Reebok 2012 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

142

2012

/

03.2

/

Group Business Performance

/

Treasur y

43

/

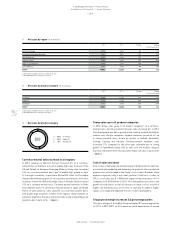

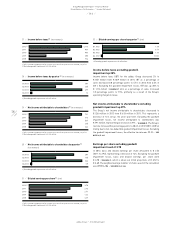

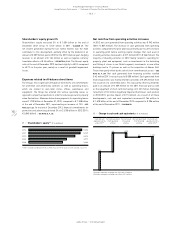

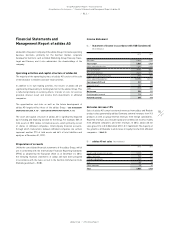

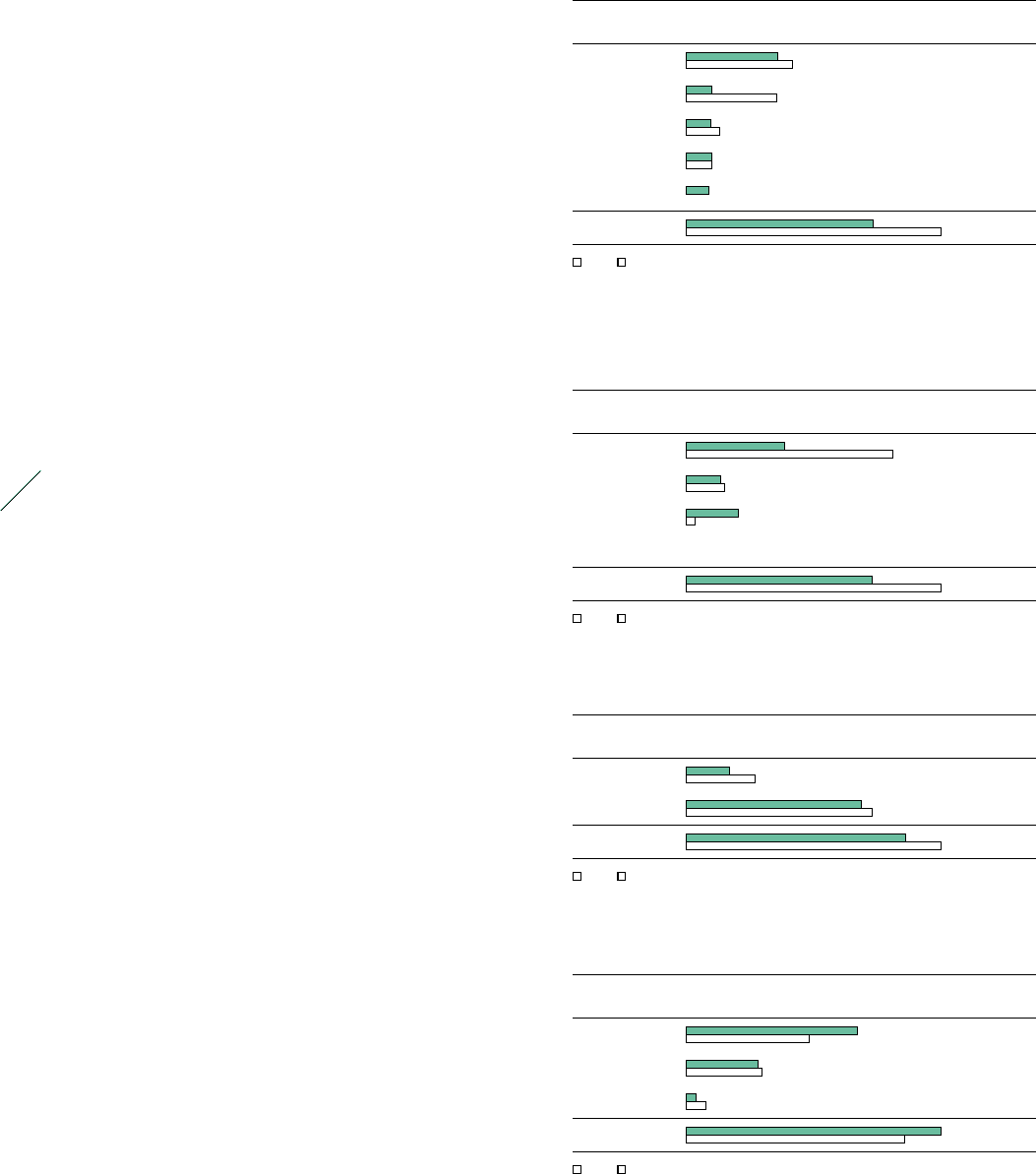

Total credit facilities (€ in millions)

2012 2011

Bilateral

credit facilities 1,863 2,164

Syndicated

loan facility 500 1,860

Private placements 480 655

Eurobond 499 499

Convertible bond 449 0

Total 3,791 5,178

■ 2012 ■ 2011

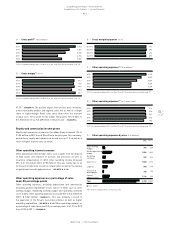

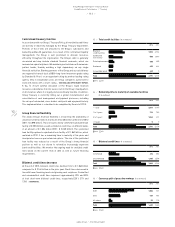

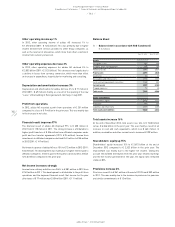

45

/

Bilateral credit lines (€ in millions)

2012 2011

Committed 376 586

Uncommitted 1,487 1,578

Total 1,863 2,164

■ 2012 ■ 2011

44

/

Remaining time to maturity of available facilities

(€ in millions)

2012 2011

< 1 year 2,014 4,187

1 to 3 years 714 780

3 to 5 years 1,063 211

> 5 years 00

Total 3,791 5,178

■ 2012 ■ 2011

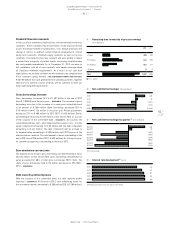

46

/

Currency split of gross borrowings (€ in millions)

2012 2011

EUR 1,004 721

USD 424 444

All others 59 115

Total 1,487 1,280

■ 2012 ■ 2011

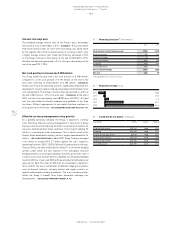

Centralised treasury function

In accordance with our Group’s Treasury Policy, all worldwide credit lines

are directly or indirectly managed by the Group Treasury department.

Portions of those lines are allocated to the Group’s subsidiaries and

backed by adidas AG guarantees. As a result of this centralised liquidity

management, the Group is well positioned to allocate resources

efficiently throughout the organisation. The Group’s debt is generally

unsecured and may include standard financial covenants, which are

reviewed on a quarterly basis. We maintain good relations with numerous

partner banks, thereby avoiding a high dependency on any single

financial institution. Banking partners of the Group and our subsidiaries

are required to have at least a BBB+ long-term investment grade rating

by Standard & Poor’s or an equivalent rating by another leading rating

agency. Only in exceptional cases are Group companies authorised to

work with banks with a lower rating

/

SEE RISK AND OPPORTUNITY REPORT,

P. 164. To ensure optimal allocation of the Group’s liquid financial

resources, subsidiaries transfer excess cash to the Group’s headquarters

in all instances where it is legally and economically feasible. In addition,

Group Treasury is currently rolling out a global standardisation and

consolidation of cash management and payment processes, including

the set-up of automated, cross-border cash pools and a payment factory.

This implementation is scheduled to be completed by the end of 2013.

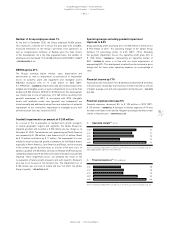

Group financial flexibility

The adidas Group’s financial flexibility is ensured by the availability of

unutilised credit facilities in an amount of € 2.304 billion at the end of 2012

(2011: € 3.898 billion). These include a newly committed syndicated loan

facility of € 500 million as well as bilateral credit lines at different banks

in an amount of € 1.804 billion (2011: € 2.038 billion). The syndicated

loan facility replaced a syndicated loan facility of € 1.860 billion, which

matured in 2012. It has a remaining time to maturity of five years and

incorporates two one-year extension options. The size of the syndicated

loan facility was reduced as a result of the Group’s strong financial

position as well as our desire to rationalise increasingly expensive

bank credit facilities. We monitor the ongoing need for available credit

lines based on the current level of debt as well as future financing

requirements.

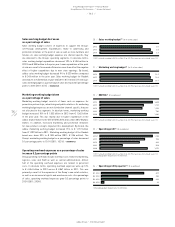

Bilateral credit lines decrease

At the end of 2012, bilateral credit lines declined 14% to € 1.863 billion

compared to € 2.164 billion in the prior year. Credit lines decreased in

line with lower financing needs and growing cash surpluses. Committed

and uncommitted credit lines represent approximately 20% and 80%

of total short-term bilateral credit lines, respectively (2011: 27% and

73%)

/

DIAGRAM 45.