ICICI Bank 2016 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

Management’s Discussion & Analysis

Annual Report 2015-2016

1. In accordance with RBI circular dated July 16, 2015, investment in the Rural Infrastructure and Development Fund and other related

deposits has been re-grouped to line item ‘Others’ under Schedule 11 - Other Assets. Accordingly, figures of the previous periods

have been re-grouped to conform to the current year presentation.

2. Borrowings exclude preference share capital.

3. The average balances are the sum of the daily average balances outstanding except for the averages of overseas branches of ICICI

Bank which are calculated on a fortnightly basis up to September 2014. From October 2014, averages of foreign branches are

averages of daily balances.

4. All amounts have been rounded off to the nearest ` 10.0 million.

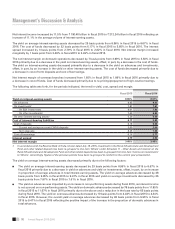

The average volume of interest-earning assets increased by 11.1% from ` 5,476.64 billion in scal 2015 to ` 6,084.83

billion in scal 2016. The increase in average interest-earning assets was primarily on account of an increase in average

advances by ` 530.54 billion and average interest-earning investments by ` 51.55 billion.

Average advances increased by 14.8% from ` 3,579.93 billion in scal 2015 to ` 4,110.47 billion in scal 2016 primarily

due to an increase in domestic advances.

Average interest-earning investments increased from ` 1,345.46 billion in scal 2015 to ` 1,397.00 billion in scal 2016,

primarily due to an increase in SLR investments by 8.5% from ` 992.42 billion in scal 2015 to ` 1,076.45 billion in

scal 2016, offset, in part, by a decrease in interest-earning non-SLR investments by 9.2% from ` 353.03 billion in scal

2015 to ` 320.55 billion in scal 2016. Average interest-earning non-SLR investments primarily include investments in

corporate bonds and debentures, PTCs, commercial papers, certicates of deposits and investments in liquid mutual

funds to deploy excess liquidity. Average interest-earning non-SLR investments decreased primarily due to a decrease

in investment in certicates of deposit, preference shares, bonds and debentures, mutual funds and PTCs, offset, in part,

by an increase in investment in commercial papers.

There was an increase in average other interest-earning assets by 4.7% from ` 551.25 billion in scal 2015 to ` 577.36

billion in scal 2016 primarily due to an increase in deposits with the RIDF and other related deposits and balances with

RBI, offset, in part, by a decrease in call and term money lent.

Average interest-bearing liabilities increased by 10.7% from ` 4,870.63 billion in scal 2015 to ` 5,391.57 billion in scal

2016 on account of an increase of ` 380.03 billion in average deposits and an increase of ` 140.91 billion in average

borrowings.

Average deposits increased due to an increase in average CASA deposits by ` 193.46 billion and an increase in average

term deposits by ` 186.57 billion.

Average borrowings increased by 8.9% from ` 1,585.11 billion in scal 2015 to ` 1,726.02 billion in scal 2016 primarily

due to an increase in term borrowings, bond borrowings and renance borrowings, offset, in part, by a decrease in

borrowings under the Liquidity Adjustment Facility of RBI.

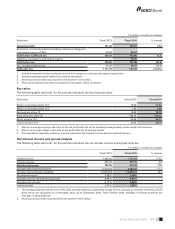

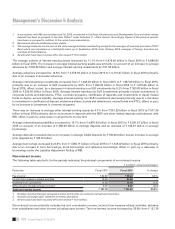

Non-interest income

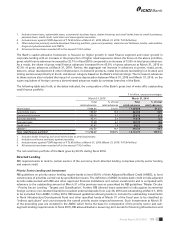

The following table sets forth, for the periods indicated, the principal components of non-interest income.

` in billion, except percentages

Particulars Fiscal 2015 Fiscal 2016 % change

Fee income1` 82.87 ` 88.20 6.4%

Income from treasury-related activities 16.93 40.60 –

Dividend from subsidiaries 15.59 15.35 (1.5)

Other income (including lease income)26.37 9.07 42.4

Total non-interest income ` 121.76 ` 153.22 25.8%

1. Includes merchant foreign exchange income and income on customer derivative transactions.

2. Includes exchange gains related to overseas operations.

3. All amounts have been rounded off to the nearest ` 10.0 million.

Non-interest income primarily includes fee and commission income, income from treasury-related activities, dividend

from subsidiaries and other income including lease income. The non-interest income increased by 25.8% from ` 121.76