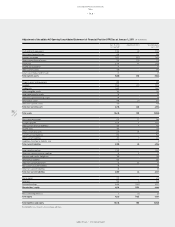

a) Manipulation of sales and accounts receivable

Through different practices, Reebok India overstated net sales and

accounts receivable, whereas inventories were understated as at

December 31, 2011 and in previous financial years.

This was achieved through the following practices:

/

Issuing invoices to customers, even though inventories were not

delivered at the time of invoicing, but stored in secret warehouses of

Reebok India or in warehouses of a shipping company.

/

Entering into sales agreements with distributors which did not

transfer risk and rewards.

/

Not recording sales returns received from customers at the time of

return and storing the returned inventory in secret warehouses.

/

Issuing unjustified invoices, for example, for subsequent price

increases, or not recording valid credit notes to customers.

/

The incorrect or omitted recording of contractual obligations towards

customers.

As a result of these practices, the allowances for inventories and the

provision for sales returns were also determined incorrectly.

The impact on the opening consolidated statement of financial

position as at January 1, 2011 and the consolidated statement of financial

position as at December 31, 2011 is as follows:

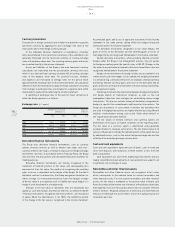

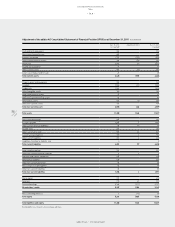

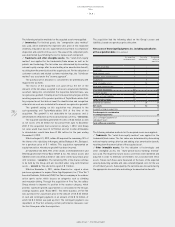

Impact on the consolidated financial statements (€ in millions)

Jan. 1, 2011 Dec. 31, 2011

Accounts receivable (94) (132)

Inventories 16 20

Other current financial liabilities – 6

Other current provisions 14 10

Other current liabilities – (1)

Total equity (92) (127)

Net sales – (37)

Cost of sales – (6)

Other operating expenses – 20

b) Fictitious cash collections

Reebok India recorded fictitious cash collections of outstanding

accounts receivable. This scheme involved agreements with business

partners, whereby Reebok India transferred money to business partners

in January 2011 while at the same time receiving cheques back-dated to

December 2010 from those same partners.

In addition, in 2011, Reebok India initiated a programme to roll

out further franchise stores, whereby the investees had to make a

prepayment which was recorded as collection of various outstanding

customer accounts instead of recording a financial liability against the

investor.

The required corrections led to a reduction of cash and cash equivalents

of € 5 million and an increase in accounts receivable of € 27 million

as well as an increase in short-term borrowings of € 11 million and in

other current and non-current financial liabilities of € 11 million in the

opening consolidated balance sheet as at January 1, 2011.

For the year ending December 31, 2011, the correction led to an

increase in accounts receivable as well as other current and non-current

financial liabilities of € 6 million.

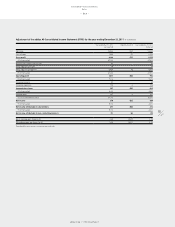

c) Unrecorded liabilities and provisions

A significant number of vendor invoices and provisions relating to

commitments given to business partners were not recorded. Amongst

others, this included committed subsequent sales discounts as well as

termination penalties in connection with store closures.

Furthermore, in the statement of financial position, Reebok India has

not recognised onerous contracts relating to contracts with franchisees

which will incur losses over the remaining contractual term due to

minimum guarantee agreements in favour of the franchisees.

The impact on the consolidated financial statements as at

December 31, 2011 is as follows:

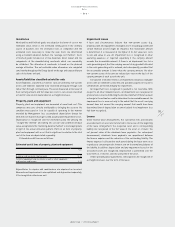

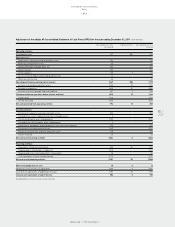

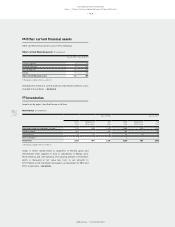

Impact on the consolidated financial statements (€ in millions)

Jan. 1, 2011 Dec. 31, 2011

Other current provisions 1 30

Current accrued liabilities – 1

Other current liabilities – 3

Other non-current provisions 32 –

Total equity (33) (34)

Net sales – (6)

Other operating expenses – 1

d) Goodwill

Deducting the overstated sales and income in the business plans

established in the previous years would have resulted in full impairment

of the goodwill allocated to the cash-generating unit Wholesale India.

Therefore, the goodwill of € 27 million is impaired in the opening

consolidated balance sheet as at January 1, 2011.

e) Deferred tax assets

Deferred tax assets of € 7 million and € 9 million for the years ending

December 31, 2010 and 2011, respectively, were recognised by Reebok

India. Deducting the overstated sales and income in the business plans

established in the previous years would have resulted in a business plan

which does not support the probability of the utilisation of these deferred

tax assets.

The required corrections led to a decrease of deferred tax assets

in the opening consolidated balance sheet as at January 1, 2011 of

€ 7 million. For the year ending December 31, 2011, the deferred tax

asset was reduced by € 9 million and tax expense for the year ending

December 31, 2011 was increased by € 4 million as the recognition

criteria for deferred tax assets were not fulfilled anymore.