ICICI Bank 2016 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016 187

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

45. Small and micro enterprises

Under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 which came into force from

October 2, 2006, certain disclosures are required to be made relating to enterprises covered under the Act. During

the year ended March 31, 2016, the amount paid after the due date to vendors registered under the MSMED Act,

2006 was ` 0.4 million (March 31, 2015: ` 4.7 million). An amount of ` 0.01 million (March 31, 2015: ` 0.06 million) has

been charged to prot & loss account towards payment of interest on these delayed payments.

46. Penalties/nes imposed by RBI and other banking regulatory bodies

The penalty imposed by RBI and other banking regulatory bodies during the year ended March 31, 2016 was Nil

(March 31, 2015: ` 10.4 million).

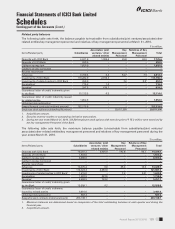

47. Disclosure on Remuneration

Compensation Policy and practices

(A) Qualitative Disclosures

a) Information relating to the bodies that oversee remuneration.

Name, composition and mandate of the main body overseeing remuneration

The Board Governance, Remuneration & Nomination Committee (BGRNC or Committee) is the main body

overseeing remuneration. The BGRNC at March 31, 2016 comprised three independent Directors. The

functions of the Committee include recommendation of appointments of Directors to the Board, evaluation

of the performance of the Wholetime Directors (including the Managing Director & CEO) on predetermined

parameters, recommendation to the Board of the remuneration (including performance bonus and

perquisites) to Wholetime Directors, approval of the policy for and quantum of bonus payable to the

members of the staff, including senior management and key management personnel, framing of guidelines

for the Employees Stock Option Scheme (ESOS) and recommendation of grant of the Bank’s stock options

to employees and WTDs of the Bank and its subsidiary companies.

External consultants whose advice has been sought, the body by which they were commissioned, and in

what areas of the remuneration process

Not Applicable

Scope of the Bank’s remuneration policy (eg. by regions, business lines), including the extent to which it

is applicable to foreign subsidiaries and branches

The Compensation Policy of the Bank, approved by the Board on January 31, 2012, pursuant to the guidelines

issued by RBI, covers all employees of the Bank, including those in overseas branches of the Bank. In addition

to the Bank’s Compensation Policy guidelines, the overseas branches also adhere to relevant local regulations.

Type of employees covered and number of such employees

All employees of the Bank are governed by the Compensation Policy. The total number of permanent

employees of the Bank at March 31, 2016 was 72,175.

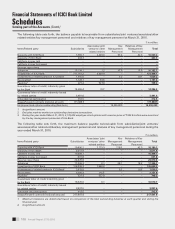

b) Information relating to the design and structure of remuneration processes.

Key features and objectives of remuneration policy

The Bank has under the guidance of the Board and the BGRNC, followed compensation practices intended to

drive meritocracy within the framework of prudent risk management. This approach has been incorporated

in the Compensation Policy, the key elements of which are given below.

Effective governance of compensation: The BGRNC has oversight over compensation. The Committee

denes Key Performance Indicators (KPIs) for Wholetime Directors and equivalent positions and the

organisational performance norms for bonus based on the nancial and strategic plan approved by the

Board. The KPIs include both quantitative and qualitative aspects. The BGRNC assesses organisational

performance as well as the individual performance for Wholetime Directors and equivalent positions.

Based on its assessment, it makes recommendations to the Board regarding compensation for Wholetime