ICICI Bank 2016 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

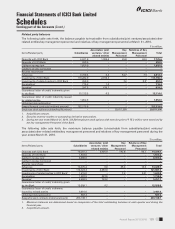

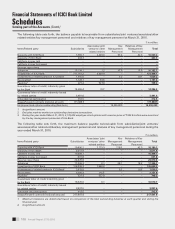

Annual Report 2015-2016182

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

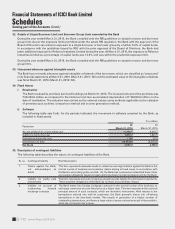

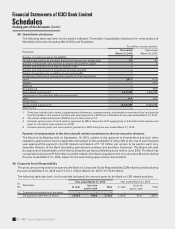

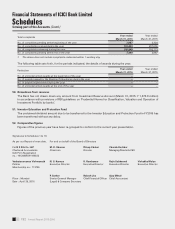

Investment in Certificate of Deposits (CDs)/bonds issued by ICICI Bank

During the year ended March 31, 2016, subsidiaries have invested in CDs/bonds issued by the Bank amounting

to Nil (March 31, 2015: ` 3,210.0 million). The material transactions for the year ended March 31, 2016 were with

ICICI Prudential Life Insurance Company Limited amounting to Nil (March 31, 2015: ` 2,000.0 million) and with ICICI

Securities Primary Dealership Limited amounting to Nil (March 31, 2015: ` 1,210.0 million).

Redemption/buyback of investments

During the year ended March 31, 2016, the Bank received ` 2,561.5 million (equivalent to CAD 50.0 million) [March

31, 2015: Nil] on account of redemption of bonds, ` 2,561.5 million (equivalent to CAD 50.0 million) [March 31, 2015:

` 3,922.6 million (equivalent to CAD 80.0 million)] on account of buyback of equity shares and ` 1,900.2 million

(equivalent to CAD 37.1 million) [March 31, 2015: Nil] on account of redemption of preference shares by ICICI Bank

Canada.

During the year ended March 31, 2016, the Bank received Nil [March 31, 2015: ` 4,687.5 million (equivalent to USD

75.0 million)] from ICICI Bank UK PLC on account of buyback of equity shares.

During the year ended March 31, 2016, the Bank received ` 305.0 million (March 31, 2015: ` 74.4 million) from ICICI

Equity Fund, ` 188.2 million (March 31, 2015: ` 118.0 million) from India Advantage Fund-III, and ` 94.6 million (March

31, 2015: ` 21.6 million) from India Advantage Fund-IV on account of redemption of units and distribution of gain/loss

on units.

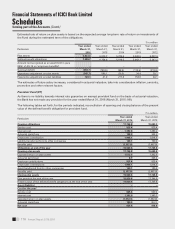

Reimbursement of expenses to subsidiaries

During the year ended March 31, 2016, the Bank reimbursed expenses to its subsidiaries amounting to ` 108.1 million

(March 31, 2015: ` 60.4 million). The material transactions for the year ended March 31, 2016 were with ICICI Bank

UK PLC amounting to ` 102.6 million (March 31, 2015: ` 57.4 million).

Reimbursement of expenses to the Bank

During the year ended March 31, 2016, subsidiaries reimbursed expenses to the Bank amounting to ` 4.2 million

(March 31, 2015: ` 5.8 million).The material transactions for the year ended March 31, 2016 were with ICICI Home

Finance Company Limited amounting to ` 2.7 million (March 31, 2015: Nil), ICICI Lombard General Insurance Company

Limited amounting to ` 0.8 million (March 31, 2015: Nil), ICICI Bank Canada amounting to ` 0.7 million (March 31,

2015: ` 4.7 million) and with ICICI Bank UK PLC amounting to Nil (March 31, 2015: ` 1.1 million).

Brokerage, fees and other expenses

During the year ended March 31, 2016, the Bank paid brokerage, fees and other expenses to its subsidiaries

amounting to ` 786.0 million (March 31, 2015: ` 833.1 million) and to its associates/joint ventures/other related

entities amounting to ` 5,248.6 million (March 31, 2015: ` 4,645.1 million). The material transactions for the year

ended March 31, 2016 were with I-Process Services (India) Private Limited amounting to ` 2,830.9 million (March

31, 2015: ` 2,362.7 million), ICICI Merchant Services Private Limited amounting to ` 2,341.3 million (March 31, 2015:

` 2,216.0 million) and with ICICI Home Finance Company Limited amounting to ` 652.5 million (March 31, 2015:

` 662.1 million).

Income on custodial services

During the year ended March 31, 2016, the Bank recovered custodial charges from its subsidiaries amounting to

` 11.3 million (March 31, 2015: ` 11.8 million) and from its associates/joint ventures/other related entities amounting

to ` 1.6 million (March 31, 2015: ` 1.5 million). The material transactions for the year ended March 31, 2016 were with

ICICI Prudential Asset Management Company Limited amounting to ` 8.8 million (March 31, 2015: ` 7.3 million) and

with ICICI Securities Primary Dealership Limited amounting to ` 2.5 million (March 31, 2015: ` 4.5 million).

Interest expenses

During the year ended March 31, 2016, the Bank paid interest to its subsidiaries amounting to ` 402.9 million (March

31, 2015: ` 614.2 million), to its associates/joint ventures/other related entities amounting to ` 102.6 million (March

31, 2015: ` 257.9 million), to its key management personnel amounting to ` 3.8 million (March 31, 2015: ` 6.2

million) and to relatives of key management personnel amounting to ` 3.0 million (March 31, 2015: ` 2.3 million).