ICICI Bank 2016 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

Management’s Discussion & Analysis

Annual Report 2015-2016

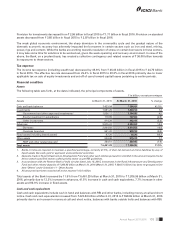

In scal 2016, the Gross additions to NPAs was ` 171.13 billion including slippages of ` 53.00 billion from the restructured

loan portfolio. In scal 2016, the Bank recovered/upgraded non-performing assets amounting to ` 21.84 billion and

written-off/sold non-performing assets amounting to ` 34.50 billion. As a result, gross NPAs (net of write-offs, interest

suspense and derivatives income reversal) of the Bank increased from ` 152.42 billion at March 31, 2015 to ` 267.21

billion at March 31, 2016.

Net NPAs increased from ` 63.25 billion at March 31, 2015 to ` 132.97 billion at March 31, 2016. The ratio of net NPAs to

net customer assets increased from 1.40% at March 31, 2015 to 2.67% at March 31, 2016. During scal 2016, the Bank

wrote-off NPAs, including retail NPAs, of an aggregate amount of ` 30.05 billion compared to ` 17.03 billion during scal

2015.

The provision coverage ratio at March 31, 2016 including cumulative technical/prudential write-offs was 61.0%. Excluding

cumulative technical/prudential write-offs, the provision coverage ratio was 50.6%.

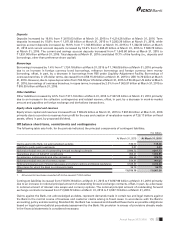

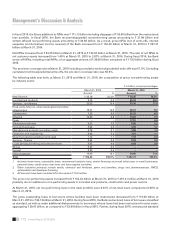

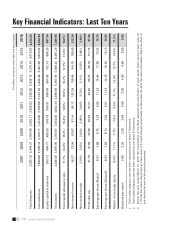

The following table sets forth, at March 31, 2015 and March 31, 2016, the composition of gross non-performing assets

by industry sector.

` in billion, except percentages

March 31, 2015 March 31, 2016

Amount % Amount %

Retail nance1` 33.78 22.2% ` 38.25 14.3%

Iron/steel and products 9.74 6.4 65.04 24.3

Services – non-nance 23.53 15.4 29.30 11.0

Road, ports, telecom, urban development and other

infrastructure 18.27 12.0 26.01 9.7

Construction 7.36 4.8 22.22 8.3

Shipping 15.00 9.8 19.60 7.3

Power – – 17.51 6.6

Wholesale/retail trade 4.53 3.0 5.90 2.2

Food and beverages 3.94 2.6 4.55 1.7

Manufacturing products (excluding metal) 4.78 3.1 3.58 1.3

Electronics and engineering 8.06 5.3 3.01 1.1

Metal & products (excluding iron & steel) 1.72 1.1 1.10 0.4

Services – nance 0.56 0.4 0.52 0.2

Crude petroleum/rening and petrochemicals 0.02 0.0 0.02 0.0

Mining 0.93 0.6 – –

Cement 0.30 0.2 – –

Other industries219.90 13.1 30.60 11.6

Total ` 152.42 100.0% ` 267.21 100.0%

1. Includes home loans, automobile loans, commercial business loans, dealer financing and small ticket loans to small businesses,

personal loans, credit cards, rural loans and loans against securities.

2. Other industries primarily include textile, chemical and fertilizers, gems and jewellery, drugs and pharmaceuticals, FMCG,

automobiles and developer financing.

3. All amounts have been rounded off to the nearest ` 10.0 million.

The gross non-performing assets increased from ` 152.42 billion at March 31, 2015 to ` 267.21 billion at March 31, 2016

primarily due to additions in non-performing assets in iron/steel and products, construction and power sectors.

At March 31, 2016, net non-performing loans in the retail portfolio were 0.61% of net retail loans compared to 0.60% at

March 31, 2015.

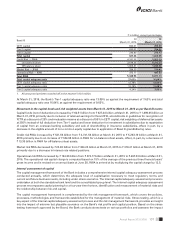

The gross outstanding loans to borrowers whose facilities have been restructured decreased from ` 119.46 billion at

March 31, 2015 to ` 93.13 billion at March 31, 2016. During scal 2016, the Bank restructured loans of borrowers classied

as standard, as well as made additional disbursements to borrowers whose loans had been restructured in prior years,

aggregating ` 29.47 billion, as compared to ` 53.69 billion in scal 2015. Further, during scal 2016, restructured standard