ICICI Bank 2016 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016166

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

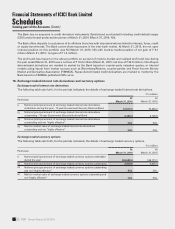

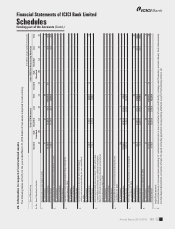

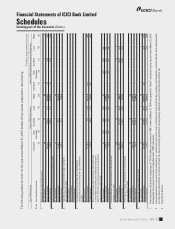

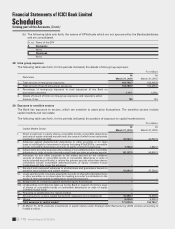

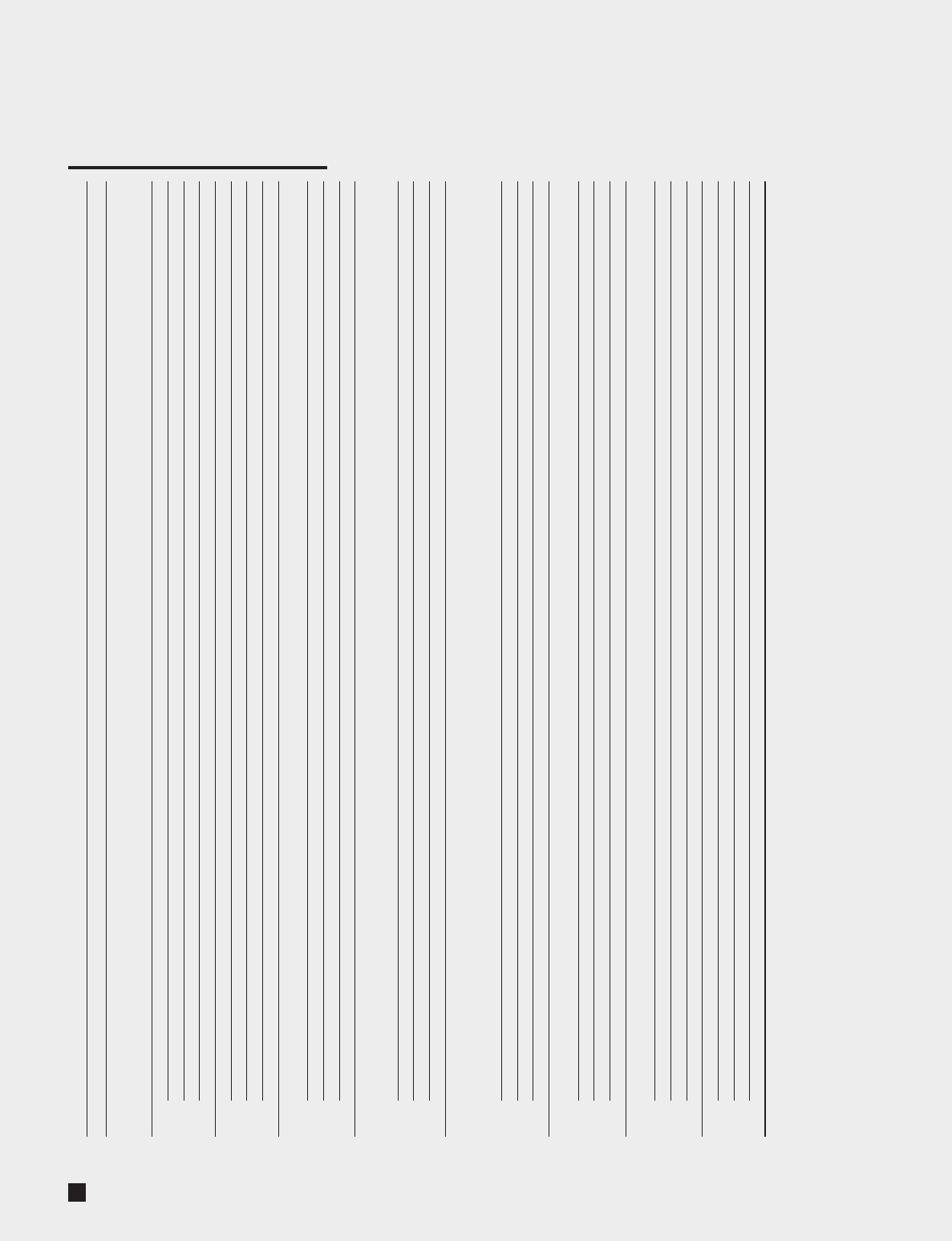

` in million, except number of accounts

Type of Restructuring

Others Total

Sr. No. Asset Classication Details

Standard

(a)

Sub-

Standard

(b)

Doubtful

(c)

Loss

(d)

Total

(e)

Standard

(a)

Sub-

Standard

(b)

Doubtful

(c)

Loss

(d)

Total

(e)

1. Restructured accounts at April 1, 2014

1

No. of borrowers 807 8 188 13 1,016 856 8202 14 1,080

Amount outstanding 27,901.8 287.6 11,734.6 603.6 40,527.6 116,524.7 287.6 16,992.8 624.7 134,429.8

Provision thereon 1,686.2 78.3 7,035.5 351.3 9,151.3 10,945.2 78.3 10,872.1 372.4 22,268.0

2. Fresh restructuring during the year ended March 31, 2015

No. of borrowers 455 6 – – 461 474 6 1 – 481

Amount outstanding 17,523.4 762.6 – – 18,286.0 35,332.5 762.6 213.7 –36,308.8

Provision thereon 1,072.2 114.4 – – 1,186.6 2,624.7 114.4 213.7 –2,952.8

3. Upgradations to restructured standard category during the

year ended March 31, 2015

No. of borrowers 17 – (17) ––17 – (17) ––

Amount outstanding 246.8 –(257.2) –(10.4) 246.8 –(257.2) –(10.4)

Provision thereon – – (168.8) –(168.8) – – (168.8) –(168.8)

4. Increase/(Decrease) in borrower level outstanding of

existing restructured cases during the year ended March

31, 2015

2

No. of borrowers – – – – –– – – – –

Amount outstanding 2,205.0 –23.1 (99.5) 2,128.6 18,361.5 –35.5 (101.4) 18,295.6

Provision thereon (62.1) –1,443.5 152.8 1,534.2 969.5 –2,092.5 150.9 3,212.9

5. Restructured standard advances at April 1, 2014, which cease

to attract higher provisioning and/or additional risk weight at

March 31, 2015 and hence need not be shown as restructured

standard advances at April 1, 2015

No. of borrowers (17) N.A. N.A. N.A. (17) (19) N.A. N.A. N.A. (19)

Amount outstanding (10.2) N.A. N.A. N.A. (10.2) (2,760.4) N.A. N.A. N.A. (2,760.4)

Provision thereon – N.A. N.A. N.A. –(63.9) N.A. N.A. N.A. (63.9)

6. Downgradations of restructured accounts during the year

ended March 31, 2015

No. of borrowers (34) 9 (103) 128 –(46) 9 (93) 130 –

Amount outstanding (9,131.4) 2,604.1 4,780.4 1,795.6 48.7 (45,292.0) 2,604.1 39,921.7 2,246.0 (520.2)

Provision thereon (1,052.6) 733.0 790.4 1,795.6 2,266.4 (5,118.9) 733.0 14,340.1 2,246.0 12,200.2

7. Write-offs/recovery/sale of restructured accounts during the

year ended March 31, 2015

No. of borrowers (24) (3) (34) (3) (64) (26) (3) (38) (3) (70)

Amount outstanding (11.5) (1.8) (2,790.9) (0.8) (2,805.0) (2,952.7) (1.8) (5,578.0) (0.8) (8,533.3)

Provision thereon (1.6) (0.2) (1,306.4) (0.8) (1,309.0) (69.5) (0.2) (2,785.4) (0.8) (2,855.9)

8. Restructured Accounts at March 31, 2015

No. of borrowers 1,204 20 34 138 1,396 1,256 20 55 141 1,472

Amount outstanding 38,723.9 3,652.5 13,490.0 2,298.9 58,165.3 119,460.4 3,652.5 51,328.5 2,768.5 177,209.9

Provision thereon 1,642.1 925.5 7,794.2 2,298.9 12,660.7 9,287.1 925.5 24,564.2 2,768.5 37,545.3

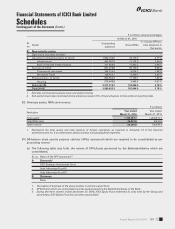

1. Three borrowers with amount outstanding of ` 7,673.3 million and provision of ` 446.1 million at March 31, 2014 was reported in “others” mechanism during the year ended March 31, 2014.

Subsequently these account have been re-classified under “CDR” mechanism.

2. Increase/(decrease) in borrower level outstanding of restructured accounts is due to utilisation of cash credit facility, exchange rate fluctuation, accrued interest, fresh disbursement,

non-fund based devolvement, conversion of loans into equity (including application pending allotment) as part of restructuring scheme, etc.

3. “Others” mechanism also include cases restructured under Joint Lender Forum (JLF) mechanism.