ICICI Bank 2016 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101Annual Report 2015-2016

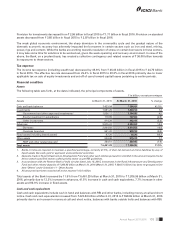

billion in scal 2015 to ` 153.22 billion in scal 2016 primarily due to an increase in income from treasury-related activities,

fee and commission income and other income.

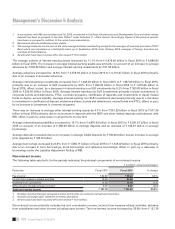

Fee income

Fee income primarily includes fees from corporate clients such as loan processing fees and transaction banking fees and

fees from retail customers such as loan processing fees, fees from credit cards business, account servicing charges and

third party referral/distribution fees.

Fee income increased by 6.4% from ` 82.87 billion in scal 2015 to ` 88.20 billion in scal 2016 primarily due to an increase

in income from transaction banking fees and third party referral fees, offset, in part, by a decrease in lending linked fees.

Profit/(loss) on treasury-related activities (net)

Income from treasury-related activities includes income from sale of investments and revaluation of investments on

account of changes in unrealised prot/(loss) in the xed income, equity and preference share portfolio, units of venture

funds and security receipts issued by asset reconstruction companies.

Prot from treasury-related activities increased from ` 16.93 billion in scal 2015 to ` 40.60 billion in scal 2016 primarily

due to gains on sale of stake in ICICI Prudential Life Insurance Company Limited and ICICI Lombard General Insurance

Company Limited amounting to ` 33.74 billion, offset, in part, by lower gains on government securities and other xed

income positions and provisioning on security receipts.

Dividend from subsidiaries

Dividend from subsidiaries decreased by 1.5% from ` 15.59 billion in scal 2015 to ` 15.35 billion in scal 2016. Dividend

from subsidiaries in scal 2016 primarily included dividend of ` 8.74 billion from ICICI Prudential Life Insurance Company

Limited, ` 1.61 billion from ICICI Securities Limited, ` 1.26 billion from ICICI Home Finance Company Limited and ` 1.22

billion from ICICI Securities Primary Dealership Limited. Dividend from subsidiaries in scal 2015 primarily included

dividend of ` 6.17 billion from ICICI Prudential Life Insurance Company Limited, ` 1.87 billion from ICICI Bank UK, ` 1.86

billion from ICICI Securities Limited and ` 1.61 billion from ICICI Home Finance Company Limited.

Other income (including lease income)

Other income increased from ` 6.37 billion in scal 2015 to ` 9.07 billion in scal 2016 primarily due to an increase in

exchange gains relating to overseas operations.

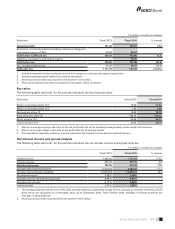

Non-interest expense

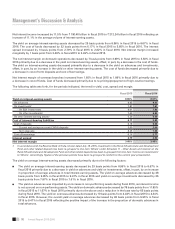

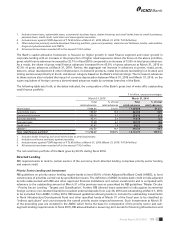

The following table sets forth, for the periods indicated, the principal components of non-interest expense.

` in billion, except percentages

Particulars Fiscal 2015 Fiscal 2016 % change

Payments to and provisions for employees ` 47.50 ` 50.02 5.3%

Depreciation on own property (including non-banking assets) 6.24 6.79 8.9

Other administrative expenses 60.87 69.83 14.7

Depreciation (net of lease equalisation) on leased assets 0.35 0.19 (45.1)

Total non-interest expense ` 114.96 ` 126.83 10.3%

1. All amounts have been rounded off to the nearest ` 10.0 million.

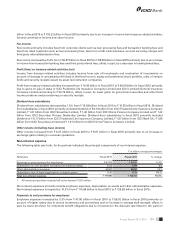

Non-interest expenses primarily include employee expenses, depreciation on assets and other administrative expenses.

Non-interest expenses increased by 10.3% from ` 114.96 billion in scal 2015 to ` 126.83 billion in scal 2016.

Payments to and provisions for employees

Employee expenses increased by 5.3% from ` 47.50 billion in scal 2015 to ` 50.02 billion in scal 2016 primarily on

account of higher salary due to annual increments and promotions and an increase in average staff strength, offset, in

part, by lower provision for retirement benet obligations due to movement in the discount rate linked to the yield on