ICICI Bank 2016 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99Annual Report 2015-2016

The Reserve Bank of India reduced the repo rate by 125 basis points from 8.00% to 6.75% in four phases on January

15, 2015, March 4, 2015, June 2, 2015 and September 29, 2015. The Bank reduced its base rate by 65 basis points

from 10.00% to 9.35% in three phases - 25 basis points with effect from April 10, 2015, 5 basis points with effect from

June 26, 2015 and 35 basis points with effect from October 5, 2015.

The yield on average interest-earning investments decreased from 7.87% in scal 2015 to 7.61% in scal 2016 primarily

due to a decrease in the yield on Statutory Liquidity Ratio (SLR) investments. The yield on SLR investments decreased

by 17 basis points from 8.01% in scal 2015 to 7.84% in scal 2016 primarily due to softening of yield on Government

securities. The yield on non-SLR investments decreased by 66 basis points from 7.49% in scal 2015 to 6.83% in scal

2016 primarily due to a decrease in yield on bonds and debentures, certicate of deposits, pass through certicates

(PTCs) and commercial paper reecting softening of interest rates. In accordance with RBI circular dated July 16, 2015,

deposits in the Rural Infrastructure Development Fund (RIDF) and other related deposits have been re-grouped from

investments to other assets. Figures for previous periods have also been re-grouped accordingly.

The above factors were offset, in part, by the following:

The yield on other interest-earning assets increased from 5.20% in scal 2015 to 5.49% in scal 2016 primarily due

to an increase in the yield on RIDF and other related deposits and a decrease in average term money lent from

overseas locations which is low yielding.

Interest on income tax refund was at ` 3.12 billion in scal 2016 (scal 2015: ` 2.71 billion). The receipt, amount

and timing of such income depend on the nature and timing of determinations by tax authorities and are neither

consistent nor predictable.

The cost of funds decreased by 32 basis points from 6.17% in scal 2015 to 5.85% in scal 2016 primarily due to the

following factors:

The cost of average deposits decreased from 6.18% in scal 2015 to 5.88% in scal 2016 primarily due to a decrease

in the cost of term deposits and an increase in proportion of CASA deposits. The cost of term deposits decreased

by 39 basis points from 8.25% in scal 2015 to 7.86% in scal 2016 primarily due to a decrease in cost of domestic

term deposits by 51 basis points from 8.61% in scal 2015 to 8.10% in scal 2016, offset, in part, by a decrease in

the proportion of overseas term deposits in total term deposits. The proportion of average CASA deposits in the

average deposits increased from 39.5% in scal 2015 to 40.7% in scal 2016.

The cost of borrowings decreased by 39 basis points from 6.16% in scal 2015 to 5.77% in scal 2016. The cost of

borrowings decreased primarily due to a decrease in the cost of call and term borrowings, cost of borrowing under

the Liquidity Adjustment Facility of RBI and an increase in foreign currency term borrowings which are lower cost.

While the net interest margin for scal 2016 was 3.49%, the net interest margin for the three months ended March 31,

2016 was 3.37%, reecting primarily the impact of non-accrual of income on the higher level of non-performing assets.

Our interest income, yield on advances, net interest income and net interest margin are likely to continue to be impacted

going forward, due to the increase in non-performing assets, increased proportion of retail advances in total advances

and lending to higher rated corporates.

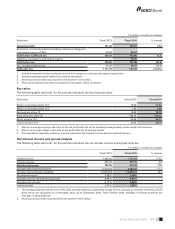

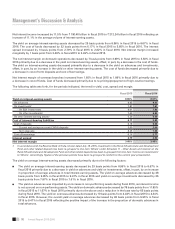

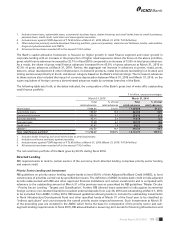

The following table sets forth, for the periods indicated, the trend in average interest-earning assets and average interest-

bearing liabilities:

` in billion, except percentages

Fiscal 2015 Fiscal 2016 % change

Advances ` 3,579.93 ` 4,110.47 14.8%

Interest-earning investments1 1,345.46 1,397.00 3.8

Other interest-earning assets1 551.25 577.36 4.7

Total interest-earning assets 5,476.64 6,084.83 11.1

Deposits 3,285.52 3,665.55 11.6

Borrowings2 1,585.11 1,726.02 8.9

Total interest-bearing liabilities ` 4,870.63 ` 5,391.57 10.7%