ICICI Bank 2016 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

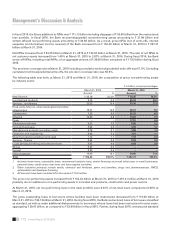

115Annual Report 2015-2016

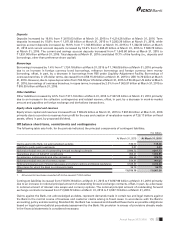

The prot before tax of ICICI Lombard General Insurance Company Limited increased from ` 6.91 billion in scal 2015

to ` 7.08 billion in scal 2016 primarily due to an increase in net earned premium and investment income, offset, in part,

by an increase in claims and benets paid and operating expenses. However, the prot after tax decreased from ` 5.36

billion in scal 2015 to ` 5.07 billion in scal 2016 due to a higher effective tax rate.

The prot after tax of ICICI Prudential Asset Management Company Limited increased from ` 2.47 billion in scal 2015 to

` 3.26 billion in scal 2016 primarily due to an increase in fee income, offset, in part, by an increase in other administrative

expenses and staff cost.

The consolidated prot after tax of ICICI Securities Limited and its subsidiaries decreased from ` 2.94 billion in scal 2015

to ` 2.39 billion in scal 2016 primarily due to a decrease in brokerage and fee income, reecting lower trading volumes

in the capital markets.

The prot after tax of ICICI Securities Primary Dealership Limited decreased from ` 2.17 billion in scal 2015 to ` 1.95

billion in scal 2016 primarily due to a decrease in trading gains, offset, in part, by an increase in net interest income.

The prot after tax of ICICI Home Finance Company Limited decreased from ` 1.98 billion in scal 2015 to ` 1.80 billion in

scal 2016 primarily due to an increase in provisions and a decrease in non-interest income.

The prot after tax of ICICI Bank Canada decreased from ` 1.82 billion (CAD 33.7 million) in scal 2015 to ` 1.12 billion

(CAD 22.4 million) in scal 2016 primarily due to an increase in provisions and a decrease in other income, offset, in part,

by an increase in net interest income.

The prot after tax of ICICI Bank UK PLC decreased from ` 1.12 billion (US$ 18.3 million) in scal 2015 to ` 0.04 billion

(US$ 0.5 million) in scal 2016 primarily due to an increase in provisions and a decrease in non-interest income, offset, in

part, by an increase in net interest income.

The prot after tax of ICICI Venture Fund Management Company Limited decreased from ` 0.01 billion in scal 2015 to

a loss after tax of ` 0.21 billion in scal 2016 primarily due to a decrease in income from operations and other income,

offset, in part, by a decrease in staff costs and other administrative expenses.

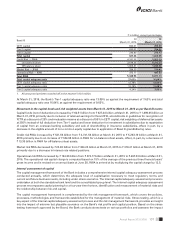

The consolidated assets of the Bank and its subsidiaries and other consolidating entities increased from ` 8,260.79 billion

at March 31, 2015 to ` 9,187.56 billion at March 31, 2016 primarily due to an increase in the assets of ICICI Bank, ICICI

Prudential Life Insurance Company Limited, ICICI Bank Canada and ICICI Bank UK. Consolidated advances increased from

` 4,384.90 billion at March 31, 2015 to ` 4,937.29 billion at March 31, 2016.

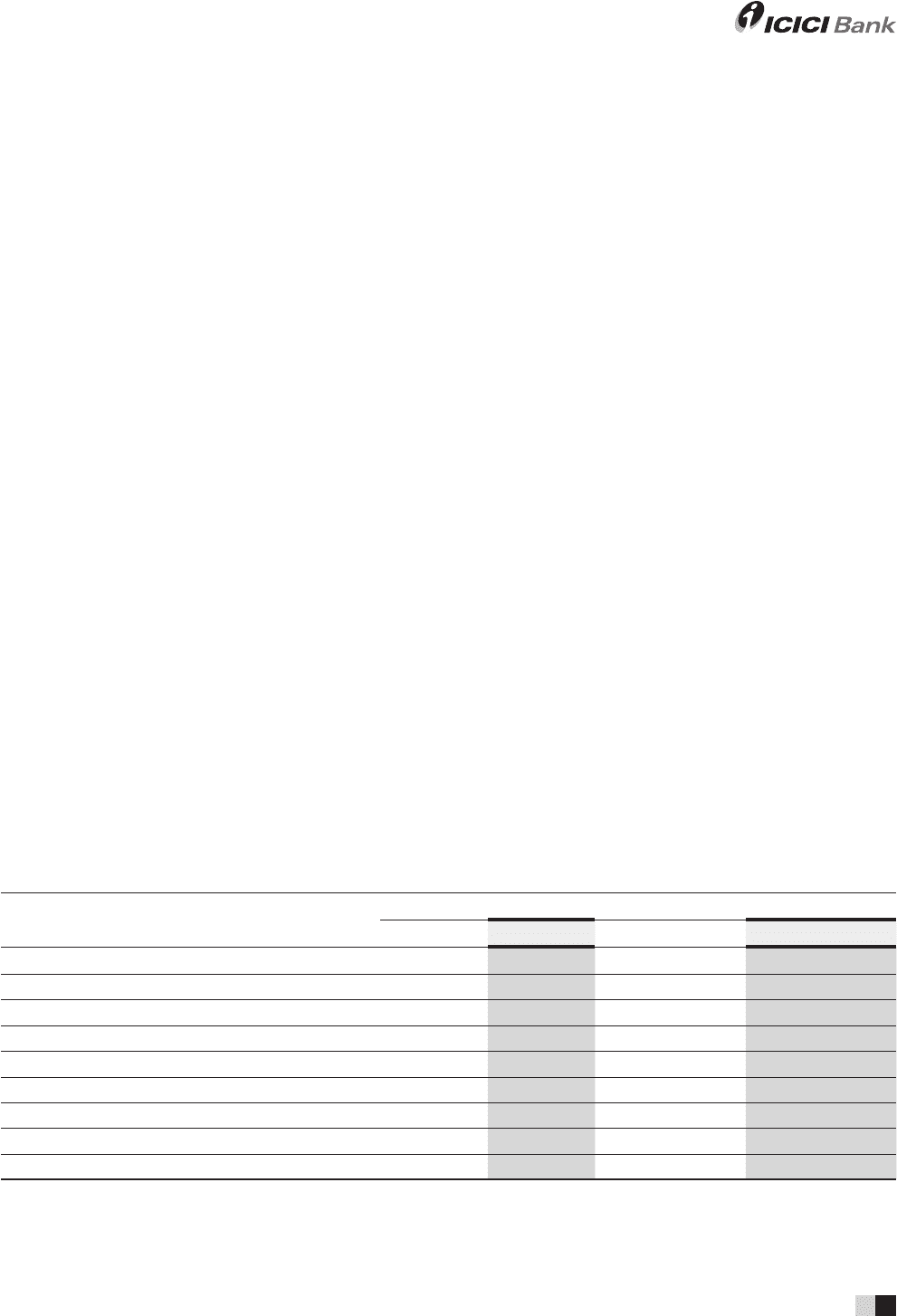

The following table sets forth, for the periods indicated, the prot/(loss) and total assets of our principal subsidiaries.

` in billion

Prot after tax Total assets

Fiscal 2015 Fiscal 2016 At March 31, 2015 At March 31, 2016

ICICI Prudential Life Insurance Company Limited ` 16.34 ` 16.50 ` 1,012.16 ` 1,047.66

ICICI Lombard General Insurance Company Limited 5.36 5.07 136.56 156.76

ICICI Bank Canada 1.82 1.12 291.19 333.45

ICICI Bank UK PLC 1.12 0.04 258.11 304.99

ICICI Securities Primary Dealership Limited 2.17 1.95 146.88 161.73

ICICI Securities Limited (consolidated) 2.94 2.39 13.63 13.97

ICICI Home Finance Company Limited 1.98 1.80 82.99 93.88

ICICI Prudential Asset Management Company Limited 2.47 3.26 7.28 8.18

ICICI Venture Funds Management Company Limited ` 0.01 ` (0.21) ` 5.14 ` 4.21

1. See also “Financials- Statement pursuant to Section 129 of the Companies Act, 2013”.

2. All amounts have been rounded off to the nearest ` 10.0 million.