ICICI Bank 2016 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016152

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

` in million

Particulars At

March 31, 2016

At

March 31, 2015

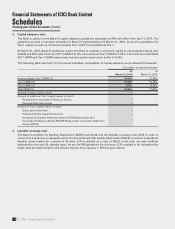

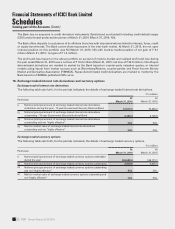

2. Movement of provisions held towards depreciation on investments

i) Opening balance225,931.8 23,775.0

ii) Add: Provisions made during the year 10,852.9 5,631.7

iii) Less: Write-off/(write-back) of excess provisions during the year (3,762.9) (2,551.8)

iv) Closing balance 33,021.8 26,854.9

1. Pursuant to RBI guidelines, investment in Rural Infrastructure and Development Fund and other related deposits of ` 280,661.8

million (March 31, 2015: ` 284,508.2 million) has been re-classified to line item ‘Others’ under Schedule 11 - Other Assets.

2. Application money has been re-classified from Schedule 8 - Investments to Schedule 11 - Other Assets. Accordingly, the

corresponding provision has also been re-classified.

Pursuant to approval by the Board of Directors of the Bank on October 30, 2015, the Bank has sold equity shares

representing 9% shareholding in ICICI Lombard General Insurance Company Limited during FY2016 for a total

consideration of ` 15,502.5 million.

Pursuant to approval by the Board of Directors of the Bank on November 16, 2015 the Bank has sold equity

shares representing 6% shareholding in ICICI Prudential Life Insurance Company Limited during FY2016 for a total

consideration of ` 19,500.0 million.

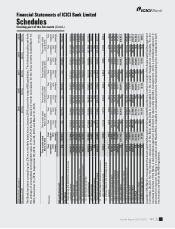

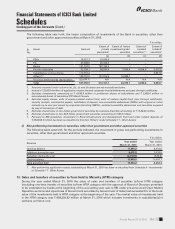

12. Investment in securities, other than government and other approved securities (Non-SLR investments)

i) Issuer composition of investments in securities, other than government and other approved securities

The following table sets forth, the issuer composition of investments of the Bank in securities, other than

government and other approved securities at March 31, 2016.

` in million

Sr.

No. Issuer Amount

Extent of

private

placement2

Extent of ‘below

investment

grade’ securities

Extent of

‘unrated’

securities2,3

Extent of

‘unlisted’

securities3

(a) (b) (c) (d)

1PSUs 15,452.7 9,633.9 – – 5,737.6

2 FIs 64,389.9 53,486.5 – – –

3 Banks 110,250.9 84,289.7 – – –

4 Private corporates 84,928.7 77,782.6 4,517.9 4,171.6 2,471.6

5 Subsidiaries/ Joint ventures 110,282.0 – – – 2,652.4

6 Others4,5 122,449.4 121,693.2 19,610.9 – –

7Provision held towards depreciation (31,843.6) N.A N.A N.A N.A

Total 475,910.0 346,885.9 24,128.8 4,171.6 10,861.6

1. Amounts reported under columns (a), (b), (c) and (d) above are not mutually exclusive.

2. Excludes investments, amounting to ` 2,652.4 million in preference shares of subsidiary ICICI Bank Canada.

3. Excludes equity shares, units of equity-oriented mutual fund, units of venture capital fund, pass through certificates,

security receipts, commercial papers, certificates of deposit, non-convertible debentures (NCDs) with original or initial

maturity up to one year issued by corporate (including NBFCs), unlisted convertible debentures and securities acquired

by way of conversion of debt.

4. Excludes investments in non-Indian government securities by overseas branches amounting to ` 21,715.2 million.

5. Excludes investments in non-SLR Indian government securities amounting to ` 2,435.7 million.