ICICI Bank 2016 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

Annual Report 2015-2016150

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

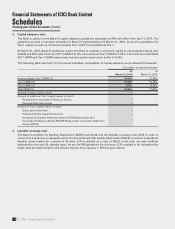

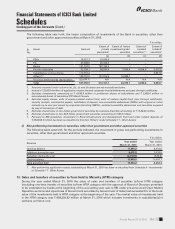

If the Bank had used the fair value of options based on binomial tree model, compensation cost in the year ended

March 31, 2016 would have been higher by ` 3,726.5 million and proforma prot after tax would have been

` 93.54 billion. On a proforma basis, the Bank’s basic and diluted earnings per share would have been ` 16.11 and

` 16.02 respectively. The key assumptions used to estimate the fair value of options granted during the year ended

March 31, 2016 are given below.

Risk-free interest rate 7.58% to 8.19%

Expected life 3.16 to 5.78 years

Expected volatility 30.67% to 32.77%

Expected dividend yield 1.62% to 2.11%

The weighted average fair value of options granted during the year ended March 31, 2016 is ` 100.50 (March 31,

2015: ` 90.09).

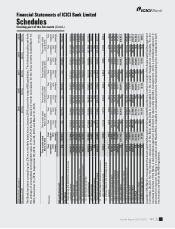

The following table sets forth, for the periods indicated, the summary of the status of the Bank’s stock option plan.

` except number of options

Particulars

Stock options outstanding

Year ended March 31, 2016 Year ended March 31, 2015

Number of

options

Weighted

average

exercise price

Number of

options

Weighted

average

exercise price

Outstanding at the beginning of the year 148,433,700 205.02 140,521,765 183.74

Add: Granted during the year 64,904,500 289.28 32,375,500 259.96

Less: Lapsed during the year, net of re-issuance 4,189,850 260.67 1,382,765 235.40

Less: Exercised during the year 17,523,785 161.16 23,080,800 150.66

Outstanding at the end of the year 191,624,565 236.36 148,433,700 205.02

Options exercisable 89,788,515 198.08 75,938,800 180.80

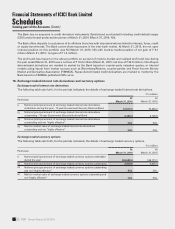

The following table sets forth, the summary of stock options outstanding at March 31, 2016.

Range of exercise price

(` per share)

Number of shares

arising out of options

Weighted average exercise

price (` per share)

Weighted average remaining

contractual life (Number of years)

60-99 2,556,700 86.96 3.03

100-199 60,755,715 180.24 3.65

200-299 96,037,150 251.67 7.85

300-399 32,275,000 308.26 9.08

The following table sets forth, the summary of stock options outstanding at March 31, 2015.

Range of exercise price

(` per share)

Number of shares

arising out of options

Weighted average

exercise price (` per share)

Weighted average remaining

contractual life (Number of years)

60-99 4,771,000 80.81 2.41

100-199 74,346,685 177.35 4.41

200-299 69,291,015 243.22 8.06

300-399 25,000 321.17 9.59

The options were exercised regularly throughout the period and weighted average share price as per NSE price

volume data during the year ended March 31, 2016 was ` 273.37 (March 31, 2015: ` 311.74).

9. Subordinated debt

During the year ended March 31, 2016, the Bank has not raised subordinated debt qualifying for Tier-2 capital (March

31, 2015: Nil).