ICICI Bank 2016 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2016 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2015-2016172

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

32. Details of Single Borrower Limit and Borrower Group Limit exceeded by the Bank

During the year ended March 31, 2016, the Bank complied with the RBI guidelines on single borrower and borrower

group limit. As per the exposure limits permitted under the extant RBI regulation, the Bank with the approval of the

Board of Directors can enhance exposure to a single borrower or borrower group by a further 5.0% of capital funds.

In accordance with the guidelines issued by RBI, with the prior approval of the Board of Directors, the Bank had

taken additional exposure to Reliance Industries Limited during the year. At March 31, 2016, the exposure to Reliance

Industries Limited as a percentage of capital funds was 14.6% and was within the prudential exposure limit.

During the year ended March 31, 2015, the Bank complied with the RBI guidelines on single borrower and borrower

group limit.

33. Unsecured advances against intangible assets

The Bank has not made advances against intangible collaterals of the borrowers, which are classied as ‘unsecured’

in its nancial statements at March 31, 2016 (March 31, 2015: Nil) and the estimated value of the intangible collaterals

was Nil at March 31, 2016 (March 31, 2015: Nil).

34. Fixed Assets

i. Revaluation

The Bank revalued its premises (land and buildings) at March 31, 2016. The revalued amount of the premises was

` 58,404.6 million as compared to the historical cost less accumulated depreciation of ` 30,229.9 million on the

date of revaluation. The valuation was carried out by external valuers using methods applicable to the valuation

of premises such as direct comparison method and income generation method.

ii. Software

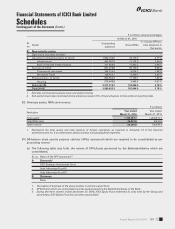

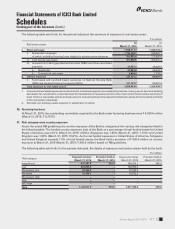

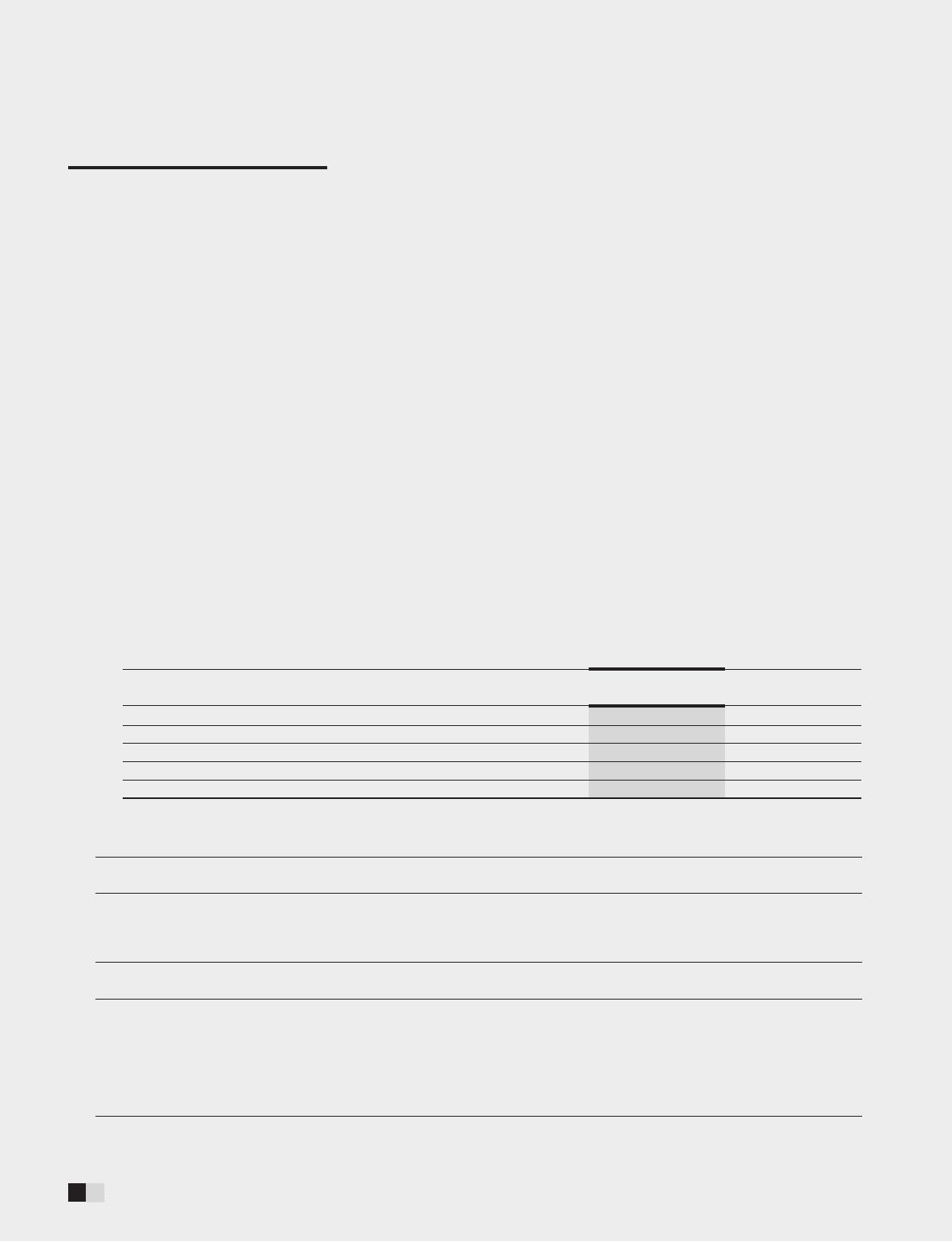

The following table sets forth, for the periods indicated, the movement in software acquired by the Bank, as

included in xed assets.

` in million

Particulars At

March 31, 2016

At

March 31, 2015

At cost at March 31 of preceding year 11,260.7 9,433.7

Additions during the year 1,877.7 1,827.9

Deductions during the year (1.8) (0.9)

Depreciation to date (10,074.9) (8,554.8)

Net block 3,061.7 2,705.9

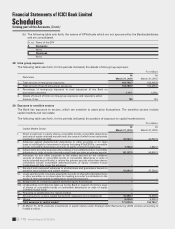

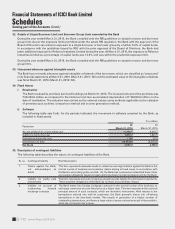

35. Description of contingent liabilities

The following table describes the nature of contingent liabilities of the Bank.

Sr. no. Contingent liability Brief Description

1. Claims against the Bank,

not acknowledged as

debts

This item represents demands made in certain tax and legal matters against the Bank in the

normal course of business and customer claims arising in fraud cases. In accordance with

the Bank’s accounting policy and AS - 29, the Bank has reviewed and classied these items

as possible obligations based on legal opinion/judicial precedents/assessment by the Bank.

2. Liability for partly paid

investments

This item represents amounts remaining unpaid towards liability for partly paid investments.

These payment obligations of the Bank do not have any prot/loss impact.

3. Liability on account of

outstanding forward

exchange contracts

The Bank enters into foreign exchange contracts in the normal course of its business, to

exchange currencies at a pre-xed price at a future date. This item represents the notional

principal amount of such contracts, which are derivative instruments. With respect to the

transactions entered into with its customers, the Bank generally enters into off-setting

transactions in the inter-bank market. This results in generation of a higher number of

outstanding transactions, and hence a large value of gross notional principal of the portfolio,

while the net market risk is lower.