ICICI Bank 2016 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016 217

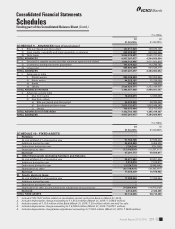

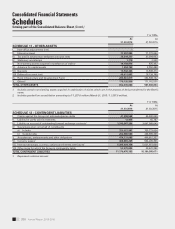

Schedules

forming part of the Consolidated Accounts (Contd.)

Consolidated Financial Statements

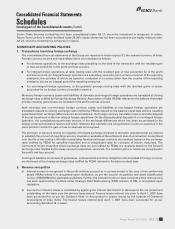

10. Employee benets

Gratuity

The Group pays gratuity, a dened benet plan, to employees who retire or resign after a minimum prescribed period

of continuous service and in case of employees at overseas locations as per the rules in force in the respective

countries. The Group makes contribution to trusts which administer the funds on their own account or through

insurance companies.

The actuarial gains or losses arising during the year are recognised in the prot and loss account.

Actuarial valuation of the gratuity liability is determined by an actuary appointed by the Group. Actuarial valuation of

gratuity liability is determined based on certain assumptions regarding rate of interest, salary growth, mortality and

staff attrition as per the projected unit credit method.

Superannuation fund and National Pension Scheme

The Bank contributes 15.00% of the total annual basic salary of certain employees to superannuation funds, a dened

contribution plan, managed and administered by insurance companies. Further, the Bank contributes 10.00% of

the total basic salary of certain employees to National Pension Scheme (NPS), a dened contribution plan, which

is managed and administered by pension fund management companies. The Bank also gives an option to its

employees allowing them to receive the amount in lieu of such contributions along with their monthly salary during

their employment.

The amounts so contributed/paid by the Bank to the superannuation fund and NPS or to employee during the year

are recognised in the prot and loss account.

ICICI Prudential Life Insurance Company, ICICI Prudential Asset Management Company and ICICI Venture Funds

Management Company have accrued for superannuation liability based on a percentage of basic salary payable to

eligible employees for the period of service.

Pension

The Bank provides for pension, a dened benet plan covering eligible employees of erstwhile Bank of Madura,

erstwhile Sangli Bank and erstwhile Bank of Rajasthan. The Bank makes contribution to a trust which administers

the funds on its own account or through insurance companies. The plan provides for pension payment including

dearness relief on a monthly basis to these employees on their retirement based on the respective employee’s years

of service with the Bank and applicable salary.

Actuarial valuation of the pension liability is determined by an actuary appointed by the Bank. Actuarial valuation of

pension liability is calculated based on certain assumptions regarding rate of interest, salary growth, mortality and

staff attrition as per the projected unit credit method.

The actuarial gains or losses arising during the year are recognised in the prot and loss account.

Employees covered by the pension plan are not eligible for employer ’s contribution under the provident fund plan.

Provident fund

The Group is statutorily required to maintain a provident fund, a dened benet plan, as a part of retirement benets to

its employees. Each employee contributes a certain percentage of his or her basic salary and the Group contributes an

equal amount for eligible employees. The Group makes contribution as required by The Employees’ Provident Funds

and Miscellaneous Provisions Act, 1952 to Employees’ Pension Scheme administered by the Regional Provident

Fund Commissioner and the balance contributions are transferred to funds administered by trustees. The funds are

invested according to the rules prescribed by the Government of India.

Actuarial valuation for the interest rate guarantee on the provident fund balances is determined by an actuary

appointed by the Group.

The actuarial gains or losses arising during the year are recognised in the prot and loss account.