ICICI Bank 2016 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103Annual Report 2015-2016

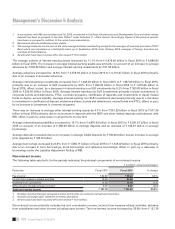

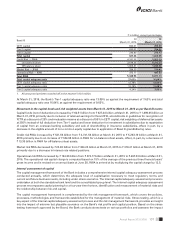

Provision for investments decreased from ` 2.98 billion in scal 2015 to ` 1.71 billion in scal 2016. Provision on standard

assets decreased from ` 3.85 billion in scal 2015 to ` 2.97 billion in scal 2016.

The weak global economic environment, the sharp downturn in the commodity cycle and the gradual nature of the

domestic economic recovery has adversely impacted the borrowers in certain sectors such as iron and steel, mining,

power, rigs and cement. While the banks are working towards resolution of stress on certain borrowers in these sectors,

it may take some time for solutions to be worked out, given the weak operating and recovery environment. In view of the

above, the Bank, on a prudent basis, has created a collective contingency and related reserve of ` 36.00 billion towards

its exposures to these sectors.

Tax expense

The income tax expense (including wealth tax) decreased by 46.8% from ` 46.45 billion in scal 2015 to ` 24.70 billion

in scal 2016. The effective tax rate decreased from 29.4% in scal 2015 to 20.3% in scal 2016 primarily due to lower

applicable tax on sale of equity investments and set-off of carry forward capital losses pertaining to earlier periods.

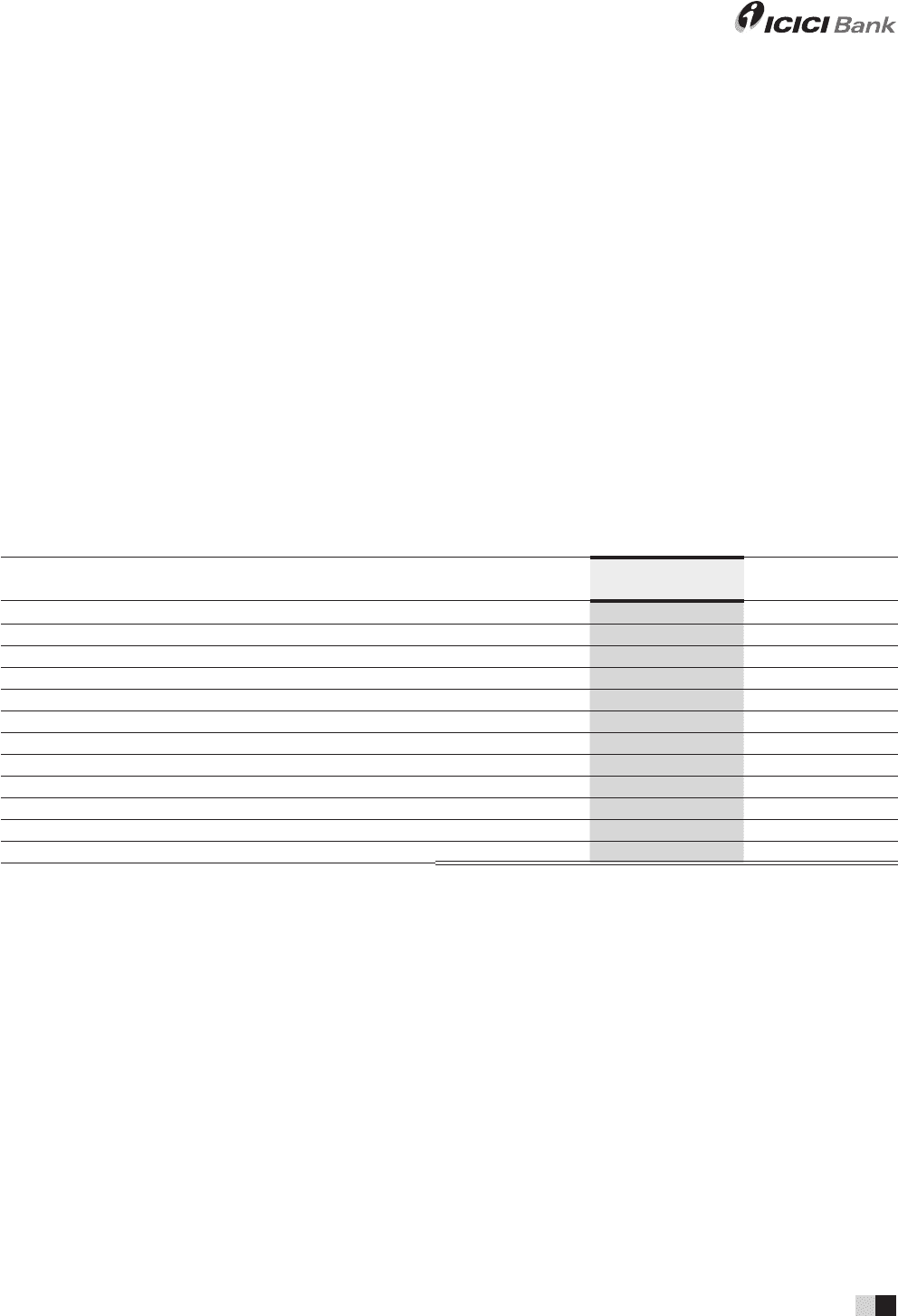

Financial condition

Assets

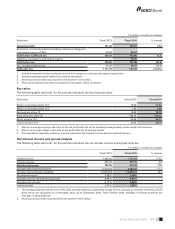

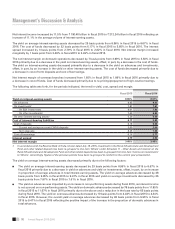

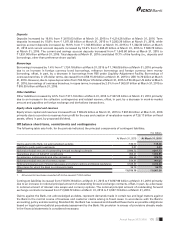

The following table sets forth, at the dates indicated, the principal components of assets.

` in billion, except percentages

Assets At March 31, 2015 At March 31, 2016 % change

Cash and bank balances ` 423.04 ` 598.69 41.5%

Investments 1,581.29 1,604.12 1.4

- Government and other approved investments1 1,056.11 1,104.05 4.5

- Equity investment in subsidiaries 110.89 107.63 (2.9)

- Other investments 414.29 392.44 (5.3)

Advances 3,875.22 4,352.64 12.3

- Domestic 2,934.02 3,414.52 16.4

- Overseas branches 941.20 938.12 (0.3)

Fixed assets (including leased assets) 47.26 75.76 60.3

Other assets 534.48 575.74 7.7

- RIDF and other related deposits2 284.51 280.66 (1.4)

Total assets ` 6,461.29 ` 7,206.95 11.5%

1. Banks in India are required to maintain a specified percentage, currently 21.5%, of their net demand and time liabilities by way of

liquid assets like cash, gold or approved unencumbered securities.

2. Deposits made in Rural Infrastructure Development Fund and other such entities pursuant to shortfall in the amount required to be

lent to certain specified sectors called priority sector as per RBI guidelines.

3. In accordance with the Reserve Bank of India circular dated July 16, 2015, investment in the Rural Infrastructure and Development

Fund and other related deposits of ` 280.66 billion at March 31, 2016 (March 31, 2015: ` 284.51 billion) has been re-grouped to line

item ‘Others’ under Schedule 11 - Other Assets.

4. All amounts have been rounded off to the nearest ` 10.0 million.

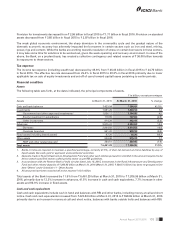

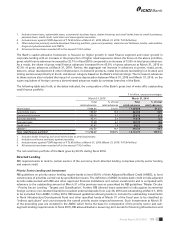

Total assets of the Bank increased by 11.5% from ` 6,461.29 billion at March 31, 2015 to ` 7,206.95 billion at March 31,

2016, primarily due to 12.3% increase in advances, 41.5% increase in cash and cash equivalents, 7.7% increase in other

assets and 60.3% increase in xed assets.

Cash and cash equivalents

Cash and cash equivalents include cash in hand and balances with RBI and other banks, including money at call and short

notice. Cash and cash equivalents increased from ` 423.04 billion at March 31, 2015 to ` 598.69 billion at March 31, 2016

primarily due to an increase in money at call and short notice, balances with banks outside India and balances with RBI.