ICICI Bank 2016 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39Annual Report 2015-2016

Discussion of the Bank’s policy and criteria for adjusting deferred remuneration before vesting and (if permitted

by national law) after vesting through claw back arrangements

The deferred portion of variable pay is subject to malus, under which the Bank would prevent vesting of all or

part of the variable pay in the event of an enquiry determining gross negligence, breach of integrity or in the

event of a reasonable evidence of deterioration in nancial performance. In such cases, variable pay already paid

out may also be subjected to clawback arrangements, as applicable.

f) Description of the different forms of variable remuneration that the Bank utilises and the rationale for using these

different forms

Overview of the forms of variable remuneration offered. A discussion of the use of different forms of variable

remuneration and if the mix of different forms of variable remuneration differs across employees or group of

employees, a description of the factors that determine the mix and their relative importance.

The Bank pays performance linked retention pay (PLRP) to its front-line staff and junior management and

performance bonus to its middle and senior management. PLRP aims to reward front line and junior managers,

mainly on the basis of skill maturity attained through experience and continuity in role which is a key differentiator

for customer service. The Bank also pays variable pay to sales ofcers and relationship managers in wealth

management roles while ensuring that such pay-outs are in accordance with applicable regulatory requirements.

The Bank ensures higher proportion of variable pay at senior levels and lower variable pay for front-line staff and

junior management levels.

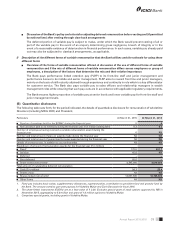

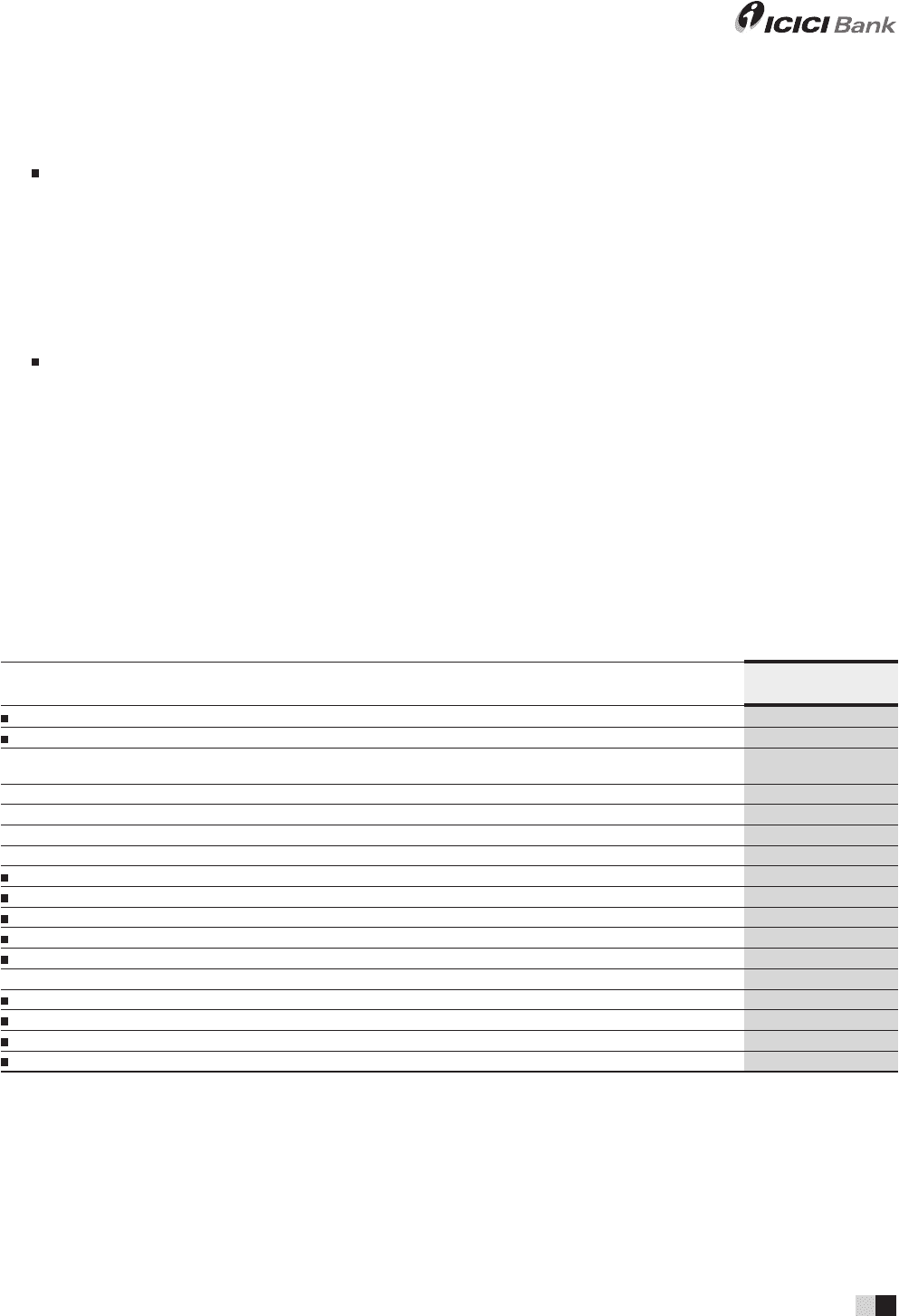

(B) Quantitative disclosures

The following table sets forth, for the period indicated, the details of quantitative disclosure for remuneration of wholetime

Directors (including MD & CEO) and President.

Particulars At March 31, 2015 At March 31, 2016

Number of meetings held by the BGRNC during the nancial year 5 8

Remuneration paid to its members during the nancial year (` in million) (sitting fees) 0.3 0.5

Number of employees having received a variable remuneration award during the

nancial year 6Nil

Number and total amount of sign-on awards made during the nancial year Nil Nil

Number and total amount of guaranteed bonuses awarded during the nancial year Nil Nil

Details of severance pay, in addition to accrued benets Nil Nil

Breakdown of amount of remuneration awards for the nancial year (` in million)

Fixed1172.6 201.7

Variable 65.0 Nil

Deferred – –

Non-deferred 65.0 –

Share-linked instruments24,395,000 4,610,000

Total amount of outstanding deferred remuneration

Cash (` in million) 54.3 23.4

Shares (nos.) Nil Nil

Shares-linked instruments313,057,500 16,725,000

Other forms Nil Nil

1. Fixed pay includes basic salary, supplementary allowances, superannuation, contribution to provident fund and gratuity fund by

the Bank. The amount contains part year payouts for Vishakha Mulye and Zarin Daruwala for fiscal 2016.

2. The share-linked instruments (ESOPs) are at a face value of ` 2.00. Excludes special grant of stock options approved by RBI in

November 2015, aggregating to 5.8 million and grant of 1.0 million options to Vishakha Mulye.

3. Comprises special grants, including grant to Vishakha Mulye.