ICICI Bank 2016 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

Management’s Discussion & Analysis

Annual Report 2015-2016

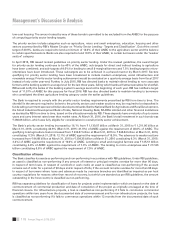

low-cost housing. The amount raised by way of these bonds is permitted to be excluded from the ANBC for the purpose

of computing priority sector lending targets.

The priority sectors include categories such as agriculture, micro and small enterprises, education, housing and other

sectors as prescribed by RBI’s Master Circular on ‘Priority Sector Lending - Targets and Classication’. Out of the overall

target of 40.0%, banks are required to lend a minimum of 18.0% of their ANBC to the agriculture sector and the balance

to certain specied sectors. Banks are also required to lend 10.0% of their ANBC, to certain borrowers under the “weaker

section” category.

In April 2015, RBI issued revised guidelines on priority sector lending. Under the revised guidelines, the overall target

for priority sector lending continues to be 40% of the ANBC; sub-targets for direct and indirect lending to agriculture

have been combined; and sub-targets of 8.0% for lending to small & marginal farmers and 7.5% lending target to micro-

enterprises have been introduced. These sub-targets are to be achieved in a phased manner by March 2017. Sectors

qualifying for priority sector lending have been broadened to include medium enterprises, social infrastructure and

renewable energy. Priority sector lending achievement would be evaluated on a quarterly average basis from scal 2017

instead of only at the year-end. Further, in July 2015, RBI has directed banks to maintain direct lending to non-corporate

farmers at the banking system’s average level for the last three years, failing which banks will attract penalties for shortfall.

RBI would notify the banks of the banking system’s average level at the beginning of each year. RBI has notied a target

level of 11.57% of ANBC for this purpose for scal 2016. RBI has also directed banks to maintain lending to borrowers

who constituted the direct agriculture lending category under the earlier guidelines.

The Bank is required to comply with the priority sector lending requirements prescribed by RBI from time to time. The

shortfall in the amount required to be lent to the priority sectors and weaker sections may be required to be deposited in

funds with government sponsored Indian development banks like the National Bank for Agriculture and Rural Development,

the Small Industries Development Bank of India, National Housing Bank, MUDRA Limited and other nancial institutions

as decided by RBI from time to time, based on the allocations made by RBI. These deposits have a maturity of up to seven

years and carry interest rates lower than market rates. At March 31, 2016, the Bank’s total investment in such bonds was

` 280.66 billion, which was fully eligible for consideration in overall priority sector achievement.

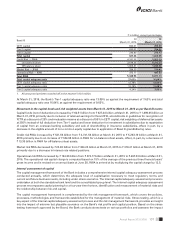

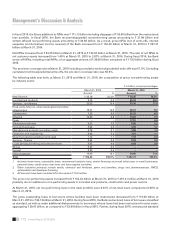

The Bank’s priority sector lending increased by 16.1% from ` 1,130.07 billion at March 31, 2015 to ` 1,311.90 billion at

March 31, 2016, constituting 40.8% (March 31, 2015: 41.0%) of ANBC against the requirement of 40.0% of ANBC. The

qualifying total agriculture loans increased from ` 332.67 billion at March 31, 2015 to ` 545.84 billion at March 31, 2016,

constituting 17.0% (March 31, 2015: 12.1%) of ANBC against the requirement of 18.0%. The advances to weaker sections

increased from ` 94.89 billion at March 31, 2015 to ` 204.35 billion at March 31, 2016 constituting 6.3% (March 31, 2015:

3.4%) of ANBC against the requirement of 10.0% of ANBC. Lending to small and marginal farmers was ` 125.51 billion

constituting 3.9% of ANBC against the requirement of 7.0% of ANBC. The lending to micro enterprises was ` 217.85

billion constituting 6.8% of ANBC against the requirement of 7.0% of ANBC.

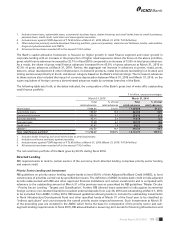

Classication of loans

The Bank classies its assets as performing and non-performing in accordance with RBI guidelines. Under RBI guidelines,

an asset is classied as non-performing if any amount of interest or principal remains overdue for more than 90 days,

in respect of term loans. In respect of overdraft or cash credit, an asset is classied as non-performing if the account

remains out of order for a period of 90 days and in respect of bills, if the account remains overdue for more than 90 days.

In respect of borrowers where loans and advances made by overseas branches are identied as impaired as per host

country regulations for reasons other than record of recovery, but which are standard as per RBI guidelines, the amount

outstanding in the host country is classied as non-performing.

RBI has separate guidelines for classication of loans for projects under implementation which are based on the date of

commencement of commercial production and date of completion of the project as originally envisaged at the time of

nancial closure. For infrastructure projects, a loan is classied as non-performing if it fails to commence commercial

operations within two years from the documented date of commencement and for non-infrastructure projects, the loan

is classied as non-performing if it fails to commence operations within 12 months from the documented date of such

commencement.