ICICI Bank 2016 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

Annual Report 2015-2016 9

We demonstrated the substantial value created by our

subsidiaries, with a 6% stake sale in ICICI Prudential

Life Insurance Company at a company valuation of

` 325.00 billion and a 9% stake sale in ICICI Lombard

General Insurance Company at a company valuation

of ` 172.25 billion.

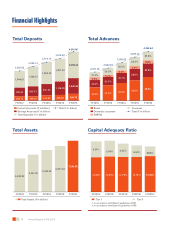

The Bank maintained a very strong capital position,

with Tier-1 capital adequacy of 13.09% and total

capital adequacy of 16.64%, well above regulatory

requirements.

The profits and the strong capital position enabled the

Bank to maintain a healthy proposed dividend of ` 5

per equity share.

We continued to strengthen our position across the

financial sector. Our insurance subsidiaries maintained

their leadership position among private sector players.

ICICI Prudential Asset Management Company became

the largest mutual fund in India, with assets under

management of over ` 1.8 trillion.

We continued to partner the nation in its journey of inclusive

growth. ICICI Foundation for Inclusive Growth scaled up the

ICICI Academy for Skills to 22 skill training centres across

the country and imparted training to over 25,000 youth,

including 10,000 women. Through the Academy and our

Rural Self Employment Training Institutes in Rajasthan,

ICICI Foundation has trained over 60,000 youth, and we

are targeting the milestone of training 100,000 youth by

March 2017. We continued to focus on rural development

through financial inclusion. At the end of fiscal 2016, the

Bank had 20.7 million basic savings bank accounts. The

Bank actively participated in the government schemes

launched under the Jan Suraksha Yojana and was among

the first to initiate enrollments for insurance schemes

through SMS.

Our strategic priorities going forward are summarised

below as the 4 x 4 Agenda:

Portfolio quality

1. Proactive monitoring of loan portfolios across

businesses;

2. Improvement in credit mix driven by focus on retail

lending and lending to higher rated corporates;

3. Reduction of concentration risk; and

4. Resolution of exposures through asset sales by

borrowers, change in management and working with

stakeholders to ensure that companies are able to

operate at an optimal level and generate cash flows.

Continuing to enhance the franchise

1. Sustaining the robust funding profile;

2. Maintaining digital leadership and a strong customer

franchise;

3. Continued focus on cost efficiency; and

4. Focus on capital efficiency and further unlocking of

value in subsidiaries.

The Indian economy is poised to build on the progress

made in the last two years to move ahead on its growth

path. The ICICI Group is well-positioned to address

the challenges in certain sectors and capitalise on the

opportunities that will arise out of India’s growth and

transformation. I look forward to your continued support

in this journey.

With best wishes,

Chanda Kochhar