Reebok 2012 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

223

2012

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

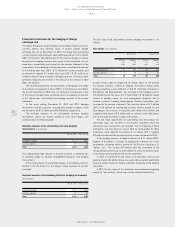

Capital management

The Group’s policy is to maintain a strong capital base so as to

uphold investor, creditor and market confidence and to sustain future

development of the business.

The Group seeks to maintain a balance between a higher return on

equity that might be possible with higher levels of borrowings and the

advantages and security afforded by a sound capital position. The Group

further aims to maintain net debt below two times EBITDA over the long

term.

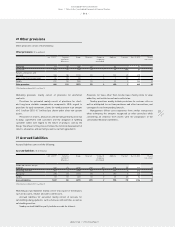

Financial leverage is defined as the ratio between net borrowings

(short- and long-term borrowings less cash and cash equivalents as well

as short-term financial assets) in an amount of negative € 448 million

(2011: negative € 90 million) and shareholders’ equity in an amount

of € 5.304 billion (2011 restated: € 5.137 billion). EBITDA amounted to

€ 1.445 billion for the financial year ending December 31, 2012 (2011

restated: € 1.199 billion). The ratio between net borrowings and EBITDA

amounted to negative 0.3 for the financial year ending December 31,

2012 (2011 restated: negative 0.1).

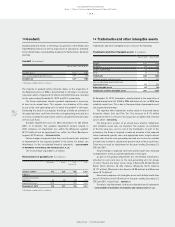

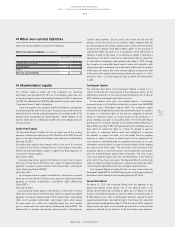

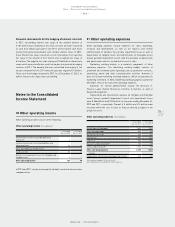

Reserves

Reserves within shareholders’ equity are as follows:

/

Capital reserve: primarily comprises the paid premium for the

issuance of share capital as well as the equity component of issued

convertible bonds.

/

Cumulative translation adjustments: comprises all foreign currency

differences arising from the translation of the financial statements of

foreign operations.

/

Hedging reserve: comprises the effective portion of the cumulative

net change in the fair value of cash flow hedges related to hedged

transactions that have not yet occurred as well as of hedges of net

investments in foreign subsidiaries.

/

Other reserves: comprise the cumulative net change of actuarial

gains or losses, the asset ceiling effect regarding defined benefit plans

as well as expenses recognised for share option plans and effects from

the acquisition of non-controlling interests.

/

Retained earnings: comprise the accumulated profits less dividends

paid.

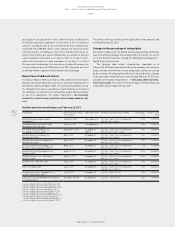

Distributable profits and dividends

Distributable profits to shareholders are determined by reference

to the retained earnings of adidas AG and calculated under German

Commercial Law.

Based on the resolution of the 2012 Annual General Meeting, the

dividend for 2011 was € 1.00 per share (total amount: € 209 million). The

Executive Board of adidas AG will propose to shareholders a dividend

payment of € 1.35 per dividend-entitled share for the year 2012 to be

made from retained earnings of € 606 million reported in the financial

statements of adidas AG according to the German Commercial Code as

at December 31, 2012. The subsequent remaining amount will be carried

forward.

As at December 31, 2012, 209,216,186 dividend-entitled shares exist,

resulting in a dividend payment of € 282 million.

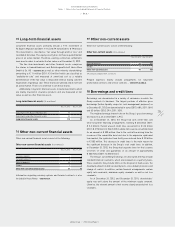

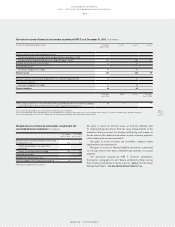

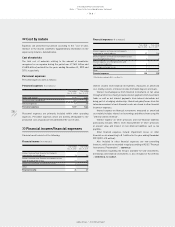

27 Non-controlling interests

This line item within equity comprises the non-controlling interests in

several subsidiaries, which are not directly or indirectly attributable to

adidas AG.

Non-controlling interests are assigned to six subsidiaries as at

December 31, 2012 and to seven subsidiaries as at December 31,

2011 (see Attachment II to the consolidated financial statements

/

SEE

SHAREHOLDINGS OF ADIDAS AG, HERZOGENAURACH, P. 240). These subsidiaries

were partly acquired in connection with the acquisition of Reebok and

partly through purchases or foundations in the last years.

As at December 31, 2011, this line item comprised a 15%

non-controlling interest in the subsidiary in Hungary, adidas Budapest

Kft., Budapest, which adidas AG acquired effective August 31, 2012

/

SEE

NOTE 04.

In 2011, in compliance with IAS 32 “Financial Instruments: Presen-

tation”, the non-controlling interests of GEV Grundstücksgesellschaft

Herzogenaurach mbH & Co. KG (Germany) were not reported within

the line item non-controlling interests as the company is a limited

partnership. The fair value of these non-controlling interests was

shown within other liabilities and the result for these non-controlling

interests was reported within financial expenses

/

SEE NOTE 33. Effective

March 30, 2012, adidas AG acquired the remaining share in the

company

/

SEE NOTE 04.

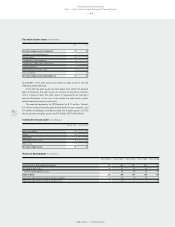

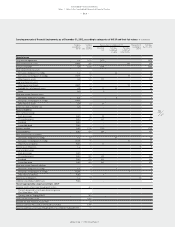

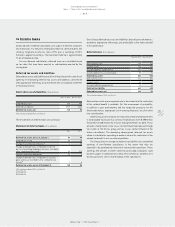

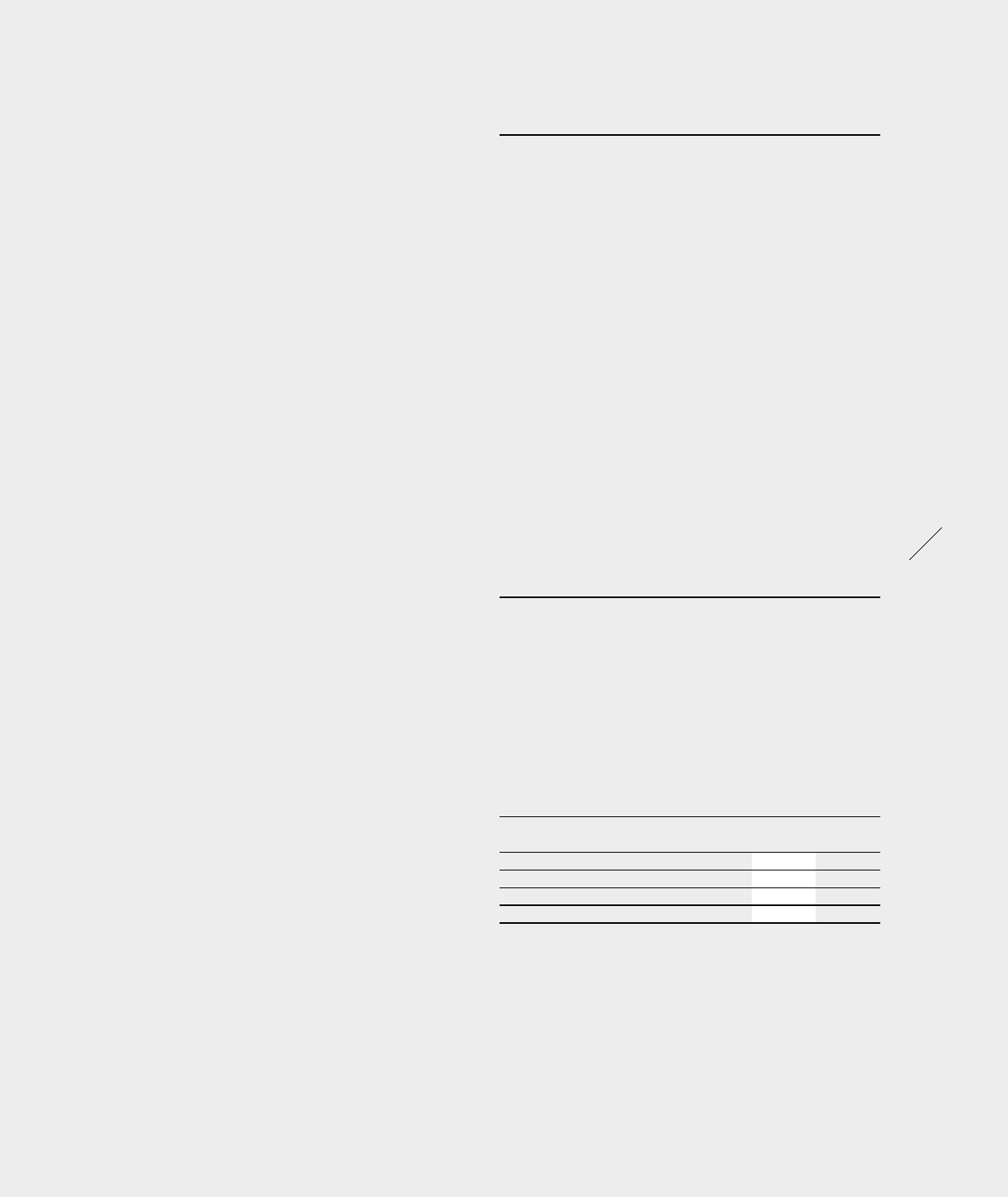

28 Leasing and service arrangements

Operating leases

The Group leases primarily retail stores as well as offices, warehouses

and equipment. The contracts regarding these leases with expiration

dates of between 1 and 13 years partly include renewal options and

escalation clauses. Rent expenses, which partly depend on net sales,

amounted to € 637 million and € 548 million for the years ending

December 31, 2012 and 2011, respectively.

Future minimum lease payments for minimum lease durations on a

nominal basis are as follows:

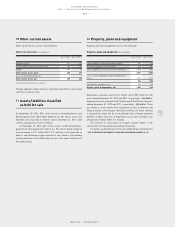

Minimum lease payments for operating leases (€ in millions)

Dec. 31, 2012 Dec. 31, 2011

Within 1 year 456 449

Between 1 and 5 years 996 778

After 5 years 346 331

Total 1,798 1,558