ICICI Bank 2016 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Business Overview

Annual Report 2015-2016

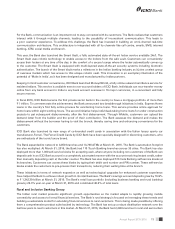

locations, which constituted 52% of the Bank’s total branch network and included 573 branches in hitherto unbanked

locations.

The Bank has developed customised nancial products and services to cater to a wide range of rural customers including

farmers, traders, processors, as well as rural entrepreneurs. During scal 2016, the Bank issued 90,000 Kisan Credit Cards

(KCCs) and renewed the limits for 45,000 KCCs.

The Bank caters to the nancial needs of women entrepreneurs through its Self-Help Group (SHG) programme as a part

of its micronance initiatives. During scal 2016, the Bank impacted the lives of close to 2.5 million women by extending

loans under the SHG-Bank linkage programme. ICICI Bank also continues to be a signicant lender to the micronance

institutions for on-lending to customers.

As of March 31, 2016, the Bank had opened over 20 million Basic Savings Bank Deposit Accounts (BSBDA) through

its branch and Business Correspondent (BC) network. The Bank has actively pursued the agenda of seeding Aadhaar

numbers in customers’ accounts and has communicated with its customers through branches, e-mails, SMSs and letters.

As of March 31, 2016, the Bank has seeded over 7.0 million accounts with Aadhaar numbers.

The Bank has contributed signicantly in promoting the Pradhan Mantri Jan-Dhan Yojana (PMJDY). It has opened 2.9

million accounts under the PMJDY scheme as of March 31, 2016, which is the highest among private sector banks.

About 89% of these accounts were opened in rural India. The Bank has also issued RuPay cards to these account

holders, which are inter-operable across various customer service points as well as ATMs of other banks. The Bank

has imparted nancial literacy to its customers and encouraged transactions through their savings accounts, using

these RuPay cards.

The Bank has actively participated in the three schemes promoted under the government’s Jan Suraksha Yojana (JSY).

These include the Pradhan Mantri Jeevan Jyoti Bima Yojana providing life insurance, the Pradhan Mantri Suraksha Bima

Yojana for accident insurance and Atal Pension Yojana for providing pension benets. The Bank facilitated enrollment

of beneciaries through its branches as well as digital channels like internet banking, SMS and phone banking. The

Bank’s effort in enrolling beneciaries for the insurance schemes through SMS was much appreciated by the Ministry of

Finance, Government of India, and directed other banks to follow the Bank’s approach. The Bank has enrolled a total of

2.9 million customers under the three JSY schemes.

The Bank’s rural portfolio grew by 25.2% to ` 300.91 billion during scal 2016.

Small & Medium Enterprises

Small and medium enterprises (SMEs) play a signicant role in India’s economic development, generating large scale

employment and facilitating inclusive growth. A strong SME sector is crucial for building a resilient and dynamic corporate

sector. At the same time, SMEs also face multiple challenges in terms of scale of production, increasing competition and

rapid adoption of innovative practices in their operations.

At ICICI Bank, we offer a comprehensive suite of banking products and solutions to SMEs for meeting their business and

growth requirements. Our long-standing experience of partnering with SMEs has enabled us to develop non-traditional

techniques for assessing credit risks. These techniques are unique and provide appropriate solutions customised to their

needs. The Bank also offers supply chain nancing solutions and small-ticket funding to the channel partners of large

corporates. The Bank has set up dedicated desks in 360 branches to assist SMEs. It also has specialised teams for current

accounts, trade nance, cash management services and door-step banking. The Bank has also tailored the internet

banking platform to cater to the unique banking needs of SMEs.

Fiscal 2016 continued to remain a challenging year for SMEs due to the gradual pick-up in economic activity, high

leverage among corporates and subdued investments. The Bank continued to pursue a strategy of calibrated growth

of the SME portfolio, with higher focus on managing concentration risks, diversication of portfolio, monitoring and

enhancement of collateral.