ICICI Bank 2016 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

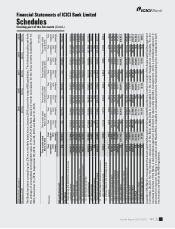

Annual Report 2015-2016138

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

The Bank holds specic provisions against non-performing loans and advances and against certain performing loans

and advances in accordance with RBI directions. The Bank also holds provisions on loans under SDR scheme of

RBI. The assessment of incremental specic provisions is made after taking into consideration the existing specic

provision held. The specic provisions on retail loans and advances held by the Bank are higher than the minimum

regulatory requirements.

a) Provision due to diminution in the fair value of restructured/rescheduled loans and advances is made in

accordance with the applicable RBI guidelines.

In respect of non-performing loans and advances accounts subjected to restructuring, the account is upgraded

to standard only after the specied period i.e. a period of one year after the date when rst payment of interest

or of principal, whichever is later, falls due, subject to satisfactory performance of the account during the period.

A standard restructured loan is upgraded to the standard category when satisfactory payment performance is

evidenced during the specied period and after the loan reverts to the normal level of standard asset provisions/

risk weights.

b) Amounts recovered against debts written-off in earlier years and provisions no longer considered necessary in

the context of the current status of the borrower are recognised in the prot and loss account.

c) The Bank maintains general provision on performing loans and advances in accordance with the RBI guidelines,

including provisions on loans to borrowers having unhedged foreign currency exposure, provision on exposures

to step-down subsidiaries of Indian companies and oating provision taken over from erstwhile Bank of Rajasthan

upon amalgamation. For performing loans and advances in overseas branches, the general provision is made at

higher of host country regulations requirement and RBI requirement.

d) In addition to the provisions required to be held according to the asset classication status, provisions are

held for individual country exposures including indirect country risk (other than for home country exposure).

The countries are categorised into seven risk categories namely insignicant, low, moderately low, moderate,

moderately high, high and very high, and provisioning is made on exposures exceeding 180 days on a graded

scale ranging from 0.25% to 25%. For exposures with contractual maturity of less than 180 days, provision is

required to be held at 25% of the rates applicable to exposures exceeding 180 days. The indirect exposure is

reckoned at 50% of the exposure. If the country exposure (net) of the Bank in respect of each country does not

exceed 1% of the total funded assets, no provision is required on such country exposure.

4. Transfer and servicing of assets

The Bank transfers commercial and consumer loans through securitisation transactions. The transferred loans are

de-recognised and gains/losses are accounted for, only if the Bank surrenders the rights to benets specied in the

underlying securitised loan contract. Recourse and servicing obligations are accounted for net of provisions.

In accordance with the RBI guidelines for securitisation of standard assets, with effect from February 1, 2006, the

Bank accounts for any loss arising from securitisation immediately at the time of sale and the prot/premium arising

from securitisation is amortised over the life of the securities issued or to be issued by the special purpose vehicle to

which the assets are sold. With effect from May 7, 2012, the RBI guidelines require the prot/premium arising from

securitisation to be amortised over the life of the transaction based on the method prescribed in the guidelines.

In the case of loans sold to an asset reconstruction company, the excess provision is not reversed but is utilised to

meet the shortfall/loss on account of sale of other nancial assets to securitisation company (SC)/reconstruction

company (RC) in accordance with RBI guideline dated July 13, 2005. With effect from February 26, 2014, in accordance

with RBI guidelines, in case of non-performing loans sold to SCs/RCs, the Bank reverses the excess provision in prot

and loss account in the year in which amounts are received.

5. Fixed assets and depreciation

Fixed assets are carried at cost and include amounts added on revaluation of premises, less accumulated depreciation

and impairment, if any. Cost includes freight, duties, taxes and incidental expenses related to the acquisition and