Reebok 2012 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

167

2012

Risk and Opportunity Report

/

03.5

/

03

/

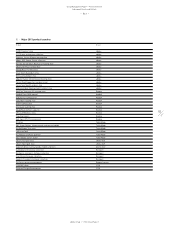

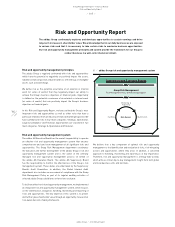

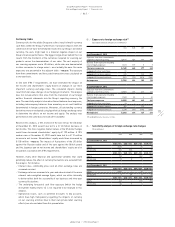

Corporate risk evaluation categories

listed in ascending order

Likelihood Potential impact

Unlikely Marginal

Possible Minor

Likely Moderate

Probable Significant

Highly probable Major

02

/

Corporate risk overview

Likelihood Potential impact

Strategic risks

Macroeconomic, socio-political and

regulatory risks

Likely Major

Risks related to distribution strategy Possible Significant

Dependency risks Possible Significant

Risks related to media and stakeholder

activities

Likely Significant

Customer consolidation/private label risks Possible Significant

Competition risks Possible Major

Risks related to risk and control

environment

Possible Major

Consumer demand risks Possible Significant

Operational risks

Own-retail risks Possible Major

Logistics risks Likely Significant

Marketing risks Likely Significant

Customer relationship risks Unlikely Major

Sales and pricing risks Possible Major

Supplier risks Unlikely Major

Inventory risks Possible Significant

Hazard risks Possible Major

Personnel risks Unlikely Significant

IT risks Possible Major

Product innovation and development risks Likely Moderate

Risks related to rising input costs Likely Moderate

Legal & compliance risks

Legal risks Possible Major

Risks related to competition, trade and

customs regulations

Possible Significant

Social and environmental risks Possible Major

Risks related to product counterfeiting

and imitation

Unlikely Significant

Product quality risks Possible Significant

Fraud and corruption risks Unlikely Significant

Financial risks

Credit risks Possible Major

Financing and liquidity risks Unlikely Minor

Currency risks Probable Major

Interest rate risks Probable Minor

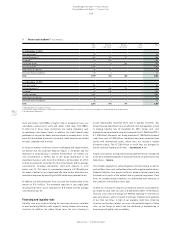

that occur infrequently and not on a routine basis. After ensuring data

plausibility, the centrally coordinated and monitored consolidation

process begins, running automatically on SAP SEM-BCS. Controls

within the individual consolidation steps, such as those relating to the

consolidation of debt or of income and expenses, are conducted both

system-based, using automatically created consolidation logs, and

manually. Any inadequacies are remedied manually by systematically

processing the individual errors and differences and are reported back

to the subsidiaries. After finalisation of all consolidation steps, all

items in the P&L and statement of financial position are analysed with

respect to trends and variances. Unless already otherwise clarified, the

subsidiaries are asked to explain any identified material deviations.

All financial systems used are protected against malpractice by means

of appropriate authorisation concepts, approval concepts and access

restrictions. Access authorisations are reviewed on a regular basis

and updated if required. The risk of data loss or outage of accounting-

related IT systems is minimised by Group IT through central control

and monitoring of virtually all IT systems, centralised management of

change processes and through regular data backups.

Further improvement of risk and opportunity

management system in 2012

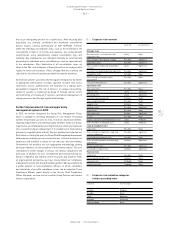

In 2012, we further sharpened the Group Risk Management Policy,

which is available to all Group employees on our intranet. The policy

outlines the principles, processes, tools, risk areas, key responsibilities,

reporting requirements and communication timelines within our Group.

In particular, we simplified the reporting thresholds, which are now based

only on potential impact independent of the likelihood of materialising

(previously a multiplication of both). We also updated and adjusted our

Risk Universe. During the year, the Group Risk Management department

held numerous training sessions and workshops, to further increase risk

awareness and establish a culture of risk-conscious decision-making.

Furthermore, we modified our risk aggregation methodology, putting

particular emphasis on the evaluation of the potential impact. This also

contributed to visible changes in various risk ratings compared to the

prior year. In addition, we also strengthened and institutionalised our

Group’s compliance and internal control structures and activities. From

an organisational perspective, we have closely linked our compliance

management system with Group Risk Management. We have established

a global network of local Compliance Officers, to whom complaints

and indications of possible compliance issues can be reported. These

Compliance Officers report directly to the Group’s Chief Compliance

Officer. Moreover, we have set up a central Group Policies and Internal

Controls department.