ICICI Bank 2016 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Directors’ Report

Annual Report 2015-2016

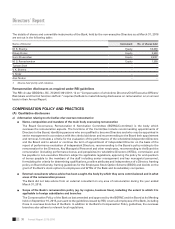

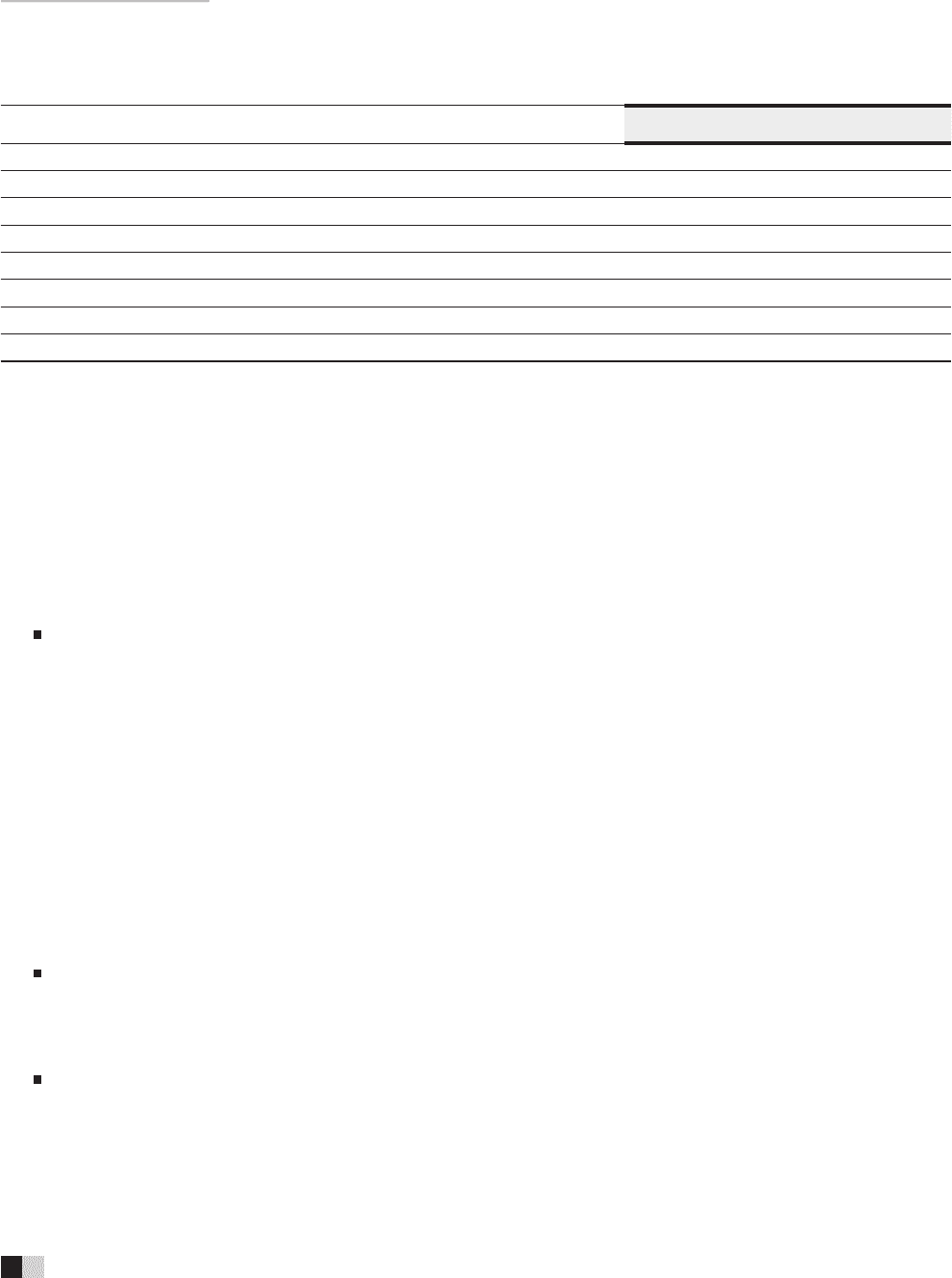

The details of shares and convertible instruments of the Bank, held by the non-executive Directors as at March 31, 2016

are set out in the following table:

Name of Director Instrument No. of shares held

M. K. Sharma Equity 50,000

Dileep Choksi Equity 2,500

Homi Khusrokhan Equity 3,5001

M. S. Ramachandran Equity 1,300

Tushaar Shah – –

V. K. Sharma – –

V. Sridar – –

Alok Tandon – –

1. Shares held jointly with relatives.

Remuneration disclosures as required under RBI guidelines

The RBI circular DBOD No. BC. 72/29.67.001/2011-12 on “Compensation of wholetime Directors/Chief Executive Ofcers/

Risk takers and Control function staff etc.” requires the Bank to make following disclosures on remuneration on an annual

basis in their Annual Report:

COMPENSATION POLICY AND PRACTICES

(A) Qualitative disclosures

a) Information relating to the bodies that oversee remuneration

Name, composition and mandate of the main body overseeing remuneration

The Board Governance, Remuneration & Nomination Committee (BGRNC/Committee) is the body which

oversees the remuneration aspects. The functions of the Committee include recommending appointments of

Directors to the Board, identifying persons who are qualied to become Directors and who may be appointed in

senior management in accordance with the criteria laid down and recommending to the Board their appointment

and removal, formulate a criteria for the evaluation of the performance of the wholetime/independent Directors

and the Board and to extend or continue the term of appointment of independent Director on the basis of the

report of performance evaluation of independent Directors, recommending to the Board a policy relating to the

remuneration for the Directors, Key Managerial Personnel and other employees, recommending to the Board the

remuneration (including performance bonus and perquisites) to wholetime Directors (WTDs), commission and

fee payable to non-executive Directors subject to applicable regulations, approving the policy for and quantum

of bonus payable to the members of the staff including senior management and key managerial personnel,

formulating the criteria for determining qualications, positive attributes and independence of a Director, framing

policy on Board diversity, framing guidelines for the Employees Stock Option Scheme (ESOS) and decide on the

grant of the Bank’s stock options to employees and WTDs of the Bank and its subsidiary companies.

External consultants whose advice has been sought, the body by which they were commissioned and in what

areas of the remuneration process

The Bank did not take advice from an external consultant on any area of remuneration during the year ended

March 31, 2016.

Scope of the Bank’s remuneration policy (eg. by regions, business lines), including the extent to which it is

applicable to foreign subsidiaries and branches

The Compensation Policy of the Bank as last amended and approved by the BGRNC and the Board at its Meeting

held on September 16, 2015, pursuant to the guidelines issued by RBI, covers all employees of the Bank, including

those in overseas branches of the Bank. In addition to the Bank’s Compensation Policy guidelines, the overseas

branches also adhere to relevant local regulations.