ICICI Bank 2016 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

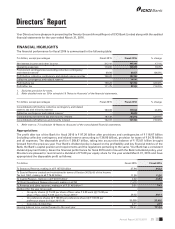

35Annual Report 2015-2016

Perquisites (evaluated as per Income-Tax rules wherever applicable and otherwise at actual cost to the Bank) such as the

benet of the Bank’s furnished accommodation, gas, electricity, water and furnishings, club fees, group insurance, use of

car and telephone at residence or reimbursement of expenses in lieu thereof, medical reimbursement, leave and leave

travel concession, education benets, provident fund, superannuation fund and gratuity, were provided in accordance

with the scheme(s) and rule(s) applicable from time to time. In line with the staff loan policy applicable to specied grades

of employees who fulll prescribed eligibility criteria to avail loans for purchase of residential property, the wholetime

Directors are also eligible for housing loans subject to approval of RBI.

The Members have approved the minimum and maximum ranges for remuneration as well as supplementary allowance

for the wholetime Directors. In terms of the said approvals, the monthly basic salary for Chanda Kochhar, Managing

Director & CEO would be within the range of ` 1,350,000 – ` 2,600,000, N. S. Kannan and Vishakha Mulye, executive

Directors would be within the range of ` 950,000 – ` 1,700,000 and Rajiv Sabharwal, executive Director would be within

the range of ` 900,000 – ` 1,600,000. The monthly supplementary allowances for the Managing Director & CEO, would be

within the range of ` 1,000,000 – ` 1,800,000, for N. S. Kannan and Vishakha Mulye, executive Directors would be within

the range of ` 675,000 - ` 1,225,000 and for Rajiv Sabharwal, executive Director would be within the range of ` 650,000 -

` 1,200,000. The Board would determine the actual remuneration/supplementary allowance payable within the above

ranges from time to time subject to the approval of RBI.

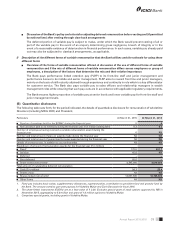

Details of Remuneration paid to non-executive Directors

As provided under Article 132 of the Articles of Association of the Bank, the fees payable to a non-executive Director

(other than to the nominee of Government of India) for attending a Meeting of the Board or Committee thereof are

decided by the Board of Directors from time to time within the limits prescribed by the Companies Act, 2013 and the rules

thereunder. The Board of Directors have approved the payment of ` 100,000 as sitting fee for each Meeting of the Board

and ` 20,000 as sitting fee for each Meeting of the Committee attended.

The Board of Directors at its Meeting held on June 9, 2015 approved a remuneration range of ` 3,000,000 – ` 5,000,000

per annum for M. K. Sharma, Chairman of the Board with the remuneration for each year to be determined by the

Board within this range. This remuneration range was also approved by the Members through a postal ballot resolution

dated April 22, 2016. The Board approved remuneration of ` 3,000,000 per annum effective July 1, 2015 to be paid to

M. K. Sharma for the rst year of his tenure. RBI while approving the appointment of M. K. Sharma for the period

July 1, 2015 to June 30, 2018 also approved the above remuneration.

Information on the total sitting fees paid to each non-executive Director during scal 2016 for attending Meetings of the

Board and its Committees is set out in the following table:

Name of Director Amount (`)

M. K. Sharma (w.e.f July 1, 2015) 860,000

K. V. Kamath (upto close of business hours on June 30, 2015) 380,000

Dileep Choksi 1,420,000

Homi Khusrokhan 2,200,000

M. S. Ramachandran 1,940,000

Tushaar Shah 700,000

V. K. Sharma 860,000

V. Sridar 1,600,000

Alok Tandon1–

Total 9,960,000

1. Being a Government Nominee Director, not entitled to receive sitting fees.