ICICI Bank 2016 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016164

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

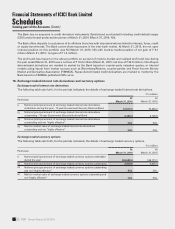

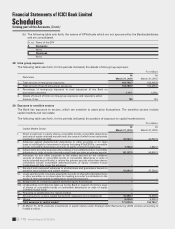

` in million, except number of accounts

Type of Restructuring

Others Total

Sr. No. Asset Classication Details

Standard

(a)

Sub-

Standard

(b)

Doubtful

(c)

Loss

(d)

Total

(e)

Standard

(a)

Sub-

Standard

(b)

Doubtful

(c)

Loss

(d)

Total

(e)

1. Restructured accounts at April 1, 2015

No. of borrowers 1,204 20 34 138 1,396 1,256 20 55 141 1,472

Amount outstanding 38,723.9 3,652.5 13,490.0 2,298.9 58,165.3 119,460.4 3,652.5 51,328.5 2,768.5 177,209.9

Provision thereon 1,642.1 925.5 7,794.2 2,298.9 12,660.7 9,287.1 925.5 24,564.2 2,768.5 37,545.3

2. Fresh restructuring during the year ended March 31, 2016

No. of borrowers 9 –––99–––9

Amount outstanding 23,070.5 –––23,070.5 23,070.5 –––23,070.5

Provision thereon 1,201.3 –––1,201.3 1,201.3 –––1,201.3

3. Upgradations to restructured standard category during the

year ended March 31, 2016

No. of borrowers 18 (5) (4) (9) –18 (5) (4) (9) –

Amount outstanding 18.4 (1.6) (6.9) (11.1) (1.2) 18.4 (1.6) (6.9) (11.1) (1.2)

Provision thereon 0.3 (0.3) (6.1) (11.1) (17.2) 0.3 (0.3) (6.1) (11.1) (17.2)

4. Increase/(Decrease) in borrower level outstanding of

existing restructured cases during the year ended March

31, 2016

1

No. of borrowers – – – – –– – – – –

Amount outstanding 3,064.5 0.1 (40.6) (33.3) 2,990.7 6,402.1 0.1 4,663.1 (33.3) 11,030.2

Provision thereon 510.5 –1,677.7 (33.3) 2,154.9 336.4 –9,851.5 (33.3) 10,154.6

5. Restructured standard advances at April 1, 2015, which cease

to attract higher provisioning and/or additional risk weight at

March 31, 2016 and hence need not be shown as restructured

standard advances at April 1, 2016

No. of borrowers (1) –––(1) (1) –––(1)

Amount outstanding (78.1) –––(78.1) (78.1) –––(78.1)

Provision thereon – – – – –– – – – –

6. Downgradations of restructured accounts during the year

ended March 31, 2016

No. of borrowers (764) 725 26 13 –(782) 725 38 14 –

Amount outstanding (25,634.2) (3,039.4) 21,406.7 6,004.3 (1,262.6) (53,002.2) (3,039.4) 47,368.5 8,020.8 (652.3)

Provision thereon (614.6) (823.0) 6,990.4 6,004.3 11,557.1 (3,406.4) (823.0) 21,883.4 8,020.8 25,674.8

7. Write-offs/recovery/sale of restructured accounts during the

year ended March 31, 2016

No. of borrowers (75) (1) (7) (22) (105) (76) (1) (14) (24) (115)

Amount outstanding (2,697.5) (0.2) (1,517.3) (1,614.8) (5,829.8) (2,740.7) (0.2) (8,104.3) (2,065.2) (12,910.4)

Provision thereon (14.9) –(1,514.1) (1,614.8) (3,143.8) (16.0) –(5,826.1) (2,065.2) (7,907.3)

8. Restructured Accounts at March 31, 2016

No. of borrowers 391 739 49 120 1,299 424 739 75 127 1,365

Amount outstanding 36,467.5 611.4 33,331.9 6,644.0 77,054.8 93,130.4 611.4 95,248.9.1 8,679.8 197,670.5

Provision thereon 2,724.7 102.3 14,942.1 6,644.0 24,413.1 7,402.7 102.3 50,466.9 8,679.8 66,651.7

1. Increase/(decrease) in borrower level outstanding of restructured accounts is due to utilisation of cash credit facility, exchange rate fluctuation, accrued interest, fresh disbursement,

non-fund based devolvement, conversion of loans into equity (including application pending allotment) as part of restructuring scheme, etc.

2. “Others” mechanism also include cases restructured under Joint Lender Forum (JLF) mechanism.