ICICI Bank 2016 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89Annual Report 2015-2016

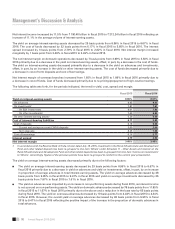

In addition, the Bank launched a range of technology-based products to offer more convenience to customers. Some of

these initiatives include Forex@click (a facility to purchase foreign exchange and travel card products 24x7), a dedicated

portal for the collection of central/state taxes, e-SOFTEX which enables software exporters to manage export reporting

to the authorities and doorstep banking for corporate customers which enables them to request collection and provide

disbursement instructions online.

To enhance fraud prevention measures, the Bank launched a real-time fraud monitoring tool for managing the fraud

on credit and debit cards. Big data and multi-channel campaign management have helped the Bank in campaigns,

management of real time offers, geospatial analytics and event-based marketing. The Bank continues to adopt state-of-

the-art technologies for infrastructure monitoring and data-centre optimisation to cater to evolving customer aspirations.

Additionally, the Bank has migrated its key systems (Core Banking System, Payment Gateway, Dealing Room Primary,

among others) to their latest versions enabling access to new features, enhanced security and better scalability.

KEY SUBSIDIARIES

ICICI Prudential Life Insurance Company (ICICI Life)

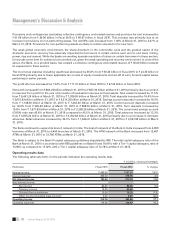

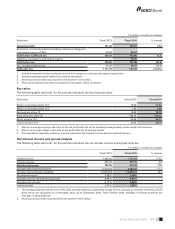

ICICI Life remains the market leader among private life insurers in terms of retail weighted received premium (RWRP) with

an overall market share of 11.3% and private market share of 21.9% for scal 2016. ICICI Life’s total premium in scal

2016 was ` 191.64 billion as compared to ` 153.07 billion during scal 2015 while the annualised premium equivalent

for scal 2016 was ` 51.70 billion as compared to ` 47.44 billion for scal 2015. The prot after tax was ` 16.50 billion as

compared to ` 16.34 billion in scal 2015. The total assets under management for ICICI Life stood at ` 1,039.39 billion

as on March 31, 2016. During scal 2016, ICICI Bank sold a 6.0% stake in ICICI Life to two investors, at a company

valuation of ` 325.00 billion. Post the transaction, our share ownership in ICICI Life came down from approximately 74%

to approximately 68%.

ICICI Lombard General Insurance Company (ICICI General)

ICICI General’s Gross Written Premium (GWP) was ` 83.07 billion in scal 2016. The company maintained its market

leadership in the private sector with an overall market share of 8.4%. The company witnessed an increase in policy

volumes by 13.90% from 13.87 million in scal 2015 to ` 15.80 million in scal 2016. ICICI General’s prot before tax

increased from ` 6.91 billion in scal 2015 to ` 7.08 billion in scal 2016 despite the impact of Chennai oods and high

weather insurance claims. ICICI General’s prot after tax decreased from ` 5.36 billion in scal 2015 to ` 5.07 billion

scal 2016, due to a higher effective tax rate in scal 2016, as loss carried forward from earlier years had already been

absorbed in prior periods. In scal 2016, ICICI Bank sold a 9.0% stake in ICICI General to its joint venture partner, Fairfax

Financial Holdings, at a company valuation of ` 172.25 billion. Following the transaction, the share ownership in ICICI

Lombard General Insurance Company of ICICI Bank and Fairfax Financial Holdings Limited is approximately 64% and

35%, respectively.

ICICI Prudential Asset Management Company (ICICI AMC)

ICICI Prudential AMC had quarterly average assets under management of ` 1,758.81 billion for quarter ended March 31,

2016, making it the largest asset management company in India. The overall market share in mutual fund business has

grown to 13.0% on quarterly average basis compared to 12.5% in scal 2015. At March 31, 2016, the closing equity mutual

fund AUM (excluding exchange traded funds) has moved up to ` 614.10 billion and the market share has increased to

14.4% from 13.5% in March 2015. ICICI AMC posted a prot after tax of ` 3.26 billion for the year ended March 31, 2016,

an increase of 32% as compared to ` 2.47 billion for the year ended March 31, 2015.

In scal 2016, the Company won the Best Fund House (Equity Category) in the Morningstar Fund Awards 2016, the Best

Debt Fund House Award in Business Today - Money Today Financial Awards 2016 and the Best Fund House - India 2016

at the APAC Investment Awards 2016.