ICICI Bank 2016 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

Management’s Discussion & Analysis

Annual Report 2015-2016

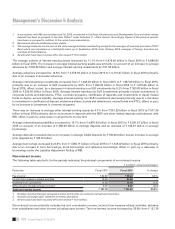

The Bank enters into foreign exchange contracts in its normal course of business, to exchange currencies at a pre-

xed price at a future date. This item represents the notional principal amount of such contracts, which are derivative

instruments. With respect to the transactions entered into with its customers, the Bank generally enters into off-setting

transactions in the inter-bank market. This results in generation of a higher number of outstanding transactions, and

hence a large value of gross notional principal of the portfolio, while the net market risk is lower.

As a part of project nancing and commercial banking activities, the Bank has issued guarantees to support regular

business activities of clients. These generally represent irrevocable assurances that the Bank will make payments in the

event that the customer fails to fulll its nancial or performance obligations. Financial guarantees are obligations to

pay a third party beneciary where a customer fails to make payment towards a specied nancial obligation, including

advance payment guarantee. Performance guarantees are obligations to pay a third party beneciary where a customer

fails to perform a non-nancial contractual obligation. The guarantees are generally issued for a period not exceeding

ten years. The credit risks associated with these products, as well as the operating risks, are similar to those relating to

other types of nancial instruments. Cash margins available to reimburse losses realised under guarantees amounted to

` 77.78 billion at March 31, 2016 compared to ` 67.47 billion at March 31, 2015. Other property or security may also be

available to the Bank to cover potential losses under guarantees.

The Bank is obligated under a number of capital contracts. Capital contracts are job orders of a capital nature, which have

been committed. Estimated amounts of contracts remaining to be executed on capital account in domestic operations

aggregated to ` 5.71 billion at March 31, 2016 compared to ` 5.39 billion at March 31, 2015.

Capital resources

The Bank actively manages its capital to meet regulatory norms, current and future business needs and the risks in

its businesses. The capital management framework of the Bank is administered by the Finance Group and the Risk

Management Group under the supervision of the Board and the Risk Committee. The capital adequacy position and

assessment is reported to the Board and the Risk Committee periodically.

Regulatory capital

The Bank is subject to the Basel III guidelines issued by RBI, effective from April 1, 2013, which are being implemented

in a phased manner by March 31, 2019 as per the transitional arrangement provided by RBI for Basel III implementation.

The Basel III rules on capital consist of measures for improving the quality, consistency and transparency of capital,

enhancing risk coverage, introducing a supplementary leverage ratio, reducing pro-cyclicality and promoting counter-

cyclical buffers and addressing systemic risk and inter-connectedness.

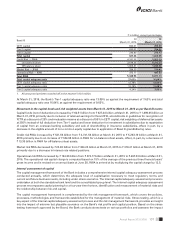

At March 31, 2016, the Bank was required to maintain a minimum Common Equity Tier-1 (CET1) capital ratio of 6.13%,

minimum Tier-1 capital ratio of 7.63% and minimum total capital ratio of 9.63%. The minimum total capital requirement

includes a capital conservation buffer of 0.63%. Under Pillar 1 of RBI guidelines on Basel III, the Bank follows the

standardised approach for measurement of credit risk, standardised duration method for measurement of market risk

and basic indicator approach for measurement of operational risk.

On March 1, 2016, RBI made certain amendments to the treatment of certain balance sheet items for the purposes of

determining bank’s regulatory capital. As per the revised guidelines, Foreign Currency Translation Reserve (FCTR) and

revaluation reserve are allowed to be considered under CET1 capital at a discount of 25% and 55% respectively. Further,

aligning RBI guidelines with the Basel III guidelines, deferred tax assets arising due to timing differences are allowed to

be recognised as CET1 capital up to 10% of a bank’s CET1 capital and risk weighted at 250%, as compared to the earlier

requirement of deduction of the entire deferred tax assets from CET1 capital.

Further, as per the framework issued for Domestic Systemically Important Banks (D-SIBs) in July 2014, RBI, on August 31,

2015, categorised ICICI Bank as a D-SIB in bucket 1 (lowest bucket) with an additional CET1 requirement as a percentage

of Risk Weighted Assets (RWA) of 0.2%. This additional requirement is applicable from April 1, 2016 in a phased manner

and would become fully effective from April 1, 2019. The additional CET1 requirement will be in addition to the capital

conservation buffer. The additional CET1 requirement for scal 2017 will be 0.05% of RWA.

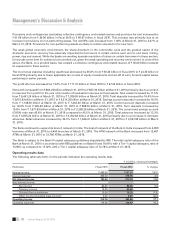

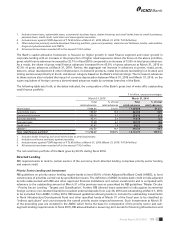

The following table sets forth the capital adequacy ratios computed in accordance with Basel III guidelines of RBI at March

31, 2015 and March 31, 2016.