Reebok 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Our Group

71

2012

Group Strategy

/

02.1

/

/

Leverage growth and operational scale through to bottom line: A

higher exposure to emerging markets as well as expanding controlled

space activities are important levers to improving brand presence,

increasing sell-through and driving higher Group profitability. In addition,

we continuously work on streamlining internal processes to accelerate

decision-making, reduce complexity and make our organisation leaner

and more efficient. At the beginning of 2011, we launched Driving Route

2015 to act as a key enabler to achieve these aspirations. The objectives

of Driving Route 2015 are very clear: speed, consistency and consumer

focus.

/

Speed by implementing a leaner organisation that allows faster

decision-making.

/

Consistency by establishing a more aligned and efficient organisation

across functions and geographies.

/

Consumer focus by reducing internal complexity, enabling us to put

more of our energy into what really matters – the consumer.

In addition, we have identified several profit levers across the Group

to support improvements in profitability. For example, we are targeting

improved product margins with initiatives such as range reduction,

where we have the goal to achieve a 25% reduction by 2015. In

wholesale, we are improving our business by sharpening our trade

terms policies and reducing our exposure to lower-quality channels of

distribution, focusing on higher-quality partners more aligned to where

our target consumer is shopping. On our mission to become a best-in-

class retailer, we are already halfway to our Route 2015 goal to add

five points of margin in our Retail segment. Given the strong results

from our HR programme SHINE, our real estate optimisation projects

and benefits from the expansion of our Global Foundation Range, we

are likely to exceed our original Retail margin target by one or two

points. In manufacturing, we are combatting inflation in the supply

chain by increasing our investments in automation and new production

techniques. Also, our investments in infrastructure such as the new

distribution centres in Osnabrueck/Germany, China and Canada will

ensure we increase capacity in a cost-efficient way to service all of

our channels, be it wholesale, own retail or eCommerce

/

SEE GLOBAL

OPERATIONS, P. 100. Finally, we continue to work on enhancing our

planning processes, to further improve profitability and working capital

efficiency

/

SEE INTERNAL GROUP MANAGEMENT SYSTEM, P. 124. Therefore, we

believe there is significant potential to increase the Group’s operating

margin to 11% sustainably by 2015.

/

Maintain financial flexibility: We strive over the long term to maintain

a ratio of net borrowings over EBITDA of less than two times. A strong

balance sheet increases our flexibility to realise value-generating

medium- and long-term opportunities in the best interests of our

shareholders as they arise.

02

/

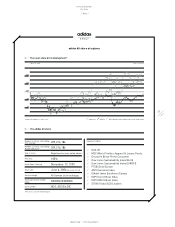

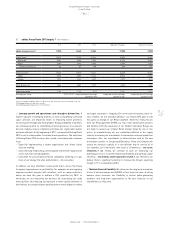

adidas Group Route 2015 targets 1) (€ in millions)

2010 2011 2012 Updated 2015 targets Original 2015 targets

adidas Group net sales 2) 11,990 13,322 14,883 17,000 17,000

Global Sales 2) 10,570 11,742 12,906 14,800 15,200

Wholesale 8,181 8,949 9,533 10,200 10,600

Retail 2,389 2,793 3,373 4,600 4,600

thereof eCommerce 55 89 158 500 500

Global Brands 2) 10,627 11,807 13,011 14,800 15,200

adidas 8,714 9,867 11,344 12,800 12,200

Reebok 1,913 1,940 1,667 2,000 3,000

Other Businesses 1,420 1,580 1,977 2,200 1,800

Operating margin 7.5% 7.2% 8% 3) 11.0% 11.0%

Earnings per share 2010 – 2012 3): compound annual earnings

growth of 18%

compound annual earnings

growth of 15%

compound annual earnings

growth of 15%

1) 2011 restated according to IAS 8, see Note 03, p. 203. Prior years are not restated, see p. 131.

2) Rounding differences may arise in totals.

3) Excluding goodwill impairment of € 265 million.