ICICI Bank 2016 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

52

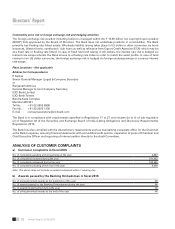

Directors’ Report

Annual Report 2015-2016

Commodity price risk or foreign exchange risk and hedging activities

The foreign exchange risk position including bullion is managed within the ` 10.00 billion net overnight open position

(NOOP) limit approved by the Board of Directors. The Bank does not undertake positions in commodities. The Bank

primarily has oating rate linked assets. Wholesale liability raising takes place in US dollar or other currencies via bond

issuances, bilateral loans, syndicated / club loans as well as renance from Export Credit Agencies (ECA) which may be

at a xed rate or oating rate linked. In case of xed rate fund raising in US dollars, the interest rate risk is hedged via

interest rate swaps wherein the Bank moves to a oating rate index in order to match the asset prole. In case of fund

raising in non US dollar currencies, the foreign exchange risk is hedged via foreign exchange swaps or currency interest

rate swaps.

Plant Locations – Not applicable

Address for Correspondence

P. Sanker

Senior General Manager (Legal) & Company Secretary

or

Ranganath Athreya

General Manager & Joint Company Secretary

ICICI Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051

Tel No. : +91-22-2653 8900

Fax No. : +91-22-2653 1230

The Bank is in compliance with requirements specied in Regulations 17 to 27 and clauses (b) to (i) of sub-regulation

(2) of Regulation 46 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements)

Regulations, 2015.

The Bank has also complied with the discretionary requirements such as maintaining a separate ofce for the Chairman

at the Bank's expense, ensuring nancial statements with unmodied audit opinion, separation of posts of Chairman and

Chief Executive Ofcer and reporting of internal auditor directly to the Audit Committee.

ANALYSIS OF CUSTOMER COMPLAINTS

a) Customer complaints in scal 2016

No. of complaints pending at the beginning of the year 2,887

No. of complaints received during the year 191,453

No. of complaints redressed during the year 190,940

No. of complaints pending at the end of the year 3,400

Note: The above does not include complaint redressed within 1 working day.

b) Awards passed by the Banking Ombudsman in scal 2016

No. of unimplemented awards at the beginning of the year Nil

No. of awards passed by the Banking Ombudsman during the year Nil

No. of awards implemented during the year Nil

No. of unimplemented awards at the end of the year Nil