Reebok 2012 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

168

2012

/

03.5

/

Risk and Opportunity Report

/

Strategic risks

Strategic risks

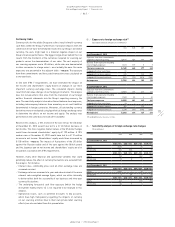

Macroeconomic, socio-political and regulatory risks

Growth in the sporting goods industry is highly dependent on consumer

spending and consumer confidence. Economic downturns, socio-

political factors such as civil unrest, nationalisation or expropriation, in

particular in regions where the Group is highly represented, therefore

pose a significant risk to sales development. In addition, significant

changes in the regulatory environment (e.g. trade policies, tax legislation,

product quality and safety standards, etc.) could lead to potential cost

increases. To mitigate these macroeconomic, socio-political and

regulatory risks, the Group strives to balance sales across key global

regions and also between developed and emerging markets. We also

continuously monitor the macroeconomic, political and regulatory

landscape in all our key markets to anticipate potential problem areas,

so that we are able to quickly adjust our business activities accordingly

upon any change in conditions. Furthermore, a core element of our

positioning in performance sports is the utilisation of an extensive global

event and partnership portfolio where demand is more predictable and

less sensitive to macroeconomic influences. In addition, building on our

leading position within the sporting goods industry, we actively engage

in supporting policymakers and regulators to liberalise global trade,

curtail trade barriers and pro-actively adapt to significant changes in the

regulatory environment.

In 2013, we expect the global economy to grow, albeit with varying

degrees of performance geographically

/

SEE SUBSEQUENT EVENTS

AND OUTLOOK, P. 157. However, as a result of the highly challenging

macroeconomic environment in many European countries, Japan and

the USA as well as the political and regulatory uncertainty in the Middle

East and several Latin American countries, we still regard the potential

impact of macroeconomic, socio-political and regulatory factors as

major. Likewise, we continue to assess the likelihood that adverse

macroeconomic, socio-political or regulatory events could impact our

business to that extent as likely.

Risks related to distribution strategy

The inability to appropriately influence in which channels the Group’s

products are sold constitutes a continuous risk. Grey market activity,

parallel imports or the distribution of our products on open online

marketplaces could negatively affect our own sales performance and the

image of our Group brands. Furthermore, weakly defined segmentation

and channel strategies could lead to an unhealthy utilisation of our

multiple distribution channels as well as strong retaliation from our

customers. As a result, the Group has developed and implemented clearly

defined distribution policies and procedures

/

SEE GLOBAL SALES STRATEGY,

P. 72 to avoid over-distribution of products in a particular channel and

limit the exposure to unwanted channels such as grey markets or open

marketplaces. In addition, we conduct specific trainings for our sales

force to appropriately manage product distribution and ensure that the

right product is sold at the right point of sale to the right consumer at

an adequate price.

Nevertheless, unbalanced product distribution and the inability to

effectively manage our different sales channels could have a significant

impact on the Group. As a result of the dynamic market environment

and the fast-changing world of online sales, we evaluate the likelihood

of materialising as possible.

Dependency risks

Risks arise from a dependence on particular suppliers, customers,

other business partners, products or even markets. An over-reliance

on a supplier for a substantial portion of the Group’s product volume,

or an over-dependence on a particular customer, increases the Group’s

vulnerability to delivery and sales shortfalls and could lead to significant

margin pressure. Similarly, a strong dependence on certain products or

markets could make the Group very susceptible to swings in consumer

demand or changes in the market environment.

To mitigate these risks, the Group works with a broad network of

suppliers and does not have a single-sourcing model for any key

product. Likewise, we utilise a broad distribution strategy which includes

further expanding our controlled space activities. This enables us to

reduce negative consequences resulting from sales shortfalls that can

occur with key customers. Specifically, no single customer of our Group

accounted for more than 10% of Group sales in 2012. Furthermore,

we consistently provide a well-balanced product portfolio with no

particular model or article contributing more than 1% to Group sales,

which enables us to minimise negative effects from sudden unexpected

changes in consumer demand.

Despite our global diversification, which reduces reliance on a particular

market as far as possible, we still remain vulnerable to negative

developments in key sales markets such as Russia/CIS, China or

North America as well as our important sourcing countries. Therefore,

we regard the potential impact of these risks as significant and the

likelihood of materialising as possible.