ICICI Bank 2016 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33Annual Report 2015-2016

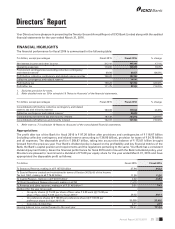

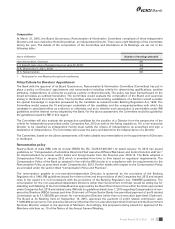

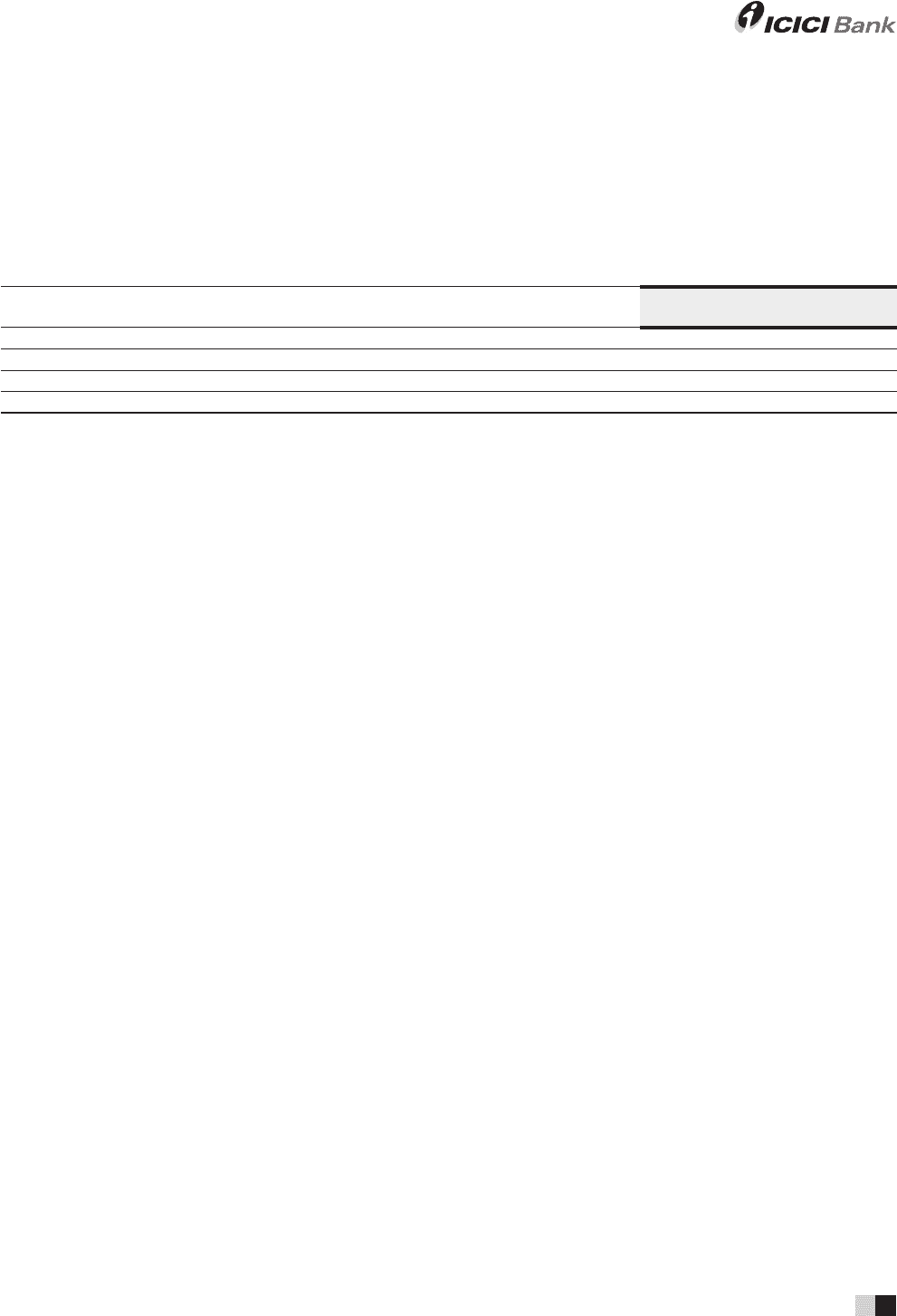

Composition

At March 31, 2016, the Board Governance, Remuneration & Nomination Committee comprised of three independent

Directors and was chaired by Homi Khusrokhan, an independent Director. There were eight Meetings of the Committee

during the year. The details of the composition of the Committee and attendance at its Meetings are set out in the

following table:

Name of Member Number of meetings attended

Homi Khusrokhan, Chairman 8/8

K. V. Kamath (upto close of business hours on June 30, 2015)13/4

M. K. Sharma (w.e.f. July 1, 2015) 4/4

M. S. Ramachandran 8/8

1. Participated in one Meeting through tele-conference.

Policy/Criteria for Directors’ Appointment

The Bank with the approval of its Board Governance, Remuneration & Nomination Committee (Committee) has put in

place a policy on Directors’ appointment and remuneration including criteria for determining qualications, positive

attributes, independence of a Director as well as a policy on Board diversity. The policy has been framed based on the

broad principles as outlined hereinafter. The Committee would evaluate the composition of the Board and vacancies

arising in the Board from time to time. The Committee while recommending candidature of a Director would consider

the special knowledge or expertise possessed by the candidate as required under Banking Regulation Act, 1949. The

Committee would assess the t and proper credentials of the candidate and the companies/entities with which the

candidate is associated either as a director or otherwise and as to whether such association is permissible under RBI

guidelines and the internal norms adopted by the Bank. For the above assessment, the Committee would be guided by

the guidelines issued by RBI in this regard.

The Committee will also evaluate the prospective candidate for the position of a Director from the perspective of the

criteria for independence prescribed under Companies Act, 2013 as well as the listing regulations. For a non-executive

Director to be classied as independent he/she must satisfy the criteria of independence as prescribed and sign a

declaration of independence. The Committee will review the same and determine the independence of a Director.

The Committee, based on the above assessments, will make suitable recommendations on the appointment of Directors

to the Board.

Remuneration policy

Reserve Bank of India (RBI) vide its circular DBOD No. BC. 72/29.67.001/2011-12 dated January 13, 2012 has issued

guidelines on “Compensation of wholetime Directors/Chief executive Ofcers/Risk takers and Control function staff etc.”

for implementation by private sector banks and foreign banks from the nancial year 2012-13. The Bank adopted a

Compensation Policy in January 2012 which is amended from time to time based on regulatory requirements. The

Compensation Policy of the Bank as adopted in line with the RBI circular is in compliance with the requirements for the

Remuneration Policy as prescribed under Companies Act, 2013. Further details with respect to the Compensation Policy

are provided under the section titled “Compensation Policy and Practices”.

The remuneration payable to non-executive/independent Directors is governed by the provisions of the Banking

Regulation Act, 1949, RBI guidelines issued from time to time and the provisions of the Companies Act, 2013 and related

rules to the extent it is not inconsistent with the provisions of the Banking Regulation Act, 1949/RBI guidelines. The

remuneration for the non-executive/independent Directors (other than Government nominee) would be sitting fee for

attending each Meeting of the Committee/Board as approved by the Board from time to time within the limits as provided

under Companies Act, 2013 and related rules. RBI vide its guidelines dated June 1, 2015 regarding Compensation of non-

executive Directors (NEDs) (except part-time Chairman) of Private Sector Banks has permitted payment of prot related

Commission up to ` 1,000,000 per annum for non-executive Directors (other than non-executive (part-time) Chairman).

The Board at its Meeting held on September 16, 2015, approved the payment of prot related commission upto

` 1,000,000 per annum to non-executive Directors (other than the non-executive (part-time) Chairman and the Government

Nominee Director) subject to the approval of Members. Accordingly, this proposal is being placed for approval of the

Members vide item no. 10 of the Notice of the Annual General Meeting.