ICICI Bank 2016 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55Annual Report 2015-2016

on the binomial tree model, compensation cost in scal 2016 would have been higher by ` 3.73 billion and proforma

prot after tax would have been ` 93.54 billion. On a proforma basis, the Bank’s basic and diluted earnings per share

would have been ` 16.11 and ` 16.02 respectively.

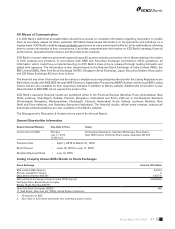

The key assumptions used to estimate the fair value of options granted during scal 2016 are given below:

Risk-free interest rate 7.58% to 8.19%

Expected life 3.16 to 5.78 years

Expected volatility 30.67% to 32.77%

Expected dividend yield 1.62% to 2.11%

Expected early exercise of options is estimated based on the historical stock option exercise pattern of the Bank. Expected

volatility is based on historical volatility determined based on observed market prices of the Bank’s publicly traded equity

shares.

The weighted average fair value of options granted during scal 2016 is ` 100.50 (March 31, 2015: ` 90.09). The weighted

average exercise price of options exercised during scal 2016 is ` 161.16 (March 31, 2015: ` 150.66)

CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE

EARNINGS AND OUTGO

The Bank has undertaken various initiatives for energy conservation at its premises, further details are given under

Principle 6 of Section E of the Business Responsibility Report. The Bank has used information technology extensively in

its operations, for more details please refer the section on Information Technology under Business Overview.

GREEN INITIATIVES IN CORPORATE GOVERNANCE

In line with the ‘Green Initiative’ since the last ve years, the Bank has effected electronic delivery of Notice of Annual

General Meeting and Annual Report to those Members whose e-mail IDs were registered with the respective Depository

Participants and downloaded from the depositories viz. National Securities Depository Limited/Central Depository

Services (India) Limited. The Companies Act, 2013 and the underlying rules as well as Regulation 36 of Securities and

Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, permit the dissemination

of nancial statements and annual report in electronic mode to the Members. Your Directors are thankful to the Members

for actively participating in the Green Initiative and seek your continued support for implementation of the Green Initiative.

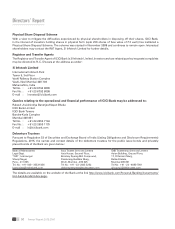

DIRECTORS’ RESPONSIBILITY STATEMENT

The Directors conrm:

1. that in the preparation of the annual accounts, the applicable accounting standards had been followed along with

proper explanation relating to material departures;

2. that they have selected such accounting policies and applied them consistently and made judgements and estimates

that are reasonable and prudent, so as to give a true and fair view of the state of affairs of the Bank at the end of the

nancial year and of the prot of the Bank for that period;

3. that they have taken proper and sufcient care for the maintenance of adequate accounting records, in accordance

with the provisions of the Banking Regulation Act, 1949 and the Companies Act, 2013 for safeguarding the assets of

the Bank and for preventing and detecting fraud and other irregularities;

4. that they have prepared the annual accounts on a going concern basis;

5. that they have laid down internal nancial controls to be followed by the Bank and that such internal nancial controls

are adequate and were operating effectively; and

6. that they have devised proper systems to ensure compliance with the provisions of all applicable laws and that such

systems were adequate and operating effectively.