ICICI Bank 2016 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

Annual Report 2015-2016 13

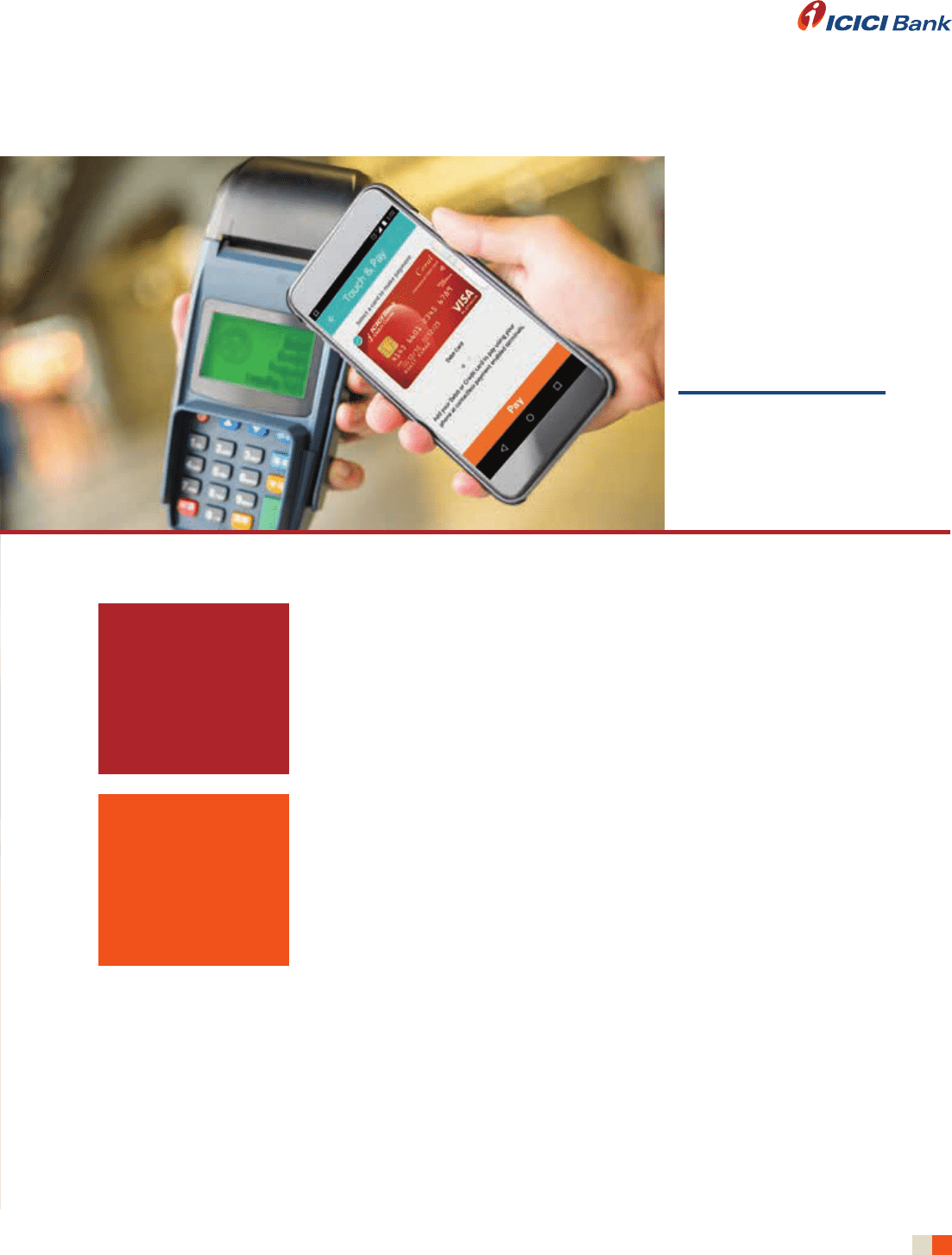

Touch & Pay

India’s first contactless

mobile payment solution

that allows payments at

over 60,000 merchant

outlets

60%

of savings account

transactions are done

through mobile and

internet banking

mVisa

service allows customers

to scan a QR code at

merchant outlets and

make a payment

Smartphones are redefining every aspect of

life today. Banking is no exception. Today,

mobile banking is mainstream. Over the

years, we have played a leading role in this

transformation: educating customers and

showing the way to the rest of the industry

to join along.

From money transfers to contactless

payments to loan applications, the Bank has

made virtually every transaction possible

on the move, so customers are no longer

constrained by time or place.

In February 2015, we launched Pockets,

India’s first digital wallet by a bank, which

can be used by customers and non-

customers alike. Users, especially the young

generation who may not have access to a

traditional bank account, can download the

Pockets app instantly on their phone, fund

it and start transacting immediately. Within

the first year of its launch, Pockets has

garnered over 3.6 million downloads. In an

industry ruled by discounts and cashbacks,

the Pockets app ranks among the top digital

wallets of the country, despite limited spends

on promotions.

In today’s fast paced world, customers like

to complete their transactions quickly and

pay in a jiffy. Realising this, the all-new

Pockets app now sports a revolutionary

feature. Touch & Pay, India’s first contactless

mobile payment solution, enables secure

payments through smartphones at retail

stores and does away with the need to

carry physical cards. All ICICI Bank credit

and debit card users can use this feature to

make payments at over 60,000 merchant

outlets across the country. They simply

need to wave their phones on Near Field

Communication (NFC) enabled merchant

terminals to make the payment.

Pockets is increasingly growing to become

a comprehensive payments app. mVisa, a

service launched in parternship with Visa

earlier in the year, allows customers to

use their Pockets app to make cashless

payments at merchant outlets. Customers

can use mVisa to scan a QR code

available at the merchant outlet, enter

the bill amount and confirm the payment

by entering their debit card PIN. A first-

of-its-kind service in the world, mVisa

ensures that the transactions are faster

and more convenient.