ICICI Bank 2016 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

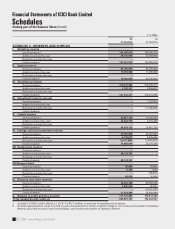

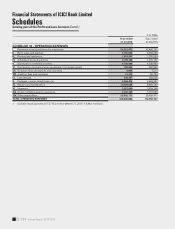

Annual Report 2015-2016136

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

k) Net income arising from sell-down/securitisation of loan assets prior to February 1, 2006 has been recognised

upfront as interest income. With effect from February 1, 2006, net income arising from securitisation of loan

assets is amortised over the life of securities issued or to be issued by the special purpose vehicle/special purpose

entity to which the assets are sold. Net income arising from sale of loan assets through direct assignment with

recourse obligation is amortised over the life of underlying assets sold and net income from sale of loan assets

through direct assignment, without any recourse obligation, is recognised at the time of sale. Net loss arising on

account of the sell-down/securitisation and direct assignment of loan assets is recognised at the time of sale.

l) The Bank deals in bullion business on a consignment basis. The difference between price recovered from

customers and cost of bullion is accounted for at the time of sales to the customers. The Bank also deals in

bullion on a borrowing and lending basis and the interest paid/received is accounted on accrual basis.

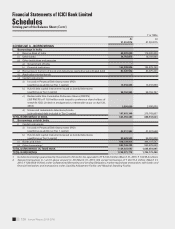

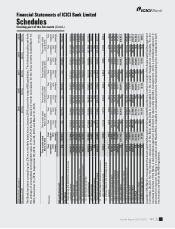

2. Investments

Investments are accounted for in accordance with the extant RBI guidelines on investment classication and valuation

as given below.

1. All investments are classied into ‘Held to Maturity’, ‘Available for Sale’ and ‘Held for Trading’. Reclassications, if

any, in any category are accounted for as per RBI guidelines. Under each classication, the investments are further

categorised as (a) government securities, (b) other approved securities, (c) shares, (d) bonds and debentures, (e)

subsidiaries and joint ventures and (f) others.

2. ‘Held to Maturity’ securities are carried at their acquisition cost or at amortised cost, if acquired at a premium over

the face value. Any premium over the face value of xed rate and oating rate securities acquired is amortised

over the remaining period to maturity on a constant yield basis and straight line basis respectively.

3. ‘Available for Sale’ and ‘Held for Trading’ securities are valued periodically as per RBI guidelines. Any premium

over the face value of xed rate and oating rate investments in government securities, classied as ‘Available

for Sale’, is amortised over the remaining period to maturity on constant yield basis and straight line basis

respectively. Quoted investments are valued based on the trades/quotes on the recognised stock exchanges,

subsidiary general ledger account transactions, price list of RBI or prices declared by Primary Dealers Association

of India jointly with Fixed Income Money Market and Derivatives Association (FIMMDA), periodically.

The market/fair value of unquoted government securities which are in the nature of Statutory Liquidity Ratio

(SLR) securities included in the ‘Available for Sale’ and ‘Held for Trading’ categories is as per the rates published

by FIMMDA. The valuation of other unquoted xed income securities, including Pass Through Certicates,

wherever linked to the Yield-to-Maturity (YTM) rates, is computed with a mark-up (reecting associated credit

risk) over the YTM rates for government securities published by FIMMDA.

Unquoted equity shares are valued at the break-up value, if the latest balance sheet is available, or at ` 1, as per

RBI guidelines.

Securities are valued scrip-wise. Depreciation/appreciation on securities, other than those acquired by way of

conversion of outstanding loans, is aggregated for each category. Net appreciation in each category, if any, being

unrealised, is ignored, while net depreciation is provided for. The depreciation on securities acquired by way of

conversion of outstanding loans is fully provided for. Non-performing investments are identied based on the

RBI guidelines.

Depreciation on equity shares acquired and held by the Bank under SDR scheme is provided over a period of

four calendar quarters from the date of conversion of debt into equity in accordance with the RBI guidelines.

4. Treasury bills, commercial papers and certicate of deposits being discounted instruments, are valued at carrying

cost.

5. The units of mutual funds are valued at the latest repurchase price/net asset value declared by the mutual fund.