ICICI Bank 2016 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

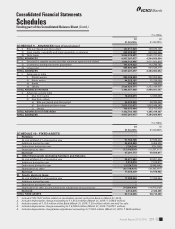

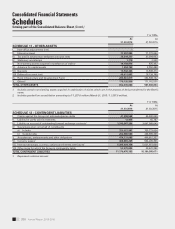

Annual Report 2015-2016216

Schedules

forming part of the Consolidated Accounts (Contd.)

Consolidated Financial Statements

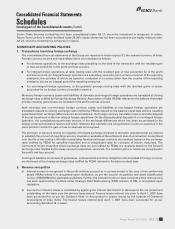

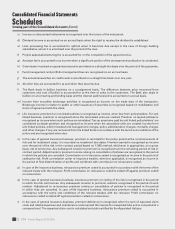

have been incurred during the accounting period but have not been reported or claimed. The claims IBNR provision

also includes provision, if any, required for claims IBNER. Estimated liability for claims IBNR/claims IBNER is based

on an actuarial estimate duly certied by the appointed actuary of the entity.

In the case of life insurance business, benets paid comprise of policy benets and claim settlement costs, if any.

Death and rider claims are accounted for on receipt of intimation. Survival and maturity benets are accounted when

due. Withdrawals and surrenders under non linked policies are accounted on the receipt of intimation.

6. Liability for life policies in force

In the case of life insurance business, the liabilities for life policies in force are calculated in accordance with accepted

actuarial practice, requirements of Insurance Act, 1938 (amended by Insurance Laws (Amendment) Act, 2015) and

regulations notied by the Insurance Regulatory and Development Authority of India and Actuarial Practice Standards

of the Institute of Actuaries of India.

7. Reserve for unexpired risk

Reserve for unexpired risk is recognised net of re-insurance ceded and represents premium written that is attributable

and to be allocated to succeeding accounting periods for risks to be borne by the entity under contractual obligations

on contract period basis or risk period basis, whichever is appropriate. It is calculated on a daily pro-rata basis subject

to a minimum of 50.00% of the aggregated premium, written on policies during the twelve months preceding the

balance sheet date for re, marine, cargo and miscellaneous business and 100.00% for marine hull business, on all

unexpired policies at balance sheet date, in accordance with the provisions of the Insurance Act, 1938.

8. Actuarial method and valuation

In the case of life insurance business, the actuarial liability on both participating and non-participating policies is

calculated using the gross premium method, using assumptions for interest, mortality, morbidity, expense and

ination, and in the case of participating policies, future bonuses together with allowance for taxation and allocation

of prots to shareholders. These assumptions are determined as prudent estimates at the date of valuation with

allowances for adverse deviations.

The greater of liability calculated using discounted cash ows and unearned premium reserves is held for the

unexpired portion of the risk for the non-unit liabilities of linked business and attached riders.

The unit liability in respect of linked business has been taken as the value of the units standing to the credit of

policyholders, using the Net Asset Value (NAV) prevailing at the valuation date.

An unexpired risk reserve and a reserve in respect of claims incurred but not reported are created, for one year

renewable group term insurance.

The interest rates used for valuing the liabilities are in the range of 4.92% to 5.53% per annum (previous year – 4.47%

to 5.39% per annum).

Mortality rates used are based on the published “Indian Assured Lives Mortality (2006 – 2008) Ult.” mortality table for

assurances and LIC 96-98 table for annuities, adjusted to reect expected experience while morbidity rates used are

based on CIBT 93 table, adjusted for expected experience, or on risk rates supplied by reinsurers.

Expenses are provided for at current levels, in respect of renewal expenses, with no allowance for future improvements

but with an allowance for any expected worsening. Per policy renewal expenses for regular premium policies are

assumed to inate at 5.18% (previous year – 4.49%).

9. Acquisition costs for insurance business

Acquisition costs are those costs that vary with and are primarily related to the acquisition of insurance contracts and

are expensed in the period in which they are incurred.