ICICI Bank 2016 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111Annual Report 2015-2016

RBI also has separate guidelines for restructured loans. Upto March 31, 2015, a fully secured standard asset could be

restructured by re-schedulement of principal repayments and/or the interest element, but had to be separately disclosed

as a restructured asset. The diminution in the fair value of the restructured loan, if any, measured in present value terms,

was either written off or a provision was made to the extent of the diminution involved. Similar guidelines applied for

restructuring of non-performing loans. Loans restructured after April 1, 2015 (excluding loans given for implementation

of projects in the infrastructure sector and non-infrastructure sector and which are delayed up to a specied period) by

re-schedulement of principal repayments and/or the interest element are classied as non-performing. For such loans,

the diminution in the fair value of the loan, if any, measured in present value terms, has to be provided for in addition to

the provisions applicable to non-performing loans.

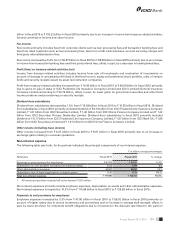

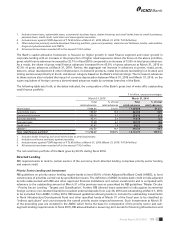

The following table sets forth, at the dates indicated, information regarding the Bank’s gross non-performing assets (net

of write-offs, interest suspense and derivative income reversals).

` in billion

March 31, 2015 March 31, 2016

Non-performing assets

Sub-standard assets ` 26.27 ` 40.91

Doubtful assets 100.63 195.94

Loss assets 25.52 30.36

Total non-performing assets1` 152.42 ` 267.21

1. Include advances, lease receivables and credit substitutes like debentures and bonds. Excludes preference shares.

2. All amounts have been rounded off to the nearest ` 10.0 million.

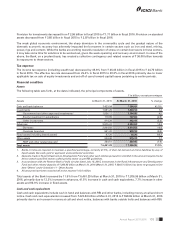

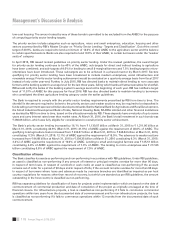

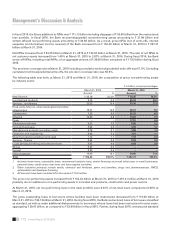

The following table sets forth, at the dates indicated, information regarding the Bank’s non-performing assets (NPAs).

` in billion, except percentages

Year ended Gross

NPA1

Net

NPA

Net customer

assets2

% of net NPA to net

customer assets2

March 31, 2013 ` 96.47 ` 22.34 ` 3,517.62 0.64%

March 31, 2014 ` 105.54 ` 33.01 ` 4,037.08 0.82%

March 31, 2015 ` 152.42 ` 63.25 ` 4,516.34 1.40%

March 31, 2016 ` 267.21 ` 132.97 ` 4,972.29 2.67%

1. Net of write-offs, interest suspense and derivatives income reversal.

2. Include advances, lease receivables and credit substitutes like debentures and bonds. Excludes preference shares.

3. All amounts have been rounded off to the nearest ` 10.0 million.

From scal 2012, the Indian economy experienced a slowdown in growth, particularly in capital investments; high interest

rates due to high ination; and signicant currency depreciation. Indian companies experienced a decline in sales and

prot growth and also an elongation of working capital cycles and a high level of receivables. Given the concerns over

growth, companies found it difcult to access other sources of funding, resulting in high leverage. As a result, the Indian

banking sector, including the Bank, experienced a rise in non-performing assets and restructured loans. Over the past two

years, the domestic economic recovery has been gradual and the global economic environment has become challenging.

Fiscal 2016 witnessed a slowdown in global economic growth mainly on account of lower growth in China and emerging

market economies, divergence in global monetary policy and signicant decline in commodity prices including crude

oil and metals. Due to the increased level of risks in the business environment, the Indian banking system in general has

experienced an increase in the level of additions to non-performing loans including slippages from restructured loans

into non-performing status. During three months ended December 31, 2015, RBI articulated the objective of early and

conservative recognition of stress and provisioning, held discussions with and asked a number of Indian banks to review

certain loan accounts and their classication over the three months ended December 31, 2015 and three months ended

March 31, 2016, through its Asset Quality Review. As a result of the above factors, non-performing loans of the Bank

increased signicantly in the second half of scal 2016.