ICICI Bank 2016 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41Annual Report 2015-2016

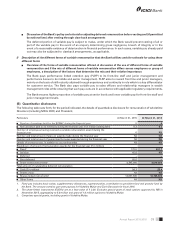

(vi) Comparison of the remuneration of the Key Managerial Personnel (KMP) against the performance of the company;

For the FY2016, the KMPs were paid around 0.22% of the PAT.

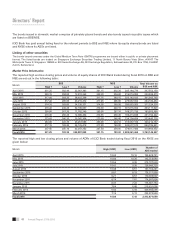

(vii) variations in the market capitalisation of the company, price earnings ratio as at the closing date of the current

financial year and previous financial year and percentage increase or decrease in the market quotations of the

shares of the company in comparison to the rate at which the company came out with the last public offer in

case of listed companies;

March 31, 2015 March 31, 2016

Market capitalisation (` in billion) 1,829.03 1,376.06

Price/Earnings multiple116.33 14.13

Increase in the market quotations of the equity shares in comparison to the rate at

which the last public offer made in August 2007 67.8% 25.9%

1. Price earnings multiple is the ratio of market price per share to earnings per share.

(viii) Average percentile increase already made in the salaries of employees other than the managerial personnel

in the last financial year and its comparison with the percentile increase in the managerial remuneration and

justification thereof and point out if there are any exceptional circumstances for increase in the managerial

remuneration;

The average percentage increase in the salaries of total employees other than the Key Managerial Personnel for scal

2016 was around 9.0%, while the average increase in the remuneration of the Key Managerial Personnel was in the range

of 12.0% to 15.0%.

(ix) Comparison of each remuneration of the Key Managerial Personnel against the performance of the company;

The ratio of the remuneration of each KMP to the PAT of the Bank is given below:

Chanda Kochhar, Managing Director & CEO 0.049%

N. S. Kannan 0.033%

K. Ramkumar 0.033%

Vishakha Mulye 0.033%

Rajiv Sabharwal 0.031%

Rakesh Jha, Chief Financial Officer 0.021%

P. Sanker, Company Secretary 0.018%

(x) The key parameters for any variable component of remuneration availed by the directors;

The Bank’s compensation policy and practices are in line with the guidelines issued by the RBI in January 2012. The Bank

undertakes an annual strategic planning exercise where the KPIs are xed for the WTDs by the BGRNC. These KPIs, in

addition to nancial parameters, include parameters related to risk and compliance. At the end of the nancial year, the

performance of the Bank as well as performance of each WTD based on their respective KPIs (including those pertaining

to compliance and risk) is presented to the BGRNC. Based on the performance assessment by the BGRNC, the variable

component of the remunerations for the WTDs is recommended to and approved by the Board.

(xi) The ratio of the remuneration of the highest paid director to that of the employees who are not directors but

receive remuneration in excess of the highest paid director during the year;

Not applicable

(xii) Affirmation that the remuneration is as per the remuneration policy of the company.

Yes