ICICI Bank 2016 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016 231

Schedules

forming part of the Consolidated Accounts (Contd.)

Consolidated Financial Statements

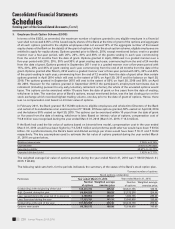

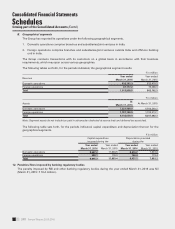

5. Assets on lease

Assets taken under operating lease

The following table sets forth, for the periods indicated, the details of future rentals payable on operating leases.

` in million

Particulars At

March 31, 2016

At

March 31, 2015

Not later than one year 470.7 561.2

Later than one year and not later than ve years 1,195.4 562.9

Later than ve years 568.8 103.1

Total 2,234.9 1,227.2

The terms of renewal are those normally prevalent in similar agreements and there are no undue restrictions in the

agreements.

6. Preference shares

Certain government securities amounting to ` 3,189.8 million at March 31, 2016 (March 31, 2015: ` 3,088.6 million)

have been earmarked against redemption of preference shares issued by the Bank, which fall due for redemption on

April 20, 2018, as per the original terms of the issue.

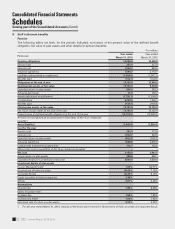

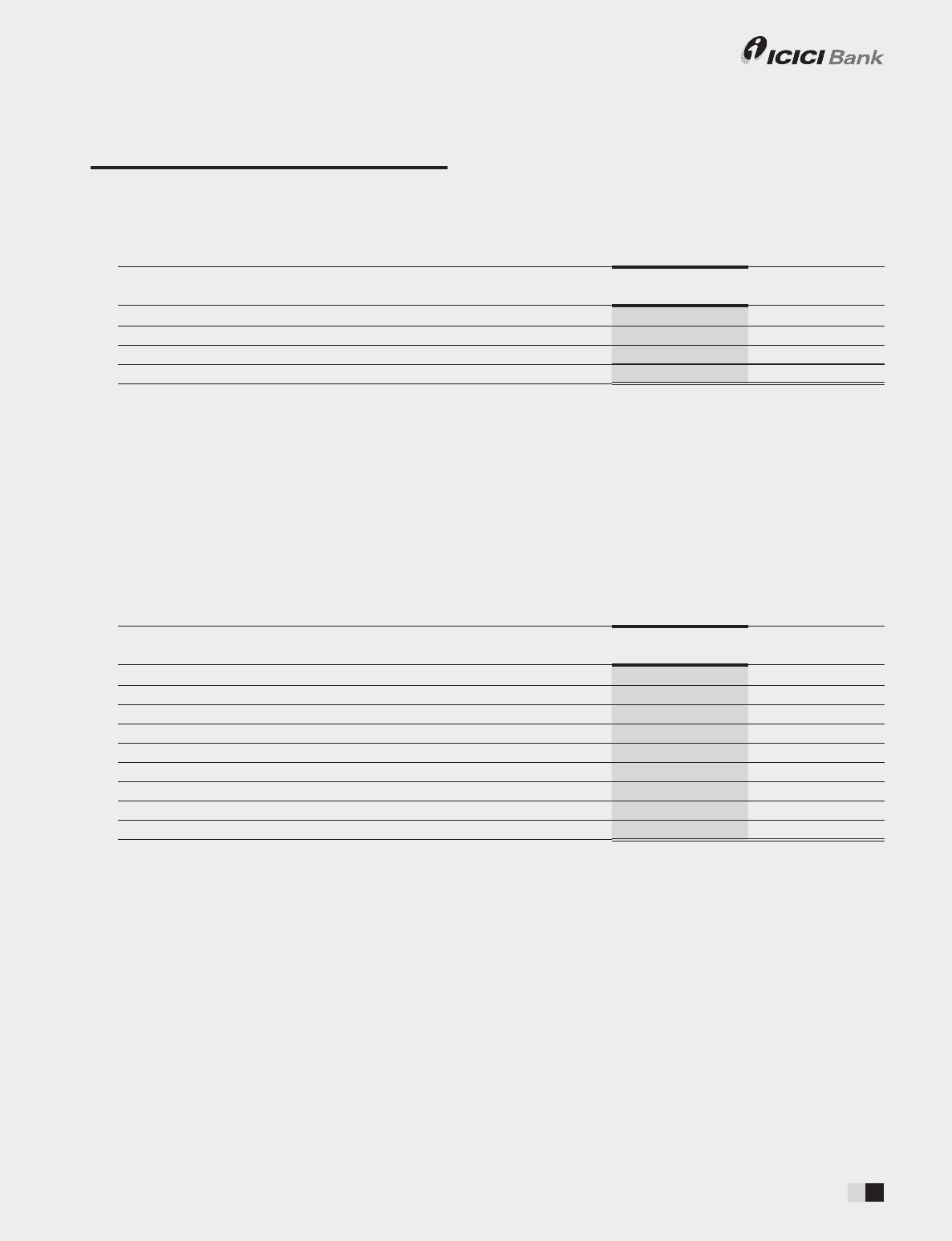

7. Provisions and contingencies

The following table sets forth, for the periods indicated, the break-up of provisions and contingencies included in

prot and loss account.

` in million

Particulars Year ended

March 31, 2016

Year ended

March 31, 2015

Provision for depreciation of investments 2,985.1 4,128.9

Provision towards non-performing and other assets 77,188.6 36,307.6

Provision towards income tax

- Current 67,365.4 56,758.0

- Deferred (33,590.4) (2,841.8)

Provision towards wealth tax 0.2 51.1

Collective contingency and related reserve 36,000.0 –

Other provisions and contingencies16,880.3 4,926.9

Total provisions and contingencies 156,829.2 99,330.7

1. Includes general provision towards standard assets amounting to ` 3,175.6 million (March 31, 2015: ` 3,927.6 million).

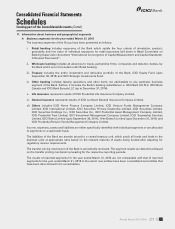

The Group has assessed its obligations arising in the normal course of business, including pending litigations,

proceedings pending with tax authorities and other contracts including derivative and long term contracts. In

accordance with the provisions of Accounting Standard - 29 on ‘Provisions, Contingent Liabilities and Contingent

Assets’, the Group recognises a provision for material foreseeable losses when it has a present obligation as a

result of a past event and it is probable that an outow of resources will be required to settle the obligation, in

respect of which a reliable estimate can be made. In cases where the available information indicates that the loss

on the contingency is reasonably possible but the amount of loss cannot be reasonably estimated, a disclosure to

this effect is made as contingent liabilities in the nancial statements. The Group does not expect the outcome of

these proceedings to have a materially adverse effect on its nancial results. For insurance contracts booked in its

life insurance subsidiary, reliance has been placed on the Appointed Actuary for actuarial valuation of “liabilities

for policies in force”. The Appointed Actuary has conrmed that the assumptions used in valuation of liabilities for

policies in force are in accordance with the guidelines and norms issued by the IRDAI and the Institute of Actuaries

of India in concurrence with the IRDA.