ICICI Bank 2016 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

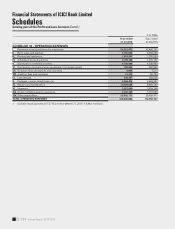

Annual Report 2015-2016 143

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

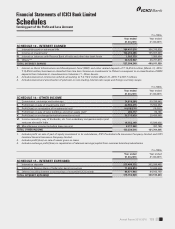

SCHEDULE 18

NOTES FORMING PART OF THE ACCOUNTS

The following additional disclosures have been made taking into account the requirements of Accounting Standards

(ASs) and Reserve Bank of India (RBI) guidelines in this regard.

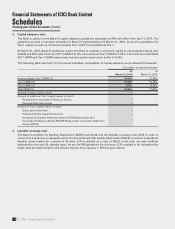

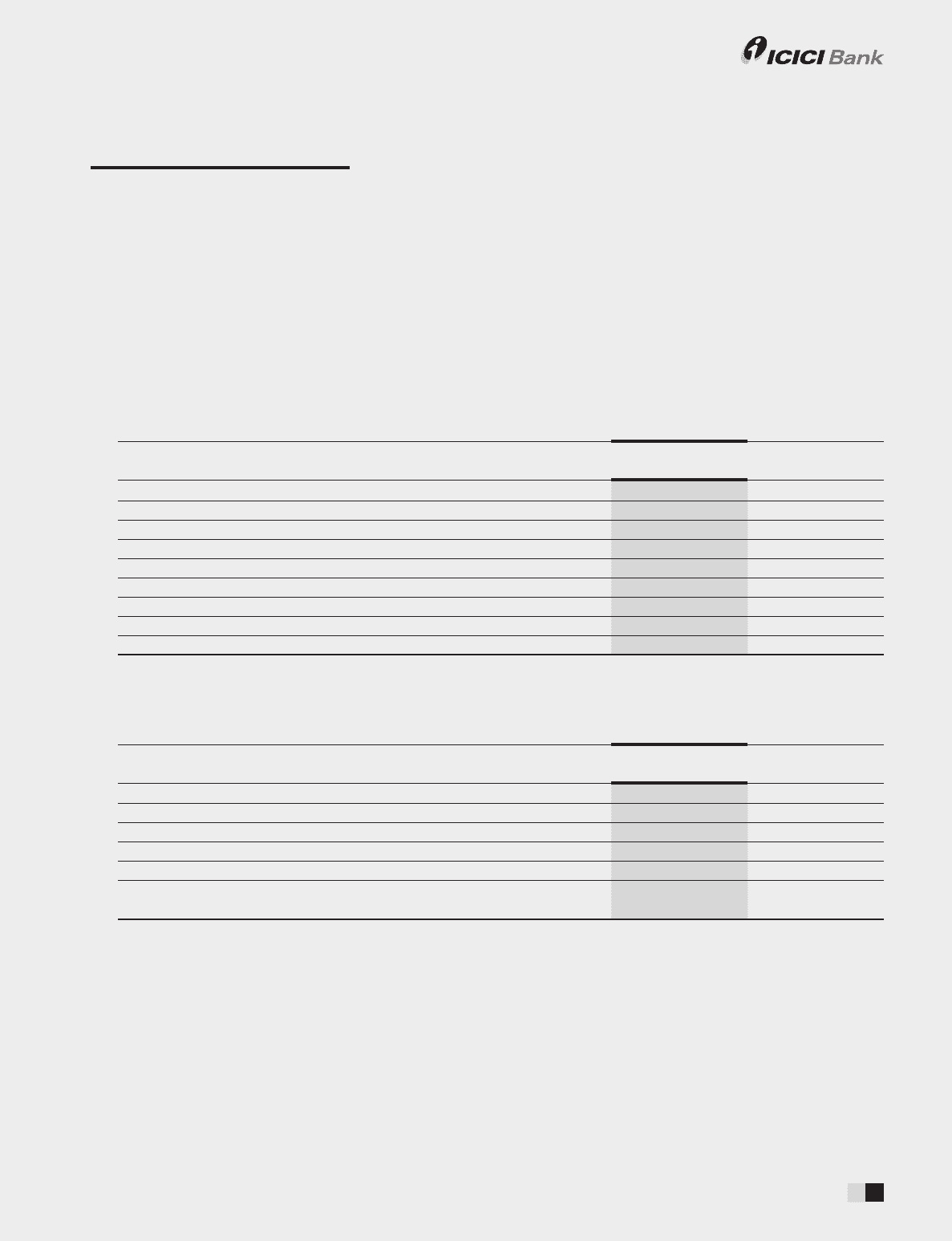

1. Earnings per share

Basic and diluted earnings per equity share are computed in accordance with AS 20 – Earnings per share. Basic

earnings per equity share are computed by dividing net prot after tax by the weighted average number of equity

shares outstanding during the year. The diluted earnings per equity share is computed using the weighted average

number of equity shares and weighted average number of dilutive potential equity shares outstanding during

the year.

The following table sets forth, for the periods indicated, the computation of earnings per share.

` in million, except per share data

Year ended

March 31, 2016

Year ended

March 31, 2015

Basic

Weighted average no. of equity shares outstanding 5,807,339,489 5,785,726,485

Net prot 97,262.9 111,753.5

Basic earnings per share (`)16.75 19.32

Diluted

Weighted average no. of equity shares outstanding 5,840,224,893 5,842,092,456

Net prot 97,262.9 111,753.5

Diluted earnings per share (`)16.65 19.13

Nominal value per share (`)2.00 2.00

The dilutive impact is due to options granted to employees by the Bank.

2. Business/information ratios

The following table sets forth, for the periods indicated, the business/information ratios.

Year ended

March 31, 2016

Year ended

March 31, 2015

(i) Interest income to working funds18.06% 8.19%

(ii) Non-interest income to working funds12.34% 2.03%

(iii) Operating prot to working funds1,2 3.65% 3.29%

(iv) Return on assets31.49% 1.86%

(v) Net prot per employee4 (` in million) 1.4 1.6

(vi) Business (average deposits plus average advances) per employee4,5

(` in million) 94.3 83.2

1. For the purpose of computing the ratio, working funds represent the monthly average of total assets computed for reporting

dates of Form X submitted to RBI under Section 27 of the Banking Regulation Act, 1949.

2. Operating profit is profit for the year before provisions and contingencies.

3. For the purpose of computing the ratio, assets represent monthly average of total assets computed for reporting dates of Form

X submitted to RBI under Section 27 of the Banking Regulation Act, 1949.

4. Computed based on average number of employees which include sales executives, employees on fixed term contracts and

interns.

5. The average deposits and the average advances represent the simple average of the figures reported in Form A to RBI under

Section 42(2) of the Reserve Bank of India Act, 1934.