ICICI Bank 2016 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016178

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

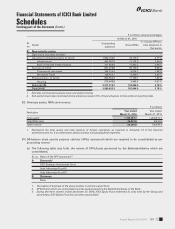

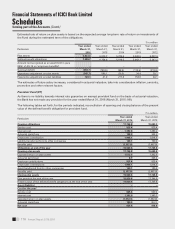

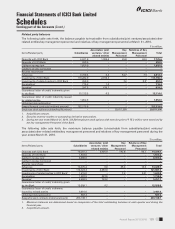

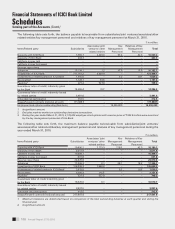

39. Provisions and contingencies

The following table sets forth, for the periods indicated, the break-up of provisions and contingencies included in

prot and loss account.

` in million

Particulars Year ended

March 31, 2016

Year ended

March 31, 2015

Provisions for depreciation of investments 1,706.9 2,979.2

Provision towards non-performing and other assets172,156.7 31,412.7

Provision towards income tax

- Current 57,886.1 48,591.4

- Deferred (33,191.8) (2,195.7)

Provision towards wealth tax –50.0

Collective contingency and related reserve236,000.0 –

Other provisions and contingencies36,814.6 4,607.9

Total provisions and contingencies 141,372.5 85,445.5

1. Includes provision towards NPA amounting to ` 64,019.9 million (March 31, 2015: ` 30,232.5 million).

2. The weak global economic environment, the sharp downturn in the commodity cycle and the gradual nature of the domestic

economic recovery has adversely impacted the borrowers in certain sectors like iron and steel, mining, power, rigs and

cement. While the banks are working towards resolution of stress on certain borrowers in these sectors, it may take some

time for solutions to be worked out, given the weak operating and recovery environment. In view of the above, the Bank has

on a prudent basis made a collective contingency and related reserve during the year ended March 31, 2016, amounting

to ` 36,000.0 million towards exposures to these sectors. This is over and above provisions made for non-performing and

restructured loans as per RBI guidelines.

3. Includes general provision towards standard assets amounting to ` 2,970.1 million (March 31, 2015: ` 3,847.9 million).

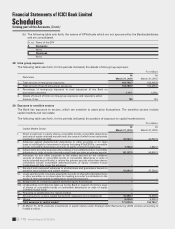

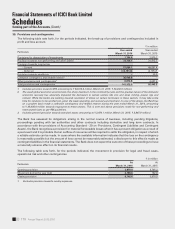

The Bank has assessed its obligations arising in the normal course of business, including pending litigations,

proceedings pending with tax authorities and other contracts including derivative and long term contracts. In

accordance with the provisions of Accounting Standard - 29 on ‘Provisions, Contingent Liabilities and Contingent

Assets’, the Bank recognises a provision for material foreseeable losses when it has a present obligation as a result of

a past event and it is probable that an outow of resources will be required to settle the obligation, in respect of which

a reliable estimate can be made. In cases where the available information indicates that the loss on the contingency

is reasonably possible but the amount of loss cannot be reasonably estimated, a disclosure to this effect is made as

contingent liabilities in the nancial statements. The Bank does not expect the outcome of these proceedings to have

a materially adverse effect on its nancial results.

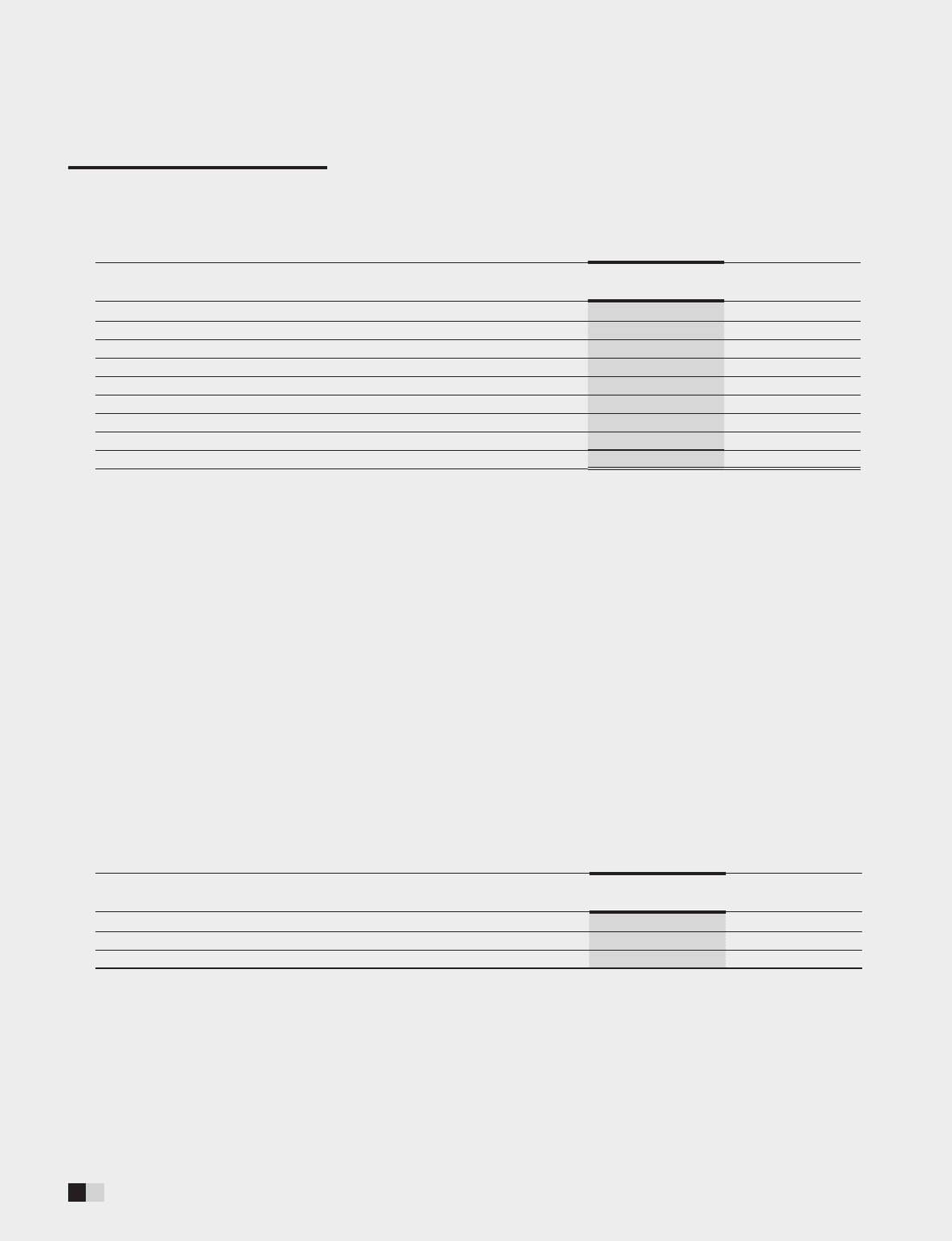

The following table sets forth, for the periods indicated, the movement in provision for legal and fraud cases,

operational risk and other contingencies.

` in million

Particulars At

March 31, 2016

At

March 31, 2015

Opening provision 3,978.0 3,795.2

Movement during the year (net) 2,168.6 182.8

Closing provision 6,146.6 3,978.0

1. Excludes provision towards sundry expenses.