ICICI Bank 2016 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93Annual Report 2015-2016

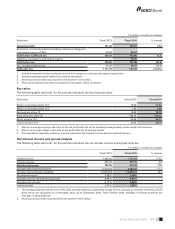

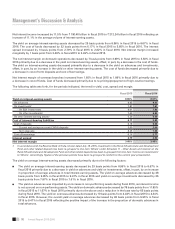

during the year. Total deposits grew by 9.7% year-on-year at April 1, 2016 compared to a growth of 12.1% at April 3, 2015.

Demand deposits grew by 15.0% year-on-year at April 1, 2016 compared to a growth of 23.7% at April 3, 2015. Time

deposits grew by 9.1% year-on-year at April 1, 2016 compared to a growth of 10.9% at April 3, 2015.

The operating environment for the Indian corporate sector continued to remain challenging in view of the subdued global

scenario, gradual nature of the domestic economic recovery, continued weak corporate investment activity, delays and

shortfalls in cash ow generation from investments and high leverage. The decline in commodity prices had an impact

on borrowers in commodity-linked sectors, such as iron and steel. These conditions led to increasing levels of non-

performing loans for the Indian banking sector.

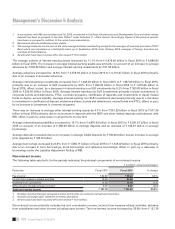

With regard to performance of the insurance sector, the rst year retail premium underwritten in the life insurance sector

(on weighted received premium basis) grew by 8.1% to ` 440.76 billion during scal 2016 compared to ` 407.65 billion

in scal 2015. Gross premium of the non-life insurance sector (excluding specialised insurance institutions) grew by

13.6% to ` 915.72 billion during scal 2016 compared to ` 805.84 billion during scal 2015. The average assets under

management of mutual funds increased by 13.9% from ` 11,886.90 billion for the three months ended March 31, 2015 to

` 13,534.43 billion for the three months ended March 31, 2016.

Some important regulatory measures announced during scal 2016 were:

In April 2015, RBI issued revised guidelines on priority sector lending, based on the recommendations of the internal

working group set up to revisit the priority sector lending guidelines. These revised priority sector guidelines are

applicable from scal 2016. The overall target for priority sector lending would continue to be 40.0% of adjusted net

bank credit. Sub-targets for direct and indirect lending to agriculture were combined and sub-targets of 8.0% for

lending to small and marginal farmers and 7.5% lending target to micro-enterprises were introduced. These sub-

targets are to be achieved in a phased manner by March 2017. Sectors qualifying for priority sector lending have

been broadened to include medium-size enterprises, social infrastructure and renewable energy. Priority sector

lending achievements will be evaluated on a quarterly average basis from scal 2017. According to the guidelines,

foreign banks with less than 20 branches will also now be required to meet priority sector lending targets of 40.0%

of adjusted net bank credit, on par with domestic banks and foreign banks with 20 or more branches by scal 2020.

Further, in July 2015, RBI directed banks to maintain direct lending to non-corporate farmers at the banking system’s

average level for the last three years, failing which banks will attract penalties for the shortfall. The banking system’s

average level will be notied at the beginning of each year. The target for scal 2016 was set at 11.51%;

In April 2015, RBI allowed banks to introduce an early withdrawal facility in term deposits as a distinguishing feature

for offering differential rates of interest. All term deposits of individuals of ` 1.5 million and below will have a

premature withdrawal facility. For other term deposits, customers have the option to choose between term deposits

either with or without premature withdrawal facility;

In May 2015, RBI allowed banks to spread the shortfall from the sale of non-performing assets to asset reconstruction

companies over a period of two years, in the event the sale value is lower than the net book value. This dispensation

is available only for non-performing assets sold up to March 31, 2016;

In May 2015, RBI issued draft guidelines on net stable funding ratio. According to the draft guidelines, the net stable

funding ratio is dened as the amount of available stable funding required to cover the liquidity requirements and

asset maturities coming up over the next year. Banks will be required to maintain a ratio of at least 100.0% on an

ongoing basis. These guidelines are expected to be applicable from January 1, 2018;

In May 2015, RBI introduced a framework for dealing with loan frauds. The guidelines relate to detection, reporting

and monitoring of fraud accounts. They prescribe continuous monitoring and red agging of accounts based on

early warning signals for accounts above ` 500.0 million. Frauds have to be reported on RBI’s central repository of

information on large credits for dissemination to other banks and decision-making by the joint lenders’ forum in

case of consortium or multiple banking arrangements. Restructuring or grant of additional facilities would not be

permitted in case of fraud or red agged accounts;

In June 2015, RBI issued guidelines on the compensation of non-executive directors of private sector banks. According

to the guidelines, the board of directors, in consultation with its remuneration committee, should formulate and

adopt a comprehensive compensation policy for the non-executive directors (other than the part-time non-executive

chairman). In the policy, the board may provide for the payment of compensation in the form of a prot related