Reebok 2012 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

178

2012

/

03.5

/

Risk and Opportunity Report

/

Financial risks

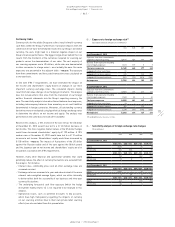

Utilising a centralised currency risk management system, our Group

hedges currency needs for projected sourcing requirements on a rolling

12- to 24-month basis

/

SEE TREASURY, P. 141. Our goal is to have the vast

majority of our hedging volume secured six months prior to the start

of a given season. In rare instances, hedges are contracted beyond the

24-month horizon. The Group also largely hedges balance sheet risks.

Due to our strong global position, we are able to minimise currency risk

to a large extent by utilising natural hedges.

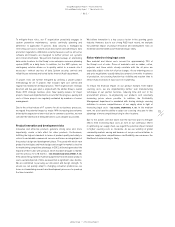

Nevertheless, our gross US dollar cash flow exposure after natural

hedges calculated for 2013 was roughly € 4.0 billion at year-end 2012,

which we hedged using forward contracts, currency options and currency

swaps

/

TABLE 05. Our Group’s Treasury Policy allows us to utilise

hedging instruments, such as currency options or option combinations,

which provide protection from negative exchange rate fluctuations

while – at the same time – retaining the potential to benefit from future

favourable exchange rate developments in the financial markets.

As 2013 hedging has almost been completed, it is clear that conversion

rates on major currencies will be less favourable compared to those of

2012. Volume forecast variances, currency volatility and an increasing

portion of our business in emerging markets will expose the adidas

Group to additional currency risks in 2013. We regard the possible

financial impact of currency risks as major and believe the likelihood of

currency risks is probable.

Interest rate risks

Changes in global market interest rates affect future interest payments

for variable-interest liabilities. As the Group does not have material

variable-interest liabilities, significant interest rate increases should

have only slight adverse effects on the Group’s profitability, liquidity and

financial position.

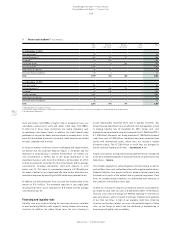

In line with IFRS 7 requirements, we have analysed the impact of

changes in the Group’s most important interest rates on net income and

shareholders’ equity. The effect of interest rate changes on future cash

flows is excluded from this analysis. Nevertheless, accrued interest,

which is recognised as a liability, has been re-calculated based on

the hypothetical market interest rates as at December 31, 2012. Fair

values for derivative interest rate instruments accounted for as cash

flow hedges were then re-evaluated based on the hypothetical market

interest rates with the resulting effects on net income and equity

included in the sensitivity analysis.

However, the effect on the income statement from changes in the fair

values of hedged items and hedging instruments attributable to interest

rate changes was not material. Exclusions from this analysis are as

follows:

/

Some fixed-rate financial instruments, such as certificates of

deposit, which we value at “fair value through profit or loss” due to

the short-term maturity of these instruments. Potential effects due

to changes in interest rates are considered immaterial and are not

recognised in the sensitivity analysis.

/

Other fixed-rate financial instruments are measured at amortised

cost. Since a change in interest rates would not change the carrying

amount of this category of instruments, there is no net income impact

and they are excluded from this analysis.

The interest rate sensitivity analysis assumes a parallel shift of the

interest yield curve for all currencies and was performed on the same

basis for both 2011 and 2012. A 100 basis point increase in interest

rates at December 31, 2012 would have increased shareholders’ equity

by € 0.00 million (2011: increase by € 0.00 million) and decreased net

income by € 0.00 million (2011: decrease by € 0.07 million). A 100 basis

point decrease of the interest rates at December 31, 2012 would have

resulted in a € 0.00 million decrease in shareholders’ equity (2011:

decrease by € 0.00 million) and a € 0.00 million increase in net income

(2011: increase by € 0.07 million).

We believe the IFRS 7 interest rate analysis represents a realistic, albeit

rough, estimate of our current interest rate risk.

To moderate interest rate risks and maintain financial flexibility, a core

tenet of our Group’s financial strategy is to continue to use surplus cash

flow from operations to reduce gross borrowings

/

SEE TREASURY, P. 141.

Beyond that, the adidas Group is constantly looking for adequate hedging

strategies through interest rate derivatives in order to mitigate interest

rate risks.

In 2012, interest rates in Europe and North America remained at low

levels. Given the central banks’ current interest rate policies and

macro-economic uncertainty, we do not foresee any major interest rate

increases in these regions for the near-term future. Since 97% of the

Group’s financing is in euros and US dollars, we regard the potential

impact of interest rate risks only as minor. Nevertheless, we assess the

likelihood that these risks will materialise as probable.