ICICI Bank 2016 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105Annual Report 2015-2016

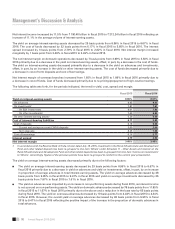

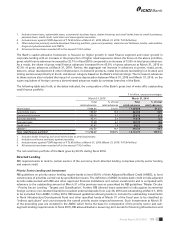

Deposits

Deposits increased by 16.6% from ` 3,615.63 billion at March 31, 2015 to ` 4,214.26 billion at March 31, 2016. Term

deposits increased by 15.8% from ` 1,971.83 billion at March 31, 2015 to ` 2,283.26 billion at March 31, 2016, while

savings account deposits increased by 16.9% from ` 1,148.60 billion at March 31, 2015 to ` 1,342.30 billion at March

31, 2016 and current account deposits increased by 18.9% from ` 495.20 billion at March 31, 2015 to ` 588.70 billion

at March 31, 2016. The current and savings account deposits increased from ` 1,643.80 billion at March 31, 2015 to

` 1,931.00 billion at March 31, 2016. Total deposits at March 31, 2016 constituted 70.7% of the funding (i.e., deposits and

borrowings, other than preference share capital).

Borrowings

Borrowings increased by 1.4% from ` 1,724.18 billion at March 31, 2015 to ` 1,748.08 billion at March 31, 2016 primarily

due to an increase in foreign currency bond borrowings, renance borrowings and foreign currency term money

borrowing, offset, in part, by a decrease in borrowings from RBI under Liquidity Adjustment Facility. Borrowings of

overseas branches, in US dollar terms, decreased from US$ 15.30 billion at March 31, 2015 to US$ 14.70 billion at March

31, 2016. However, due to rupee depreciation from ` 62.50 per US dollar at March 31, 2015 to ` 66.26 per US dollar at March

31, 2016, borrowings of overseas branches, in rupee terms, increased by 2.3% from ` 953.97 billion at March 31, 2015 to

` 976.35 billion at March 31, 2016.

Other liabilities

Other liabilities increased by 9.5% from ` 317.19 billion at March 31, 2015 to ` 347.25 billion at March 31, 2016 primarily

due to an increase in the collective contingencies and related reserve, offset, in part, by a decrease in mark-to-market

amount and payables on foreign exchange and derivatives transactions.

Equity share capital and reserves

Equity share capital and reserves increased from ` 804.29 billion at March 31, 2015 to ` 897.36 billion at March 31, 2016

primarily due to accretion to reserves from prot for the year and creation of revaluation reserve of ` 28.17 billion on xed

assets, offset, in part, by proposed dividend.

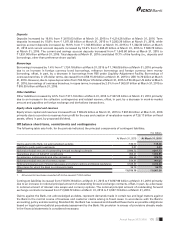

Off balance sheet items, commitments and contingencies

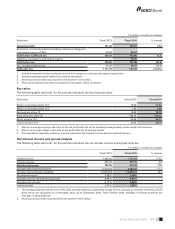

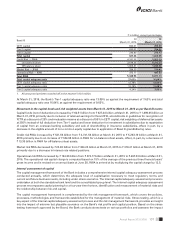

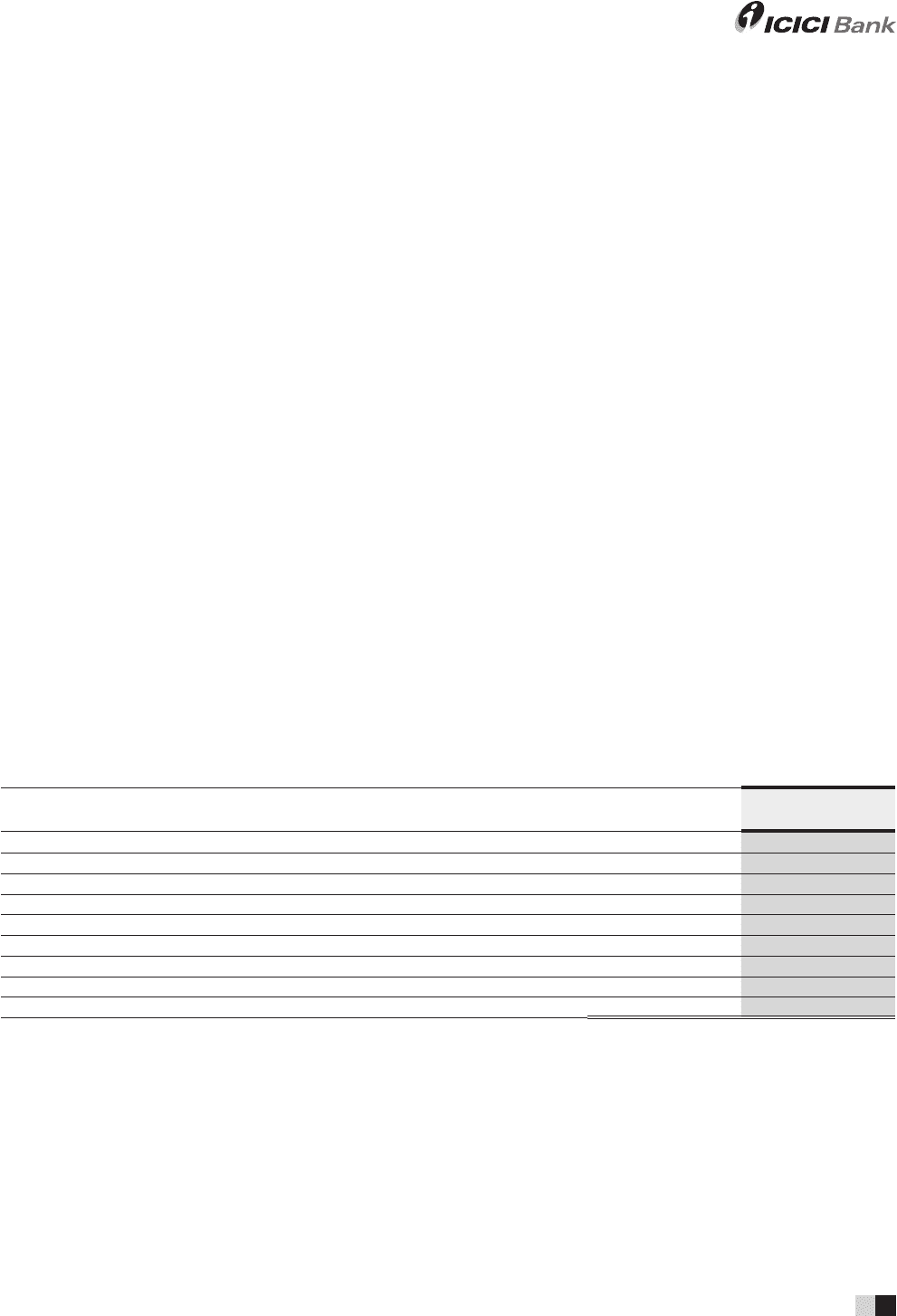

The following table sets forth, for the periods indicated, the principal components of contingent liabilities.

` in billion

At March 31, 2015 At March 31, 2016

Claims against the Bank, not acknowledged as debts ` 39.77 ` 35.36

Liability for partly paid investments 0.07 0.01

Notional principal amount of outstanding forward exchange contracts 2,898.72 3,567.73

Guarantees given on behalf of constituents 993.27 1,004.95

Acceptances, endorsements and other obligations 496.59 472.78

Notional principal amount of currency swaps 514.31 460.01

Notional principal amount of interest rate swaps and currency options and interest rate futures 3,538.30 3,414.40

Other items for which the Bank is contingently liable 38.75 52.75

Total ` 8,519.78 ` 9,007.99

1. All amounts have been rounded off to the nearest ` 10.0 million.

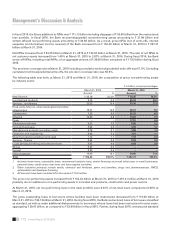

Contingent liabilities increased from ` 8,519.78 billion at March 31, 2015 to ` 9,007.99 billion at March 31, 2016 primarily

due to an increase in notional principal amount of outstanding forward exchange contracts, offset, in part, by a decrease

in notional amount of interest rate swaps and currency options. The notional principal amount of outstanding forward

exchange contracts increased from ` 2,898.72 billion at March 31, 2015 to ` 3,567.73 billion at March 31, 2016.

Claims against the Bank, not acknowledged as debts, represent demands made in certain tax and legal matters against

the Bank in the normal course of business and customer claims arising in fraud cases. In accordance with the Bank’s

accounting policy and Accounting Standard 29, the Bank has reviewed and classied these items as possible obligations

based on legal opinion/judicial precedents/assessment by the Bank. No provision in excess of provisions already made

in the nancial statements is considered necessary.