ICICI Bank 2016 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016 225

Schedules

forming part of the Consolidated Accounts (Contd.)

Consolidated Financial Statements

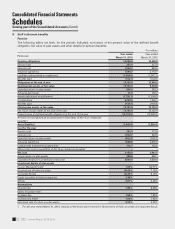

The following were the signicant transactions between the Group and its related parties for the year ended March

31, 2016. A specic related party transaction is disclosed as a material related party transaction wherever it exceeds

10% of all related party transactions in that category.

Insurance services

During the year ended March 31, 2016, the Group received insurance premiums from associates/other related entities

amounting to ` 42.1 million (March 31, 2015: ` 34.4 million), from key management personnel of the Bank amounting

to ` 3.3 million (March 31, 2015: ` 1.3 million) and from relatives of key management personnel amounting to ` 2.0

million (March 31, 2015: ` 1.3 million). The material transactions for the year ended March 31, 2016 were with ICICI

Foundation for Inclusive Growth amounting to ` 22.5 million (March 31, 2015: ` 16.0 million) and with FINO PayTech

Limited amounting to ` 13.3 million (March 31, 2015: ` 12.1 million).

During the year ended March 31, 2016, the Group paid insurance claims to associates/other related entities amounting

to ` 22.1 million (March 31, 2015: ` 0.3 million) and to relatives of key management personnel of the Bank amounting

to Nil (March 31, 2015: ` 0.6 million). The material transactions for the year ended March 31, 2016 were with FINO

PayTech Limited amounting to ` 12.7 million (March 31, 2015: Nil), Akzo Nobel India Limited amounting to ` 9.2

million (March 31, 2015: Nil) and with I-Process Services (India) Private Limited amounting to ` 0.2 million (March 31,

2015: ` 0.3 million).

Fees, commission and other income

During the year ended March 31, 2016, the Group received fees from its associates/other related entities amounting

to ` 21.1 million (March 31, 2015: ` 30.7 million), from key management personnel of the Bank amounting to

` 0.3 million (March 31, 2015: ` 1.7 million) and from relatives of key management personnel amounting to ` 0.1

million (March 31, 2015: ` 0.01 million). The material transactions for the year ended March 31, 2016 were with India

Infradebt Limited amounting to ` 17.2 million (March 31, 2015: ` 9.2 million), ICICI Merchant Services Private Limited

amounting to ` 3.4 million (March 31, 2015: ` 5.5 million) and with India Advantage Fund-IV amounting to ` 0.01

million (March 31, 2015: ` 12.5 million).

1. Insignificant amount.

Lease of premises, common corporate and facilities expenses

During the year ended March 31, 2016, the Group recovered from its associates/other related entities an amount of

` 87.1 million (March 31, 2015: ` 80.4 million) for lease of premises, common corporate and facilities expenses. The

material transactions for the year ended March 31, 2016 were with ICICI Foundation for Inclusive Growth amounting

to ` 57.1 million (March 31, 2015: ` 52.0 million) and with FINO PayTech Limited amounting to ` 23.2 million (March

31, 2015: ` 22.9 million).

Secondment of employees

During the year ended March 31, 2016, the Group recovered for deputation of employees from its associates/other

related entities an amount of ` 10.7 million (March 31, 2015: ` 19.2 million). The material transactions for the year

ended March 31, 2016 were with I-Process Services (India) Private Limited amounting to ` 7.5 million (March 31,

2015: ` 7.1 million) and with ICICI Foundation for Inclusive Growth amounting to ` 3.2 million (March 31, 2015: ` 12.1

million).

Brokerage, fees and other expenses

During the year ended March 31, 2016, the Group paid brokerage/fees and other expenses to its associates/other

related entities amounting to ` 5,338.7 million (March 31, 2015: ` 4,876.1 million). The material transactions for the

year ended March 31, 2016 were with I-Process Services (India) Private Limited amounting to ` 2,915.9 million (March

31, 2015: ` 2,397.7 million) and with ICICI Merchant Services Private Limited amounting to ` 2,341.3 million (March

31, 2015: ` 2,216.0 million).

Purchase of investments

During the year ended March 31, 2016, the Group invested in the units of India Advantage Fund-IV amounting to Nil

(March 31, 2015: ` 1,970.4 million) and in the units of India Advantage Fund-III amounting to Nil (March 31, 2015:

` 1,163.5 million).