ICICI Bank 2016 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

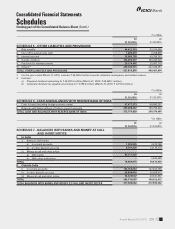

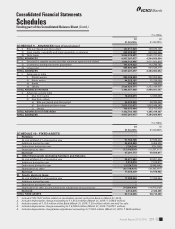

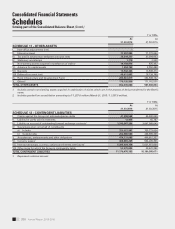

Annual Report 2015-2016214

Schedules

forming part of the Consolidated Accounts (Contd.)

Consolidated Financial Statements

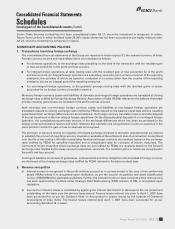

c) Income on discounted instruments is recognised over the tenure of the instrument.

d) Dividend income is accounted on an accrual basis when the right to receive the dividend is established.

e) Loan processing fee is accounted for upfront when it becomes due except in the case of foreign banking

subsidiaries, where it is amortised over the period of the loan.

f) Project appraisal/structuring fee is accounted for on the completion of the agreed service.

g) Arranger fee is accounted for as income when a signicant portion of the arrangement/syndication is completed.

h) Commission received on guarantees issued is amortised on a straight-line basis over the period of the guarantee.

i) Fund management and portfolio management fees are recognised on an accrual basis.

j) The annual/renewal fee on credit cards is amortised on a straight line basis over one year.

k) All other fees are accounted for as and when they become due.

l) The Bank deals in bullion business on a consignment basis. The difference between price recovered from

customers and cost of bullion is accounted for at the time of sales to the customers. The Bank also deals in

bullion on a borrowing and lending basis and the interest paid/received is accounted on accrual basis.

m) Income from securities brokerage activities is recognised as income on the trade date of the transaction.

Brokerage income in relation to public or other issuances of securities is recognised based on mobilisation and

terms of agreement with the client.

n) Life insurance premium for non-linked policies is recognised as income when due from policyholders. For unit

linked business, premium is recognised when the associated units are created. Premium on lapsed policies is

recognised as income when such policies are reinstated. Top-up premiums paid by unit linked policyholders’ are

considered as single premium and recognised as income when the associated units are created. Income from

unit linked policies, which includes fund management charges, policy administration charges, mortality charges

and other charges, if any, are recovered from the linked funds in accordance with the terms and conditions of the

policy and are recognised when due.

o) In the case of general insurance business, premium is recorded for the policy period at the commencement of

risk and for instalment cases, it is recorded on instalment due dates. Premium earned is recognised as income

over the period of the risk or the contract period based on 1/365 method, whichever is appropriate, on a gross

basis, net of service tax. Any subsequent revision to premium is recognised over the remaining period of risk or

contract period. Adjustments to premium income arising on cancellation of policies are recognised in the period

in which the policies are cancelled. Commission on re-insurance ceded is recognised as income in the period of

ceding the risk. Prot commission under re-insurance treaties, wherever applicable, is recognised as income in

the period of nal determination of prots and combined with commission on reinsurance ceded.

p) In case of life insurance business, reinsurance premium ceded is accounted in accordance with the terms of the

relevant treaty with the reinsurer. Prot commission on reinsurance ceded is netted off against premium ceded

on reinsurance.

q) In the case of general insurance business, insurance premium on ceding of the risk is recognised in the period

in which the risk commences. Any subsequent revision to premium ceded is recognised in the period of such

revision. Adjustment to re-insurance premium arising on cancellation of policies is recognised in the period

in which they are cancelled. In case of life insurance business, reinsurance premium ceded is accounted in

accordance with the terms and conditions of the relevant treaties with the reinsurer. Prot commission on

reinsurance ceded is netted off against premium ceded on reinsurance.

r) In the case of general insurance business, premium deciency is recognised when the sum of expected claim

costs and related expenses and maintenance costs exceed the reserve for unexpired risks and is computed at a

company level. The expected claim cost is calculated and duly certied by the Appointed Actuary.