ICICI Bank 2016 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016 153

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

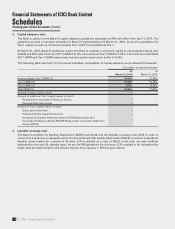

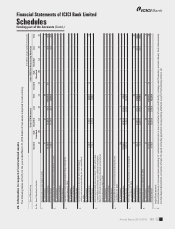

The following table sets forth, the issuer composition of investments of the Bank in securities, other than

government and other approved securities at March 31, 2015.

` in million

Sr.

No.

Issuer Amount

Extent of

private

placement2

Extent of ‘below

investment grade’

securities

Extent of

‘unrated’

securities 3,4

Extent of

‘unlisted’

securities4

(a) (b) (c) (d)

1PSUs 16,011.7 10,870.8 – – –

2 FIs 37,028.6 25,340.3 – – –

3 Banks 121,737.0 107,104.2 – – –

4 Private corporates 97,754.7 88,835.8 7,836.4 4,054.6 3,032.8

5 Subsidiaries/ Joint ventures 117,751.2 – – – 6,861.9

6 Others5,6,7 142,751.0 141,016.6 16,888.7 – –

7Provision held towards depreciation (25,674.7) N.A N.A N.A N.A

Total 507,359.5 373,167.7 24,725.1 4,054.6 9,894.7

1. Amounts reported under columns (a), (b), (c) and (d) above are not mutually exclusive.

2. Includes ` 33,050.4 million of application money towards corporate bonds/debentures and pass through certificates.

3. Excludes investments, amounting to ` 4,396.9 million in preference shares of subsidiaries and ` 2,465.0 million in

subordinated bonds of subsidiary ICICI Bank Canada.

4. Excludes equity shares, units of equity-oriented mutual fund, units of venture capital fund, pass through certificates,

security receipts, commercial papers, certificates of deposit, non-convertible debentures (NCDs) with original or initial

maturity up to one year issued by corporate (including NBFCs), unlisted convertible debentures and securities acquired

by way of conversion of debt.

5. Excludes investments in non-Indian government securities by overseas branches amounting to ` 17,824.0 million.

6. Excludes investments in non-SLR Indian government securities amounting to ` 90.8 million.

7. Pursuant to RBI guidelines, investment in Rural Infrastructure and Development Fund and other related deposits of

` 284,508.2 million has been re-classified to line item ‘Others’ under Schedule 11 - Other Assets.

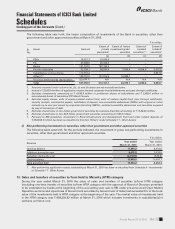

ii) Non-performing investments in securities, other than government and other approved securities

The following table sets forth, for the periods indicated, the movement in gross non-performing investments in

securities, other than government and other approved securities.

` in million

Revenue Year ended

March 31, 2016

Year ended

March 31, 2015

Opening balance 11,444.2 4,414.0

Additions during the year 8,075.2 7,633.5

Reduction during the year (2,718.9) (549.8)

Closing balance 16,800.5 11,497.7

Total provision held 10,404.2 8,262.2

1. Non-performing application money outstanding at March 31, 2015 has been re-classified from Schedule 8 - Investments

to Schedule 11 - Other Assets.

13. Sales and transfers of securities to/from Held to Maturity (HTM) category

During the year ended March 31, 2016 the value of sales and transfers of securities to/from HTM category

(excluding one-time transfer of securities to/from HTM category with the approval of Board of Directors permitted

to be undertaken by banks at the beginning of the accounting year, sale to RBI under pre-announced Open Market

Operation auctions and repurchase of Government securities by Government of India) had exceeded 5% of the book

value of the investments held in HTM category at the beginning of the year. The market value of investments held

in the HTM category was ` 999,326.82 million at March 31, 2016 which includes investments in subsidiaries/joint

ventures carried at cost.