Reebok 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Our Group

107

2012

Research and Development

/

02.6

/

Highly skilled technical personnel

Our R&D departments comprise experienced and multi-skilled people

from different areas of technical expertise and from diverse cultural

backgrounds. A significant part of our innovation process, and therefore

personnel and skill base, relates to consumer and user insights.

Product designers, engineers and sport scientists as well as material

engineering experts focus on product development. These teams

are supported by project managers to coordinate execution. Process

and production specialists also form an essential part of our product

development competencies. Other professional backgrounds include

software development, electronic engineering, Finite Element Analysis,

advanced CAD design and kinesiology.

The number of people employed in the Group’s R&D activities at

December 31, 2012, was 1,035, compared to 1,029 employees in the prior

year. This represents 2% of total Group employees. In 2013, we expect

the number of R&D employees to remain stable.

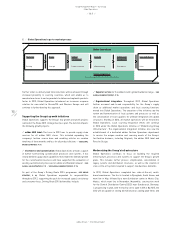

Initiatives to further streamline product creation process

We aim at improving our ability to adapt to changing consumer

preferences more quickly, flexibly and efficiently. We achieve this by

facilitating the direct interaction with and involvement of our suppliers in

product creation, quality control, product testing and commercialisation.

In 2012, we enhanced our computer simulation research platform to

further reduce the time to market of product innovations. This software

system, with its advanced material and design capabilities, allows

for more creativity in the design phase and significantly improves the

level of product detailing. While increasing speed and reducing the

need for physical product samples and testing in the R&D process,

the benefits also translate into other Group commercial and efficiency

initiatives. Advanced 3D models contributed to the Group’s cross-

functional virtualisation project, where in 2012 we reduced the number

of manufactured physical samples by over 20%. An additional benefit

of creating virtual assets is their application in other areas, such as

e-commerce, computer games, virtual merchandising and digital

communication.

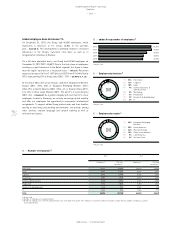

R&D expenses increase 12%

Each year, we invest considerable resources into developing and

commercialising new technologies as well as fresh design ideas, in

order to offer the best experience for our users. R&D expenses include

expenses for personnel and administration, but exclude other costs, for

example those associated with the design aspect of the product creation

process

/

SEE NOTE 02, P. 197. In 2012, as in prior years, all R&D costs were

expensed as incurred. adidas Group R&D expenses increased 12% to

€ 128 million (2011: € 115 million) as a result of increases at the adidas

brand from initiatives relating to the development of lightweight and

intelligent products. Personnel expenses represent the largest portion

of R&D expenses, accounting for more than 69% of total R&D expenses.

In 2012, R&D expenses represented 2.1% of other operating expenses

as in the prior year. R&D expenses as a percentage of sales remained

stable at 0.9% (2011: 0.9%)

/

TABLE 02.

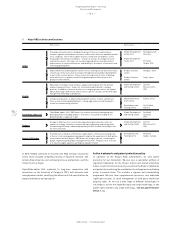

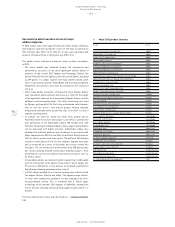

Successful commercialisation of technological

innovations

We believe developing industry-leading technologies and user

experiences is only one aspect of being an innovation leader. Even more

important is the successful commercialisation of those technological

innovations, while consistently increasing our commitment to sustainable

product development. The awards we attained in 2012 highlight our

technology leadership within the sporting goods industry

/

TABLE 04.

As in prior years, the majority of adidas Group sales were generated

with products newly introduced in the course of 2012. New products tend

to have a higher gross margin compared to products which have been

in the market for more than one season. As a result, newly launched

products contributed over-proportionately to the Group’s net income

in 2012. We expect this development to continue in 2013 as our launch

schedule includes a full pipeline of innovative products

/

SEE SUBSEQUENT

EVENTS AND OUTLOOK, P. 157.

02

/

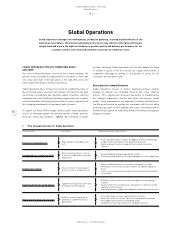

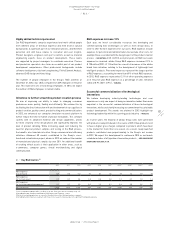

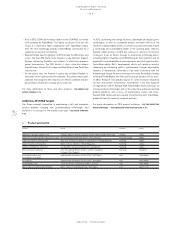

Key R&D metrics 1)

2012 2011 2010 2009 2008 2007 2006 2) 2005 3) 2004 3) 2003 4)

R&D expenses

(€ in millions) 128 115 102 86 81 84 98 63 59 86

R&D expenses

(in % of net sales) 0.9 0.9 0.8 0.8 0.8 0.8 1.0 0.9 1.0 1.4

R&D expenses

(in % of other operating expenses) 2.1 2.1 2.0 2.0 1.9 2.1 2.6 2.5 2.6 3.7

R&D employees 1,035 1,029 1,002 999 1,152 976 1,040 636 595 985

1) 2011 restated according to IAS 8, see Note 03, p. 203. Prior years are not restated, see p. 131.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006.

3) Reflects continuing operations as a result of the divestiture of the Salomon business segment.

4) Including Salomon business segment, which was more research-intensive due to its significant hard goods exposure.